Cable Rally Testing

One of the more noteworthy events thus far on the week was the surprise announcement from British PM, Theresa May, of early general elections. The move has largely been applauded by analysts as a cogent political move ahead of what’s expected to be a terse negotiation around Brexit; but for traders and investors the bigger question is whether Tuesday’s announcement is a legitimate ‘game-changer’ for the U.K. economy.

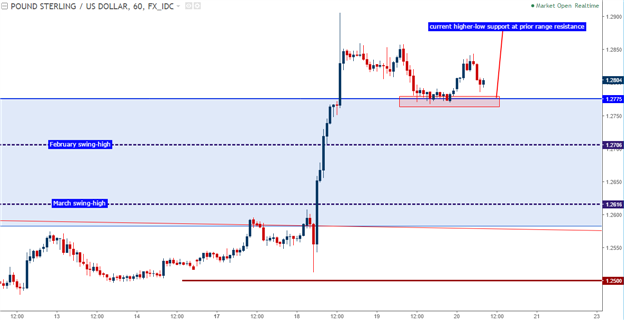

The British Pound burst-higher on Ms. May’s announcement, breaking above the range that’s denominated price action in the pair since the ‘flash crash’ in early-October. But as we warned as it was happening, the move was very new and traders would likely want to avoid chasing-higher until more confirmation was seen. Since then, we’ve seen prices pullback a bit to find support at that same level that had previously offered resistance – around 1.2775. In yesterday’s technical piece on GBP/USD, we looked at how traders could take a risk-focused approach towards continuation strategies in Cable.

On the chart below, we look at the updated price action in GBP/USD, with eyes on how one might be able to continue to plot top-side strategies up to the 1.3000-big figure. For those that do want to take on short-exposure in Cable, fading this recent move-higher – they’d likely want to wait for this higher-low around 1.2775 to give way before plotting the short-side of the move.

Chart prepared by James Stanley

18-Year Trend-Line in Oil Still Catching Inflections

Oil prices have been swinging wildly of recent, and much of this has been driven by prognostications around OPEC and a continuation of last year’s OPEC/Non-OPEC deal. The current deal is set to end in June, but as of this morning reports that Saudi Arabia announced that Gulf-based Oil producers have reached an agreement on extending the deal.

Leave A Comment