Making Sense:

The lack of fixed income market understanding in the financial world is astounding. The comments I have heard and read from individuals one would assume to be knowledgeable is, in my opinion, quite disturbing. One of the more common unknowledgeable questions I hear asked is: Why is the long and of the yield curve not pricing in a Fed tightening?

Are You Experienced? (Have you ever been experienced?)

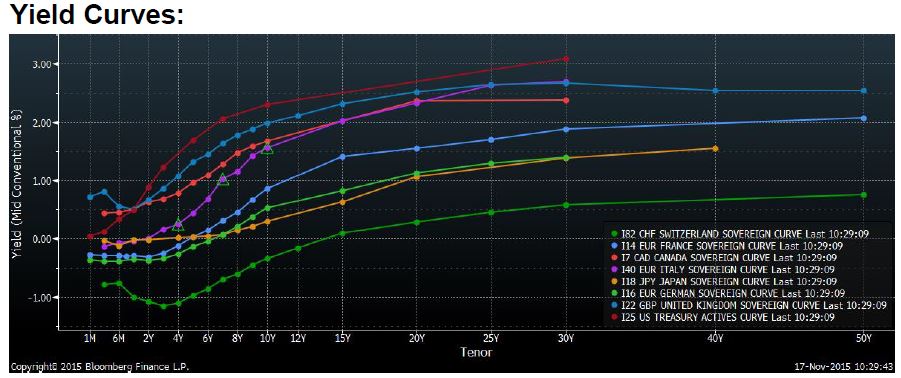

Really, the long end of the curve is not pricing in a Fed tightening? Let’s consider what the long end of the curve has done the past two weeks. The yield of 10-year UST note rose to 2.34% on 11/9/15 from a recent low of 2.02% on 10/21/15. This followed economic data which augured for the sustainability of U.S. economic growth and a more hawkish than expected FOMC statement (due mainly to a moderate rebound in economic data). At the time of this writing, the yield of the 10-year UST note stood at 2.30%. In my opinion, long-term interest rates (UST yields) reacted as expected given the data and Fed statement. The problem is not the bond market’s reaction, but expectations among pundits, investors and (sadly) investment professionals.

There is a mistaken belief that a Fed tightening augurs for higher rates across the yield curve. As I discussed in the 11/15/15 “In the Trenches” report, both Fed policy and long-term interest rates respond to the same stimuli, higher inflation rates/expectations. However, because the bond market can (and often does) act much more quickly in response to economic data, long-term rates often rise before the Fed tightens. Late last month we had stronger Personal Consumption, Nonfarm Payrolls and Average Hourly Earnings data, all potentially inflationary. The long end of the UST curve responded immediately by trending higher. Financial media sources reported that some institutional bond market positions began shorting the long end of the UST curve late last month. This was almost certainly due to the fairly strong (inflationary) economic data.

Leave A Comment