Fed moves to Quantitative Contraction, QC

Did anyone Notice?

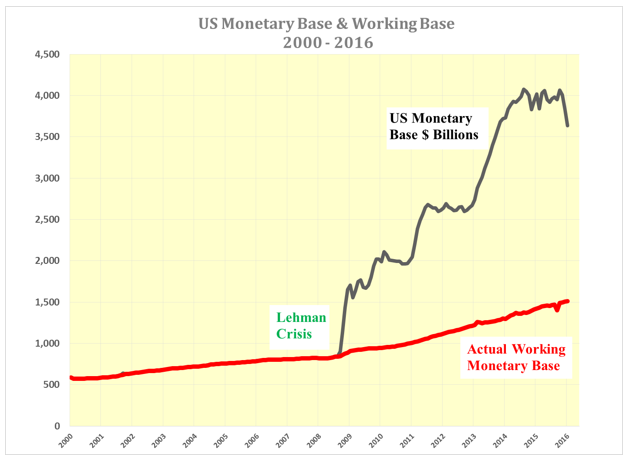

Not only did the Fed raise the Funds rate in December but it set in motion the start of the contraction of the monetary base. Quantatative Contraction, or QC perhaps? The substantial decline in the U.S. monetary base was reported by the Fed in its weekly release on January 7, 2016 that covered the two week period ended to January 6, 2015.

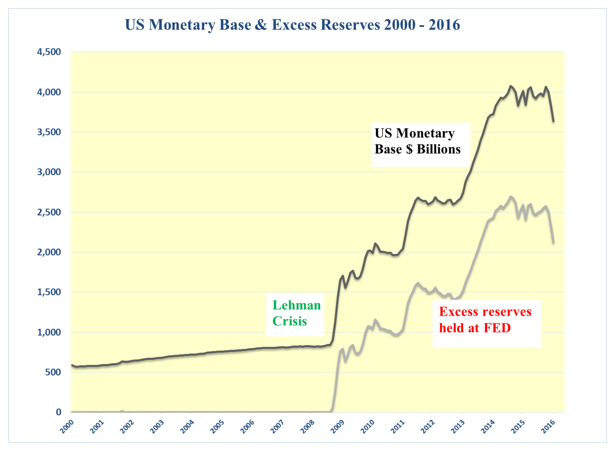

This is serious tightening by the Fed that should have a much greater impact than the 0.25% hike in the Funds rate. The drop was the result of a 15% decline during December of the excess reserves held at the Fed.

This drop may be accounted for by the ending of the rolling-over and re-investment of maturing debt coinciding with the year end. I asked the Fed for an explanation but have not received a reply. Whatever the reason, there has been a srerious reduction in the pool of available U.S. dollars while other countries continue to expand the amounts of their respective currencies.

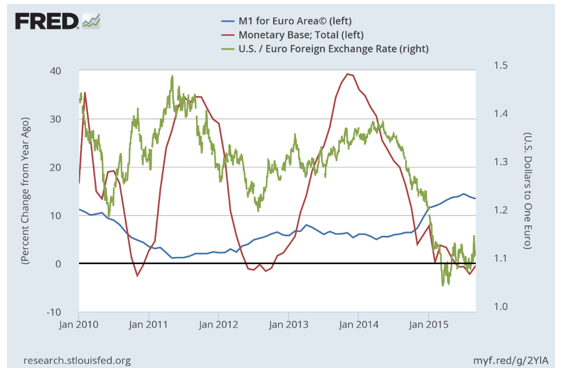

When viewed as commodities any change in the relative supply of currencies will alter their relative prices. With the supply of U.S. dollars contracting under QC, the price of the U.S. dollar should continue to rise as it has been since the end of QE in 2014 with the similtaneous expansion of money in Japan, Europe and the UK. China is also allowing its currency to fall slowly. It would have done so faster without the Peg.

The next chart shows how the Euro rises and falls as the year-over-year rates of change of the Euro M1 and the U.S. monetary base gyrate.

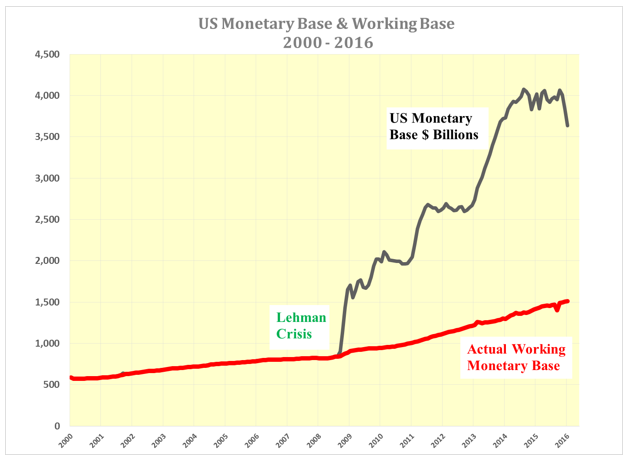

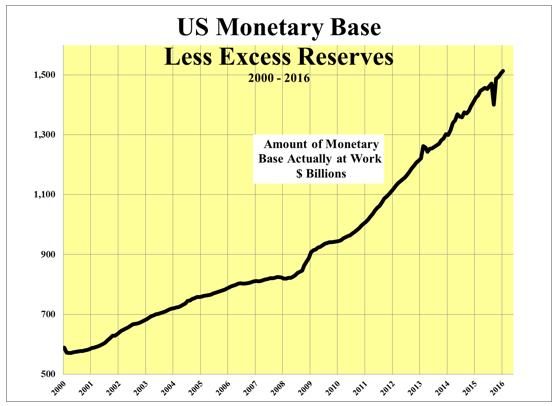

The impact of the tightening on U.S.domestic economy is unlikely to be felt in the short term the as the actual working amount of the monetary base is still rising and it is still well below the gross figure of US$3.6 trillion as shown in the first chart above.

The major negative impact of a “strong” U.S. dollar should be on U.S. exporters and U.S. multinationals. On the positve side there should be a significant importation of deflation even though this may result in the further exportation of the U.S. manufactuing base.

In turn, this may lead to the reversal of the Fed’s action even going as far as having to introduce negative interest rates. Eventually, this should be good for gold and silver and non-U.S. currencies but it will take time for market participants to wake up to the full implications of the decline of the gross U.S. monetary base now underway.

Leave A Comment