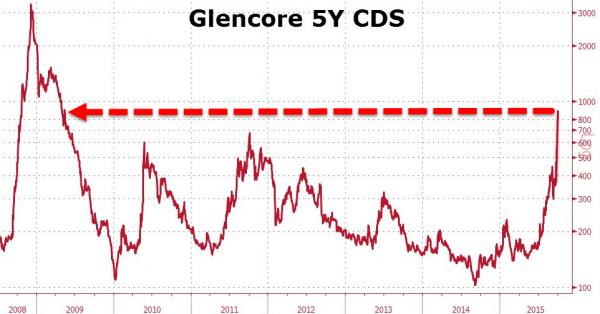

Glencore is in total free-fall across all markets today. Most worrying for systemic risk concerns is the rush into credit protection that has occurred, as counterparties attempt to hedge their exposures. For the first time since 2009, Glencore CDS are being quoted with upfront pricing (something that happens as firms become seriously distressed). Based on the latest data, it costs 875bps per year (or 14% upfront) to buy protection against a Glencore default (which implies – given standard recoveries – a 54% chance of default).

Do not panic!!

These are the highest levels of risk since the post-Lehman systemic crisis…

As Bloomberg reports,

Derivatives traders started demanding upfront payments to protect against a default by the company, the first time that’s happened since 2009, according to data provider CMA

The cost of five-year credit-default swaps jumped so high that they effectively were pricing in 54% odds that the company defaults, CMA data show

“Glencore management need to make an official announcement to calm nerves,” said Darren Reece, a money manager at GAM Holdings AG in London, which oversees $127b

Charts: Bloomberg

Leave A Comment