Whether trade walls suddenly fall or some other relief occurs between now and Midterms, is a certain ‘known-unknown’. However Larry Kudlow’s Friday morning appearance on CNBC did not produce the kind of rebound seen on his last references to ‘trade’, although the down-bounce-falter of that first hour is just what I called for in a pre-opening intraday note.

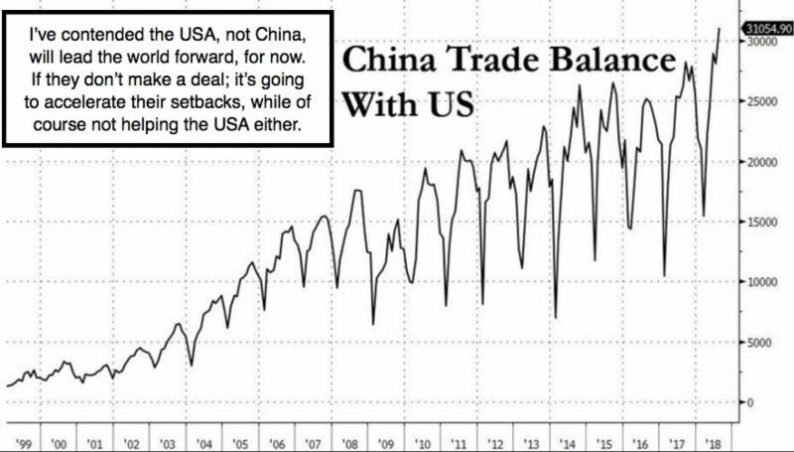

Later, as the President outlined a proposed further increase in tariffs on Chinese made goods (this time including many of Apple’s products; hence bearing the shares a bit more just days before their next product rollout), stocks of course came under renewed pressure. We got a forecast down-up-down session; but the point is that many stocks have been setting-up for decline for weeks if not months; as consistently observed.

I also agreed with reasonably favorable interpretations of the Jobs Report; at the same time none of it was really earthshaking. Average Hourly Wage earnings were solid; and that’s more ammunition for the Fed to hike and I’d not be consoled by the idea of needing 2 or 3 more to impact markets.

Daily action has actually rolled around throughout an excessively longer than usual trip of mine (with recovery from a ‘ship flu’ bug complete); oddly finding the S&P tense throughout, but little resolved or changed trend-wise as the leading (capitalization-based) Senior Index stays in a high range. At the same time, whether Financials; cryptocurrencies; or EM stocks; most did not reward investors; and even eroded while the S&P range persisted.

That range is troubling; because ‘even if’ the US finally executes new trade deals that the markets like, those Indexes were at such extreme levels that one might get a sharp rally that nevertheless gets sold into.

As assessed before traveling to Europe; the high-priced momentum stocks (including FANG..Facebook, Apple, Netflix & Google) or other extended stocks, were at risk of blowing-off, already correcting, or too high-priced to interest any buyer not compelled to chase the upside. (Tesla is one stock I also warned of for many months as on borrowed time, due to competitors driving forward. I admired Musk; while recognizing challenges faced.)

Leave A Comment