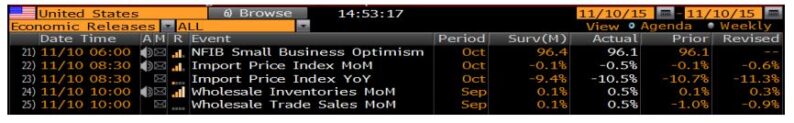

Numbers:

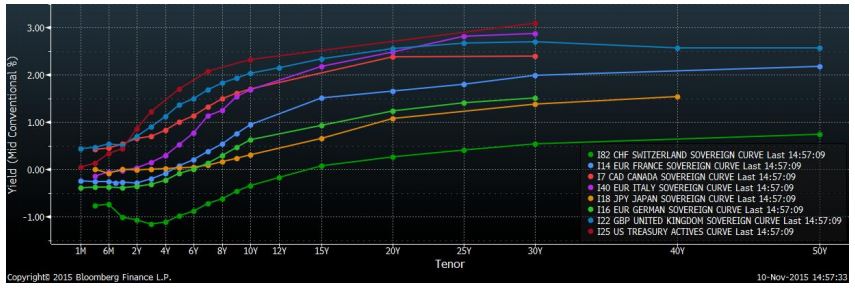

Yield Curves:

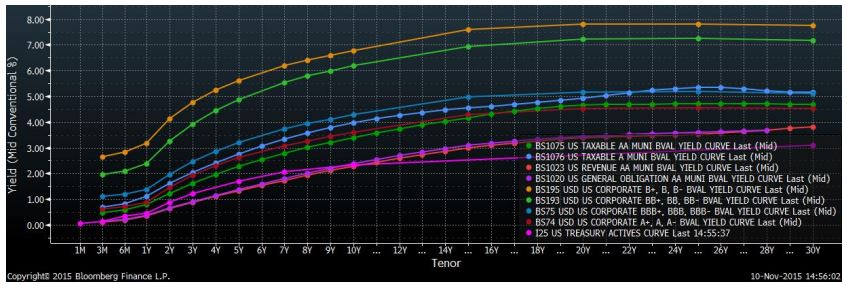

Credit Curves:

Making Sense:

We have several topics worthy of discussion today. So sit back, grab a coffee or tea and enjoy some relaxing bond market reading.

Thick as a BRIC

Goldman Sachs has become less sanguine on the Brazil, Russia, India and China (BRIC) story. Craig Pirrong, a University of Houston finance professor, told the Wall Street Journal: “I would view this as a confirming signal that the party in commodities, and BRICs, is over.” GS spokesman, Andrew Williams stated: “If I were to change it, I would just leave the ‘C, but then, I don’t think it would be much of an acronym.” I would just leave the “I” from the group, but that is what makes markets. GS still believes EM should be a strategic part of investor portfolios. I believe it should be a tactical part of portfolios and individual countries should be chosen. At present, I prefer net commodity consuming economies versus net commodities producers. However, EM investing is not suitable for all investors. As such, please contact me directly for specific recommendations.

Green Grass and Low Prices Forever?

The IEA announced that it does not expect the price of crude oil to return to the $80 per barrel level until 2020. By that time, the IEA believes that OPEC will have squeezed out many of its rivals. This contrasts sharply with the popular outlook from earlier this year that the price of WTI might reach $80 by the end of 2015. This also contrasts sharply with the opinion of Citigroup energy analyst, Anthony Yuen, who believes that crude oil prices will probably settle in to the $50 to $60 range during the next several years and that OPEC could fracture during the next five or six years.

Although Mr. Yuen’s outlook makes much more sense to me, in a world where the U.S. is likely to be the swing producer, forecasting out five years, or even three years, is borderline foolish. Few saw the plunge in oil which began in 2014. Few believed that shale producers could be profitable below $80 a barrel. According to presenters at last week’s Global Interdependence Center energy conference, most U.S. shale producers are profitable at the $50 level. Most of OPEC (other than the Saudi’s) need oil near or over $100 a barrel. The difference is that U.S. producers are more efficient and they have the private sector ability to increase efficiencies as technology allows, without the baggage from a central energy policy and government-dictated wage and hiring policies. If you think that the grass is greener in foreign backyards, I would suggest you check to see if the green paint is still wet before climbing the proverbial fence.

Leave A Comment