The biggest banks in the world are in real trouble. They may have won too much when they won their derivatives bets. At issue is whether these big banks manipulated the LIBOR rate downward, increasing the gap between the floating rate they bet on, and the fixed rate their counterparties bet on to protect against inflation.

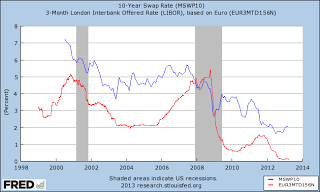

I have used the following chart many times to show the relationship between the fixed high rate and floating low rates that banks use. When the fixed rate drops below the floating rate the banks are compromised. They want the floating rate, designated by the red line, to always float below the blue line.

The long simmering LIBOR cases against the big banks may have hit a danger point according to reports by Fortune Magazine and others.

Fortune said: on Monday, a judge pushed an anti-trust case against the banks forward, warning that if the case ends up being successful it could be devastating, potentially bankrupting 16 of the 17 largest banks in the world.

“Requiring the banks to pay treble damages to every plaintiff who ended up on the wrong side of an independent Libor?denominated derivative swap would, if appellants’ allegations were proved at trial, not only bankrupt 16 of the world’s most important financial institutions, but also vastly extend the potential scope of antitrust liability in myriad markets where derivative instruments have proliferated,”

The following chart that I have used many times shows the tracking of the fixed rates by the blue line. Tracking the floating rates that the banks took is shown by the red line.

So, the claim is that the red line in the chart was artificially manipulated downward – price fixed downward, if you will. It may be, if proven in court, that the red line should have been closer to the blue line or even above the blue line for longer. The banks took the low floating red line rate, and they won against the cities and investors because those investors took blue line fixed side of the bet in order to protect against inflation. Some investors were forced to take the fixed blue side of the bet to even get a loan in the first place. Of course, as anyone can see, when the blue line dipped below the red line, banks were in trouble, and the recession was upon us. This crossing of the lines helped lead to the Great Recession. Here is an example:

Leave A Comment