Daily Forex Market Preview, 16/02/2016

With the markets now into their second consecutive day of declining against the US Dollar, there is a broad market pattern that indicates a potential pullback in the US Dollar, giving rise to a short-term bounce/correction in the recent market declines. The British Pound, however, is the exception as the monthly inflation numbers are due for release later today.

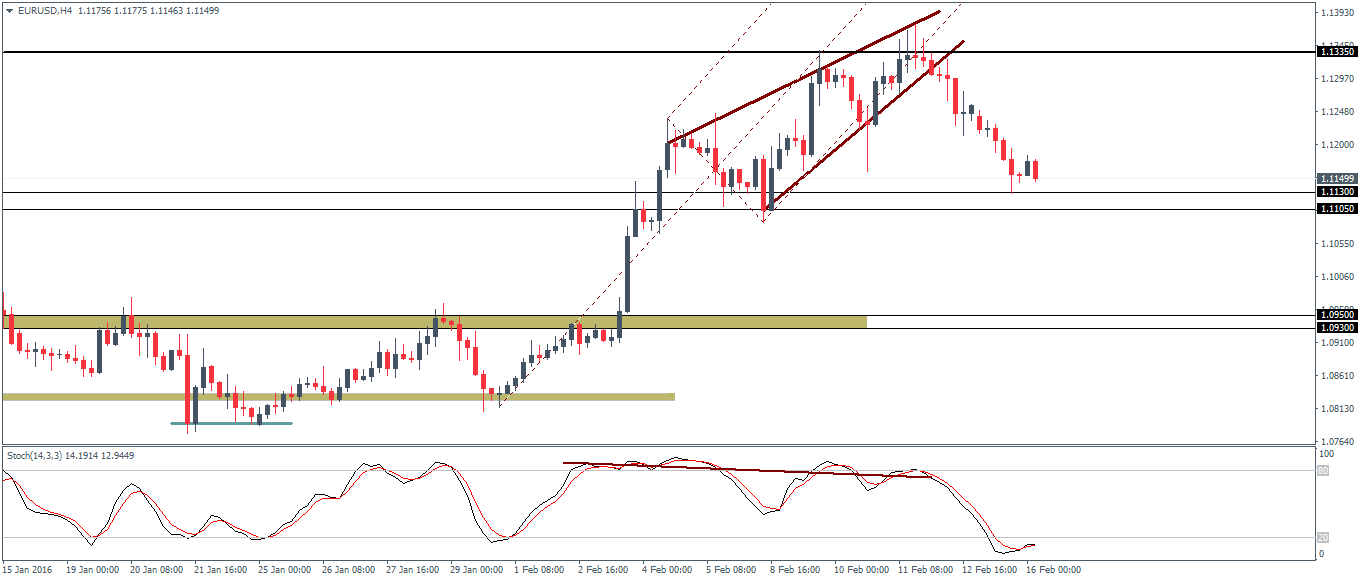

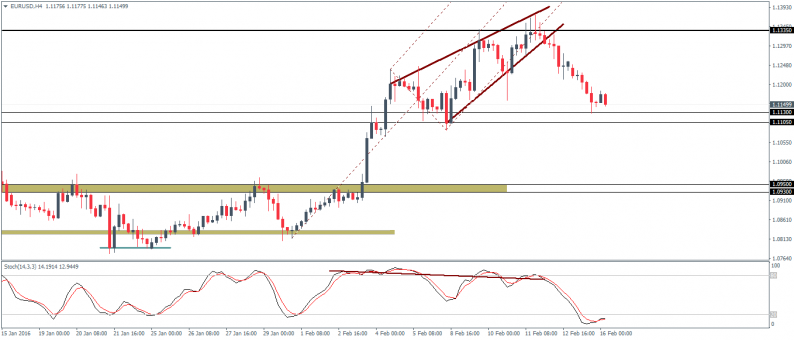

EURUSD Daily Analysis

EURUSD (1.11): EURUSD continued to decline for the second consecutive day closing below the doji low from 10th February at 1.1154. A continuation of this decline is likely to see a test to 1.113 – 1.11 support. A bounce of this support in the near term could keep EURUSD range bound before the support is tested once again. In the event of a break below 1.11, 1.095 – 1.0933 will be the next level of support that could be broken. The upside gains are limited as long as EURUSD trades below 1.1335 resistance.

USDJPY Daily Analysis

USDJPY (114.6): USDJPY closed on a bullish note, breaking to the upside from the inside bar that was formed previously. Prices remain biased to the upside, with a test of 117.25 – 117.0 now being likely to be tested for resistance after the support gave way previously. There is scope for a pullback to this rally with support at 113 – 112.5 being tested on a pullback. Prices could remain range bound for a while, trading below 117.25 – 117.0 and 113 – 112.5 support. This is confirmed by the fact that the Stochastics oscillator has formed a hidden bearish divergence by marking a higher high against price’s lower high. A test to 113 – 112.5 will signal the correction ahead of a longer term correction to 117.

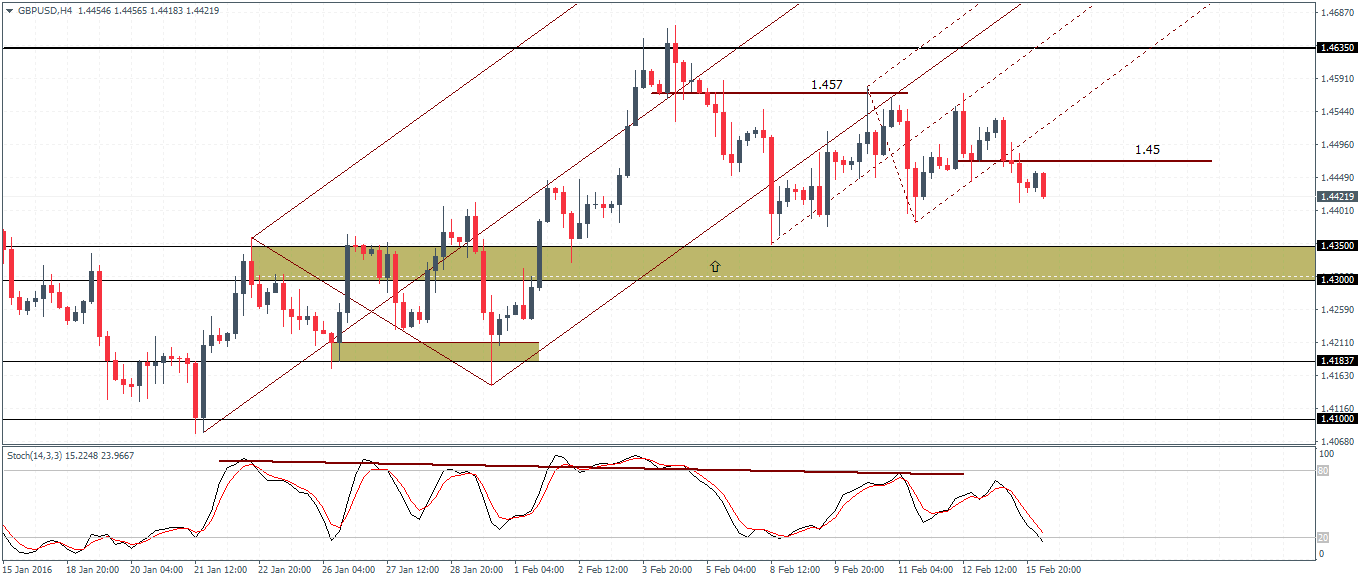

GBPUSD Daily Analysis

GBPUSD (1.44): GBPUSD remains trading sideways but the support near 1.443 is likely to give way sooner than later. Below 1.443 a test to 1.435 – 1.43 is very likely. A decline in the lower support could mark the correction ahead of a move to the upside. The minor median line shows prices breaking out lower following a breakout at 1.45. A retest to this level could signal a short-term correction ahead of a decline down to the identified support level.

Leave A Comment