WTI Crude Oil

The WTI Crude Oil markets fell rather significantly during the day on Wednesday, briefly breaking below the $28 level. However, we bounced enough to form a nice-looking hammer, which of course means that we might have a bit of a fight on our hands at this point. However, I believe that the market will continue to offer selling opportunities, as there is more than enough bearish pressure to continue what we have seen recently. After all, the demand simply is not there and of course we have the currency headwinds with the US dollar strengthening so much.

I’m looking for short-term rallies in order to sell again, and waiting to see exhaustive candles. I believe that you will see several of these going forward, but I would also be willing to sell a break of the bottom of the hammer as it is a pretty catastrophic sign. I am aiming for the $25 handle.

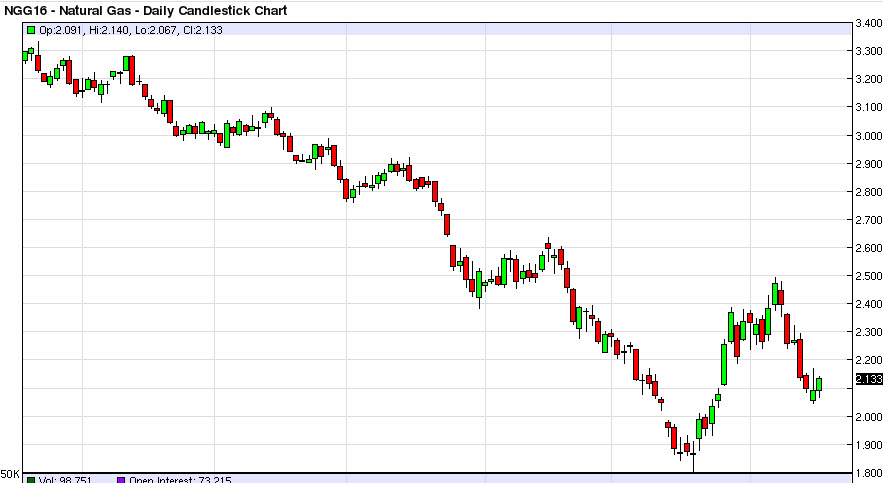

Natural Gas

The natural gas markets rose slightly during the day on Wednesday, but without a doubt this is a very bearish market. I would anticipate that there should be a significant amount of resistance somewhere near the $2.25 handle, as it was previously supportive. Any type of resistive candle there would have me interested in selling this market, and of course a break down below the lows from the Tuesday session would also do the same thing. I have no interest in buying, and recognize that the natural gas markets are in serious trouble for the long-term, not just this particular session.

After all, there is more than enough natural gas out there to keep the supply too strong for the demand to take out of commission. Yes, recently we have seen China suffer a bit of a supply problem, but at the end of the day China is slowing down and therefore can only absorb so much of the excess supply in the market. I am a seller.

Leave A Comment