VIX made a wide swing between weekly Intermediate-term resistance at 20.21 and weekly mid-Cycle support at 15.97, but did not make a new low. An aggressive buy signal (NYSE sell signal) may be confirmed with a rise above Long-term support/resistance at 18.40. A breakout above the neckline suggests a very robust follow-through rally that may last several weeks.

(Bloomberg). To see how fast sentiment soured on last year’s momentum winners, look at the options market, where the price of insuring technology stocks against losses is holding stubbornly high versus other industries.

A Chicago Board Options Exchange gauge tracking costs of hedging in the Nasdaq 100 Index is the highest since August versus a similar measure for the Standard & Poor’s 500 Index, according to data compiled by Bloomberg. The ratio of the two gauges sits 11 percent above its seven-year average and is hovering at a level has reached only two other times since the start of the bull market.

SPX closes at the 4.3-year trendline.

The SPX made another attempt at its 4.3-year trendline at 2022.50 and its Long-term resistance at 22.05, closing between them. This trendline was originally broken on January 6, in the decline to the January 20 low. Trendlines are important support areas that often attract, then repel the markets. A second attempt that meets with a failure may signal a reversal.

(ZeroHedge). While many investors may be breathing a sigh of relief thanks to the bounce off the February low, with the S&P up 11% since the start of February – it’s still not all lollipops and rainbows out there in market-land. There’s some worrying undercurrents that could spell more trouble ahead, not to mention pros like Jeff Gundlach claiming there’s just 2% of upside in the S&P 500 and 20% downside.

Just what’s on the mind of some of the sharpest investment managers out there? We were lucky enough to have Mike Melissinos of Melissinos Trading send along a collection of charts and indicators he’s been looking at with a worried eye, and thought it was worth sharing here. Enjoy…

NDX ends week beneath Intermediate-term resistance.

NDX closed a second time beneath weekly Intermediate-term resistance at 4378.61, completing a 55.6% retracement. Should it decline beneath weekly mid-cycle support at 4168.55, NDX may continue its decline to 3000 or lower.

(ZeroHedge) Nasdaq risk is dramatically higher than S&P risk at current levels. Despite the exuberant ramp of the last few weeks, the ratio of Nasdaq VIX to S&P VIX is at its highest in over 6 months.

This is worrisome since the last time Nasdaq traders were this much more concerned about future risk than S&P traders, was right before the August flash-crash collapse…

High Yield Bond Index extends its rally.

The High Yield Index extended its rally to nearly a 100% retracement of the decline to the August low. The retracement from the next decline may not be as generous.

(USNews). Despite coming off a year with a relatively low number of defaults, weakness in the commodity sectors, particularly in energy and mining, is likely to lead to more defaults in the high-yield market in 2016.

Last year’s total defaults represented about 2 percent of the market, while Standard & Poor’s estimates the long-term average is 4.4 percent. This year, however, the severe loss in the energy and mining sector could push the total percentage of high-yield bond defaults to 5 or 6 percent of the overall market, says Scott Roberts, co-head of high-yield investments and senior portfolio manager at Invesco in Atlanta.

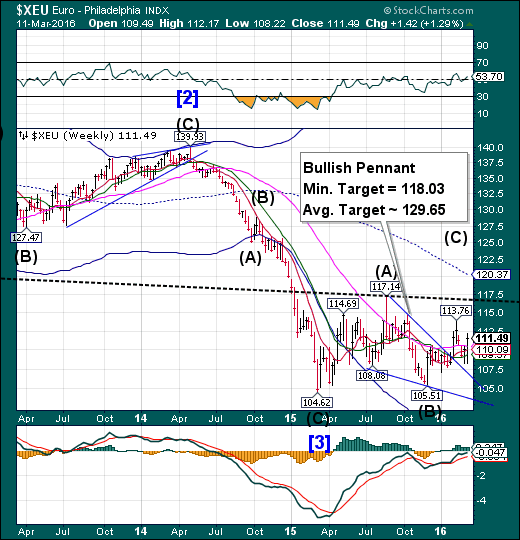

The Euro breaks above its consolidation zone.

The Euro broke above Long-term resistance at 110.45. The Cycles Model suggests a period of strength has begun and may continue through the end of the month with the minimum Pennant target in reach.

(Reuters) If the European Central Bank’s latest monetary easing salvo was a surprise in its intensity, then so was the seemingly perverse rise of the euro in response – a move that’s left the most bearish currency forecasters scratching their heads.

Leave A Comment