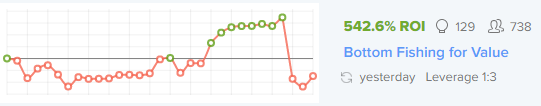

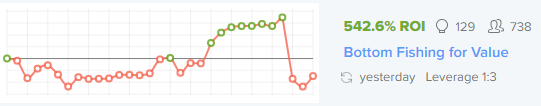

A favorable reversal for momentum stocks helped the Bottom Fishing for Value continue its positive ROI. Ambarella (AMBA) may move and hold above the $40 level, as markets rewarded the stock for its value through multi-year contracts and a moat in automotive safety solutions.

In the semiconductor space, Intel (INTC) said it would slow the pace of chip releases. Why not? AMD (AMD) is a big threat, with its Zen release for later this year, but not big enough in company size to scare Intel. Qualcomm’s (QCOM) stock made most of its gains alongside the market moving higher.

Here is a direct link to the strategy.

The bearish calls on optical equipment maker Ciena (CIEN), ailing search engine firm Yahoo (YHOO), and solar supplier SolarCity (SCTY) all closed. These companies took a direction unfavorable to the strategy.

For the micro-cap for value strategy, Glu Mobile (GLUU) finally sold off. The absence of any new game releases, positive user growth for existing games, and profit taking all helped move the stock lower. Similarly, MeetMe’s (MEET) over 50% ROI and Stratasys (SSYS) are falling due to profit taking. They had a nice run.

Leave A Comment