The technical trajectory has supported our view for several weeks regarding probabilities of ‘front-selling’ in April; erosion in May; and likely not surviving this month without a notable decline in the S&P. Meanwhile the S&P ‘swoon’ really is a ‘catch-down’ with the behavior of the broader market, even the Dow Industrial Average, which is already below the referenced lows of recent weeks.

This reluctant decline has been facilitated of course by events (including many clarifications by the Fed of the ‘probability’ of a rate hike); but preceded by many indications of distribution and heaviness money managers and analysts mostly tried to ignore, as they shuffled the sector deck (rearranging musical chairs) in a way intended to obfuscate the ongoing selling in vulnerable momentum areas.

All-in-all it’s been a tedious project; but while not exciting, it was as forecast. It’s rare (if not unprecedented) that we would retain a single ‘guideline trade’ for now three weeks. We did that (and have stated daily) because we advised against a too-rapid trading approach; reflecting our confidence this was a topping process that was going to work its way to lower levels, as has evolved according to the April-May overall projection.

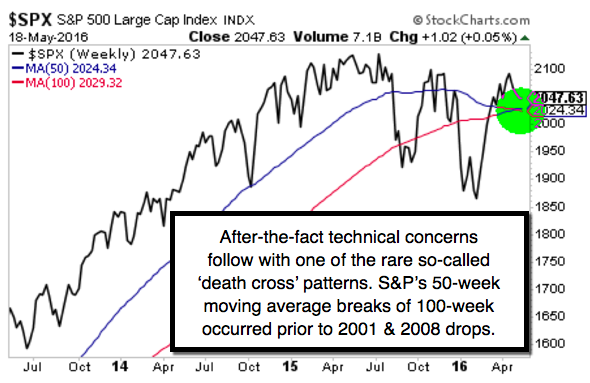

Fundamentals can only be viewed in a vacuum ‘technically’ when trading for sure; but not when one considers long-term investment implications. Today we frequently hear ‘technical’ arguments for movements higher based on patterns that might be plausible (like the twin lows of last year and February; when we as you know harvested incredible downside gains in our short-selling guidelines), ‘if’ this were another time and ‘if’ the Country (and global picture) was different.

Do keep in mind how many pundits or analysts have been compelled to retreat and downgrade guidance and GDP outlooks, just as we’ve forewarned for more than a year. We have allowed for trading moves either way in the framework, but recognize throughout that it was subsidized first by monetary policy; and later by buybacks; both of which were not affirmed by growth in actual business profits.

Leave A Comment