Gold is still up near the highs set this morning, and there are no visible signs of topping. Prices would have to break below $1,273 to generate selling pressure. Silver would have to drop below $18.24.

The dollar sold off sharply yesterday after comments from Trump. It has recovered most of that slump. Prices are currently at 100.44, closing above 100.60 would be dollar positive.

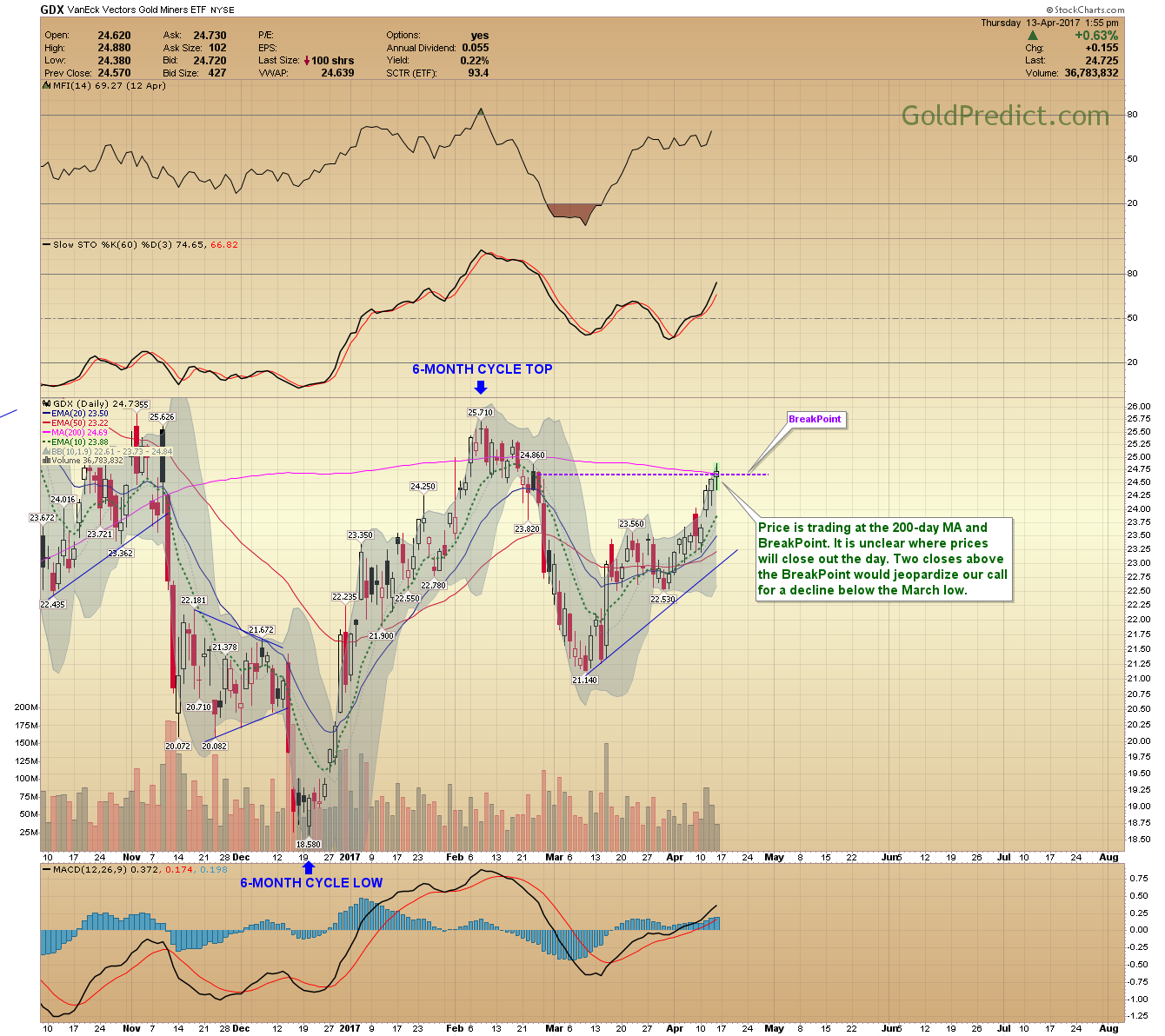

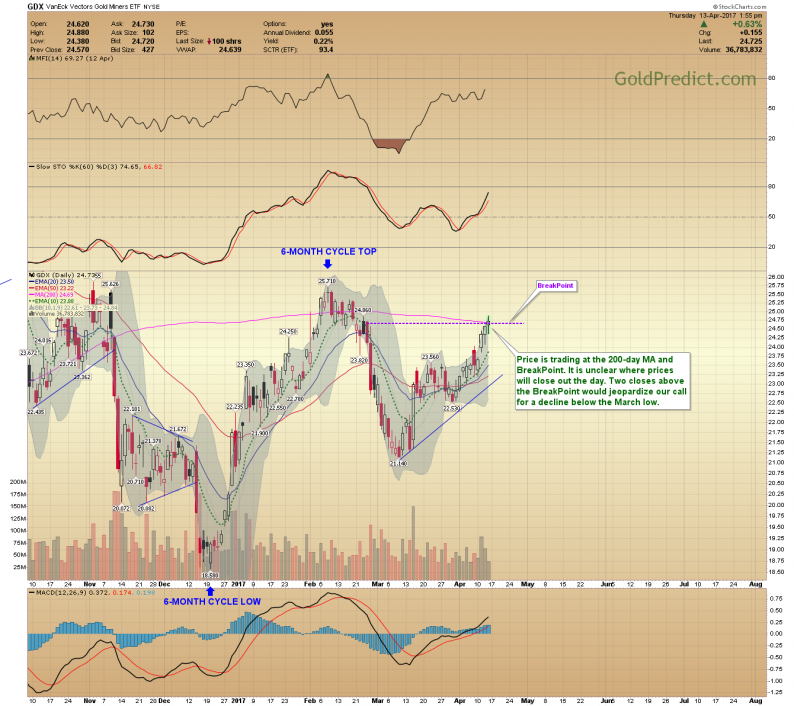

-GDX- Price is trading at the 200-day MA and BreakPoint. It is unclear where prices will close out the day. Two closes above the BreakPoint would jeopardize our call for a decline below the March low.

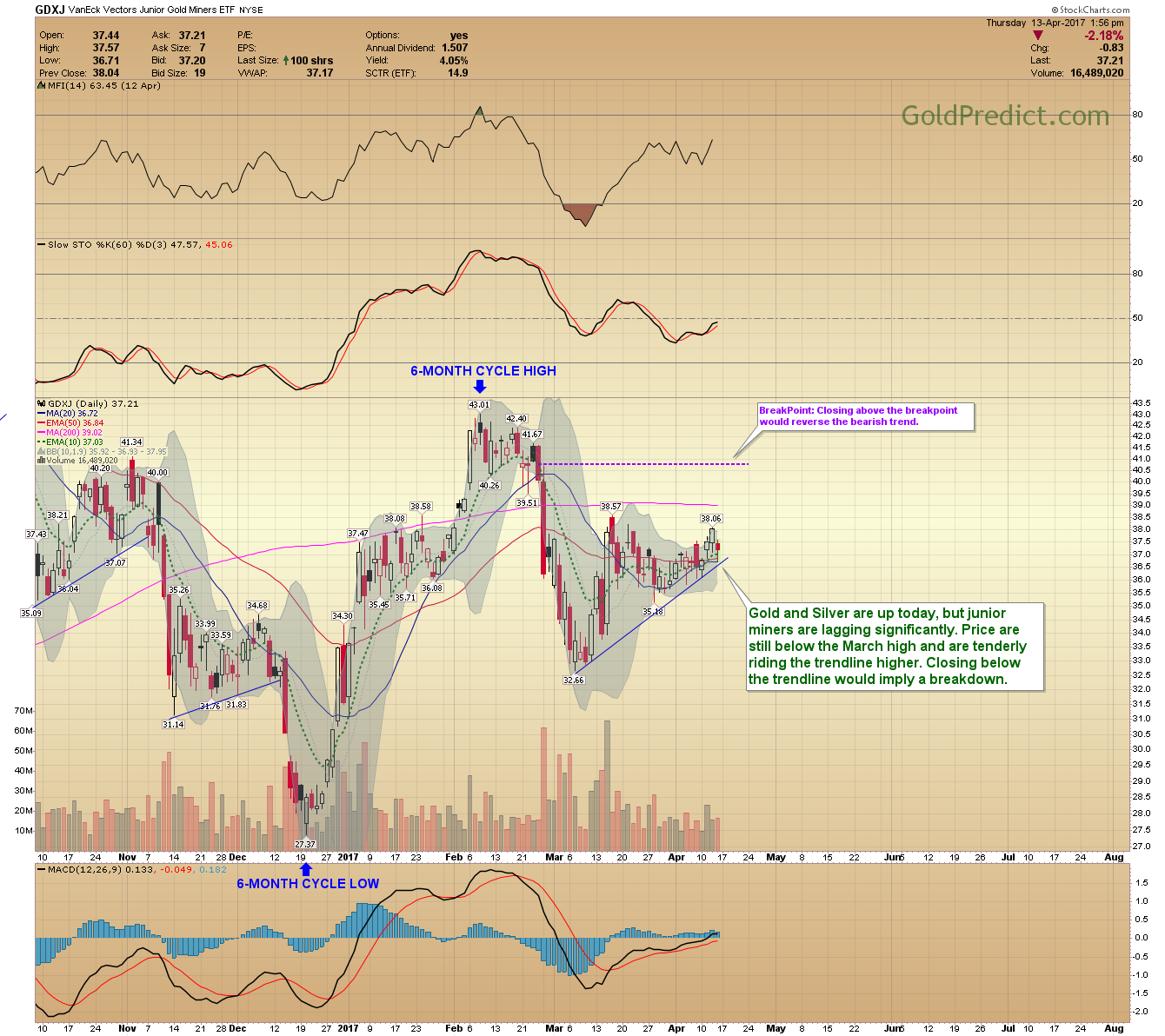

-GDXJ- Gold and Silver are up today, but junior miners are lagging significantly. Price are still below the March high and are tenderly riding the trendline higher. Closing below the trendline would imply a breakdown.

Oil is showing signs of weakness. Dropping below $52.75 would lead to more selling.

Precious metals are unpredictable at the moment. I don’t plan on doing anything with them until there are clear signs of topping. That presumably won’t happen until next week. US Markets are closed tomorrow.

Leave A Comment