I woke up yesterday to see oil below $27 a barrel, the US 10-year at 1.6% and the Dow down to 15,600. How quickly the economy is faltering. It is a crazy moment.

Oil below $29 a barrel creates Geo-political tensions that can create attacks of aggression. Other countries have already tried to negotiate with the Saudis to raise oil prices… and now oil is slipping to even new lows. A tense situation for oil producers.

The US 10-year hitting 1.6% so fast over the past month seems to be building downward momentum. The yield curve is trying hard to flatten even with short-term rates near zero.

Recession seems imminent. Will it happen?

I called a recession this year based on my assessment of effective demand. Others like Tim Duy and Janet Yellen do not see a recession this year. But they lack an understanding of effective demand.

I have seen this coming for a couple of years.

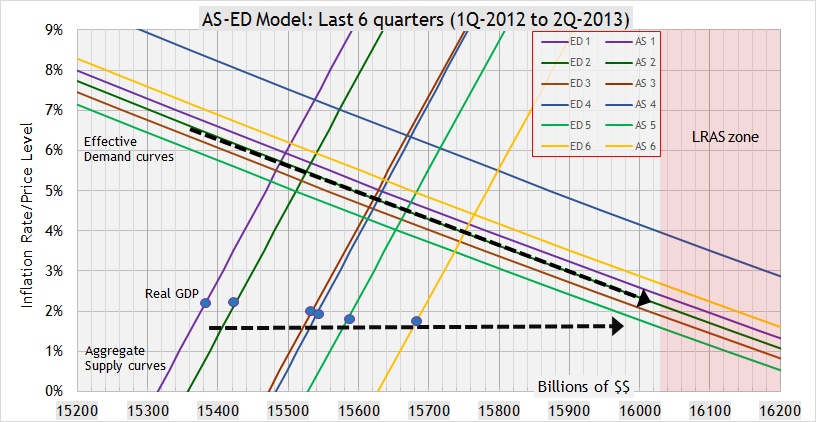

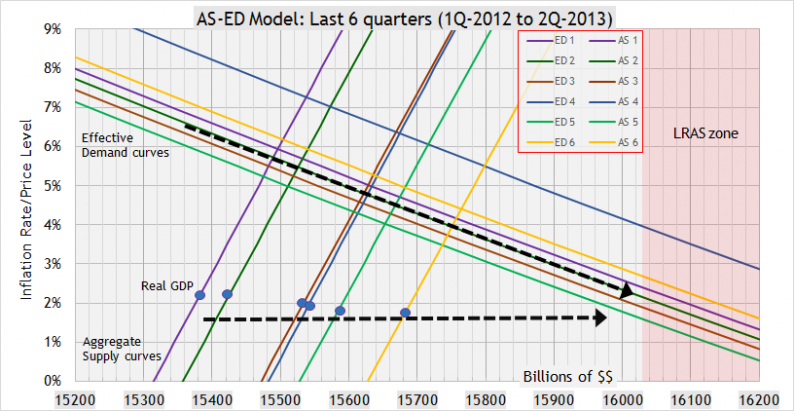

Back in September of 2013, using my Aggregate Supply- Effective Demand model, I saw that an effective demand limit was forming at a Real GDP around $16 trillion (2009 $$). The AS-ED model was only developed in April, 2013.

Here is an image from a post back then.

I saw that the effective demand lines were bunching together setting up a Long-run Aggregate Supply zone around $16.1 trillion, where the aggregate supply and effective demand lines would meet.

I wrote in September, 2013…

“The blue dots along the bottom are real GDP on the aggregate supply curves increasing at an inflation rate around 2%. Real GDP will most likely continue this path over the next year, shown by lower dashed black line. The dashed black line above shows the effective demand limit coming steadily downward toward the LRAS zone. (LRAS is long-run aggregate supply). Real GDP and effective demand will meet at the LRAS zone. What will happen when they meet? … If real GDP keeps growing at around $100 billion per quarter as it did in 2nd quarter 2013, real GDP will enter the LRAS zone in mid 2014.“

Leave A Comment