Overwhelming defensive fears combined with weak oil, to deliver Friday defensive, if indecisive, behavior, very much in line with our idea of fake-out nominal moves above the 50-Day. These have minimal sustainability since they are primarily a series of short squeezes, which never warrant the ‘hurry what do we buy’ stock market pitches that come right-back to the fore after each such breakdown. This market is pretty-much nervously ‘still on-hold’.

Of course three major pieces of Legislation are possibly forthcoming in the week ahead and that weighed on the trading swings this week (rapidly and in both directions on Friday), which we’ll touch upon a bit more later.

In a sense what they’re missing is that this is a prolonged equity distribution process; which ‘high-wealth’ and hedge-fund behavior anticipated (the latter reflecting a mostly poor performance for months, because they positioned for a Trump defeat, not bump of the magnitude we looked for ‘if’ he won).

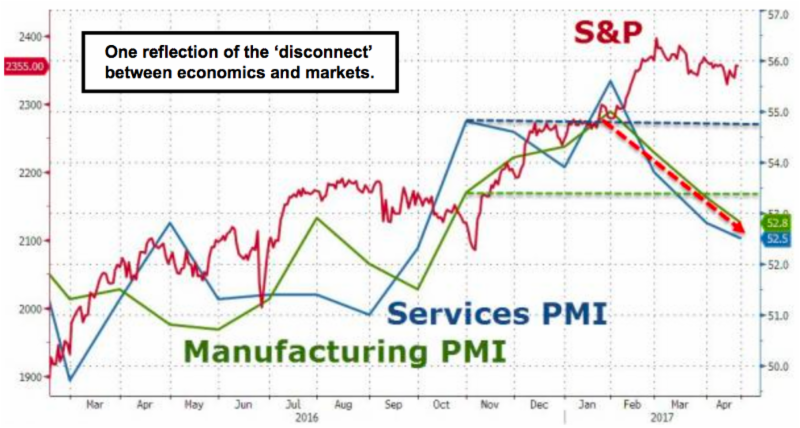

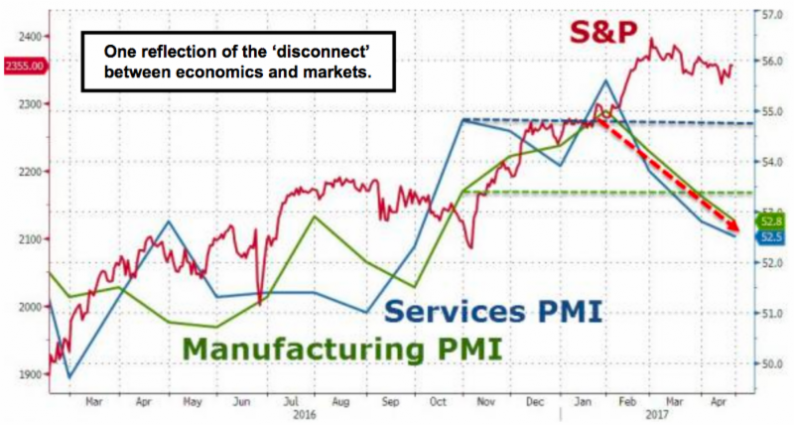

Yes, we have pointed-out for months that the advance was predicated, as a market will do, on anticipation of ‘Legislation, Enactment, and then of course Implementation’ of pro-growth policies to further rejuvenate overall growth. I have shown many charts displaying ‘disconnects’ between the ‘real’ normal household incomes and ongoing sluggish business behavior, and of course the robust market action which presumes growth progress is forthcoming.

My view was and remains that robust action was a ‘discounting mechanism’ for growth reform and initiatives; with the equity market over the last couple months essentially having ‘priced in’ those coming policies, pending actually getting the results. The entire late February to now view was seen as ‘fade the rallies’ time, rather than buy the dips that prevailed from early November until then. Investors increasingly grasp that restructuring precedes profits. It simply suggests that the ‘normal’ anticipation rally needs ‘factual’ follow-thru to keep it alive, or at least to mitigate against substantial corrective action.

Leave A Comment