Markets are obsessing about price again, data has become an excuse to sell not buy risky assets. US divergence of rate policy and growth is in doubt. Diversity isn’t working in portfolios, as risk assets all continue to suffer. The US market moved towards correction status with the Russell 2000 dancing on a bear market. The catch-up of US stocks to the rest of the world may not be so simple with the ECB meeting the main focus for global markets as many hope for a dovish Draghi performance. Norges bank was a non-event and likely the ECB wishes to be the same. The pressure from US President Trump on FOMC Powell has kept him quiet as well.

Markets are looking for a back-stop to buy but the clear shift in buying dips to selling rallies has been the October game. They aren’t getting that from central bankers. So the stability for markets will be in the more traditional games of value, government stimulus, and evidence of growth and earnings outperforming. The reasons for today to be different than yesterday’s rout are not just about the noise of increased volatility – though 50 point moves in the S&P500 should be expected. The fear list looks less obvious: UK May survived another political challenge, Italy and its budget battle waits for the ECB, US earnings continue with more winners than losers, China managed to hold stable as the CNY holds the line. Against this the Korea GDP miss reopens BOK hike doubts, the German IFO shows a clock moving to the bottom left instead of the top right.

While many would like to say that JPY is the best barometer for risk and AUD/JPY does have the longest track record, the role for Asia and EM shifted after August 2015. The 6.95 CNY level looks more important now than ever and its not going to be obvious until tomorrow that today’s modest bounce back in China, Europe and the US mood has meaning until after the US GDP report.

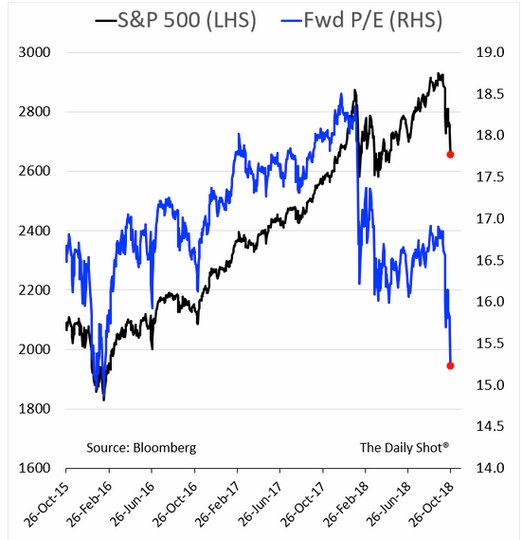

Question for the Day:Are risk markets oversold? The blame game for the October pain trade in equities has been put on US trade policy, US rate policy, the USD, the fear of peak earnings, the fear of global economic slowing, the geopolitical noises from Iran sanctions to South China Sea worries, to Brexit politics to Italian budgets. Markets have been able to climb a wall of worry until October but they have given back all the yearly gains. What this means is that positive news on growth and earnings will have a more profound effect going forward and today’s bounce will be watched to see if the selling rallies mantra of the month still holds. The relationship of rate policy to financial stability has been clear since 2008 but its been wobbly since 2014 and the tamper tantrum. The most important part of the weaker US market is in what expectations are for future earnings and growth. Value opportunities go up with the present share weakness.

The most interesting chart comes from the GS baskets of R&D vs Cash buyback shares. They highlight the view that the 9% move down in October is an opportunity for companies that have cash to buy back shares and they punish those that spend money on investments to improve growth and productivity.

Leave A Comment