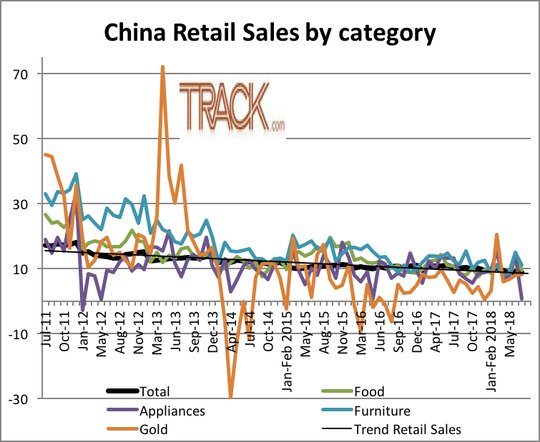

If yesterday was about contagion, today is about relief. The fact that TRY isn’t at a new low has brought out buyers of the dip. The flip-flop of mood has been attributed to this calming of Turkey contagion fears. The reality is that nothing has changed and that Erdogan now wants to ban Apple Iphones as his next retaliation against the US. The headline stories of EM calm obscure the facts about China slowing. The watching Turkey not China story will unwind today as the data from China is clearly troubling – jobs which are the most important to keeping social stability are less plentiful. Investment spending is at a new low – and particularly where people need it the most – healthcare and education.

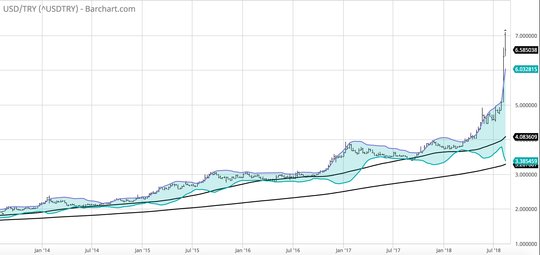

There is nothing good about the China story except that the trade tariff talk has slowed. Perhaps that is enough for the flippers to keep buying the dip. As for Europe – there was a significant economic data dump with German GDP mixed, EU GDP better and UK jobs strong but wages flat. The job to inflation connection has stalled in the developed markets and its allowed central bankers room. The question remains whether the FOMC is still the central bank of the world and its path to normalization off-putting enough to drive away more risk in September. Data for Europe today puts ECB back in ending QE mode and that helps and hurts – with Italy still mired in political budget battles and EU fights. The simple angle for trading today is that after Friday and Monday selling, today is a resting day, but the more complicated view maybe about taking advantage of a market focused on the wrong hand of EM risks. Turkey remains in a dire devaluation trend. Wake me up if 6 breaks until then today is a breather and an opportunity to hedge more risk.

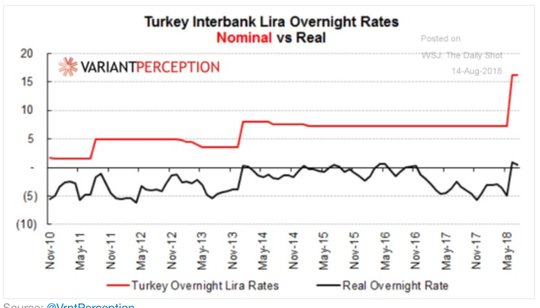

Question for the Day: Will higher rates fix EM outlfows? Short answer now – its about inflation inspired by FX weakness. The Argentinian central bank hiked rates 5% to 45% to help battle against the inflation caused from the weaker ARS – which remains near 30 and off 38% on the year-to-date.This hike didn’t seem to matter much.China has another tact on its battle against the weaker CNY – it’s been changing reserve requirements on forwards – hiking cost of shorting CNY – but also keeping tighter capital controls and trying to offset the US tariff inspired slowing by more government stimulus. The CNY has gained against its basket for 2 weeks but not today – with risk that 7.00 is tested still. The Turkey response to its crisis is also different but the rate response stands out with real rates near 0% overnight despite the nominal tick ups – TRY is better today but that 5.5% gain today is a blip in the 42% losses year-to-date.Real rates maybe the better way of thinking about crisis responses with Brazil the stand out player in using them to stamp out speculation.

What Happened?

Leave A Comment