As the Bank of Canada gets ready for its next rate policy meeting on July 12th, Canadian economists appear almost unanimous in calling for a rate hike, the first in nearly seven years. For many, the job numbers for June, just released today, re-enforce their expectations that the BoC will pull the trigger next week and go for 25pb hike. Economists from all the major banks have baked in about 90% chance that the BoC will raise its overnight rate.

However, the labor market in Canada seems far from robust and certainly, in and of itself, does not indicate that the economy is operating a full capacity such that monetary tightening is required. Today’s release of the June employment number supports this contention.

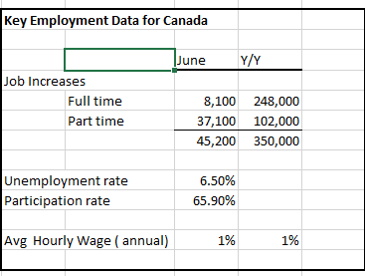

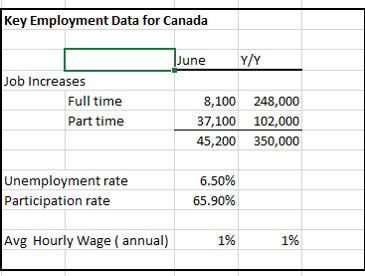

The Canadian labor market dynamics are being driven, in significant measure, by the growth in part-time jobs.Of the 45,200 new jobs created in June, 37,100 were part-time and only 8,100 were full-time positions. Over the past 12 months, nearly a third of all jobs created were part-time. Part-time workers earn less per hour than their full-time colleagues and do not enjoy equal benefits. In many cases, workers would prefer full-time work but are unable to secure this. In sum, the quality of part-time work is usually low-skilled, unreliable and hence low-income. At any rate, the growth in part-time employment does not signify a robust labor market.

The weakness in the labor market clearly shows up in wage growth. Wage growth has been stagnating for several years. The average annual wage rate increase in June was a mere 1%, unchanged from May. We hear a chorus of economists who say “it is just a matter of time” before wage inflation is felt throughout the economy. This mantra has been heard for several years to no avail. This is just a case of crying wolf.

The BoC frequently notes that there is an output gap, a measure of spare capacity in the labor market, that has persisted since the 2008 financial crisis. The June employment report does nothing to suggest that the output gap has closed. If the BoC moves ahead with a rate hike next week, it will be hard-pressed to argue that it is in response to labor market pressures. Nor will a hike be in response to inflationary pressures. An earlier blog[1] argued that BoC has consistently over-estimated the prospects for inflation and, hence, seems further away from reaching its target rate of 2%. The combination of an elevated unemployment rate of 6.5% and an inflation rate of 1.3% do not provide sufficient evidence to support a rate hike.

Leave A Comment