Markets made a mistake when it allowed for a drop in the share price of PayPal (PYPL). After reporting quarterly results that negated fears of weaker transactional volumes, PayPal’s stock bounced back. There are a number of reasons the former eBay (EBAY) subsidiary will give strong returns for investors.

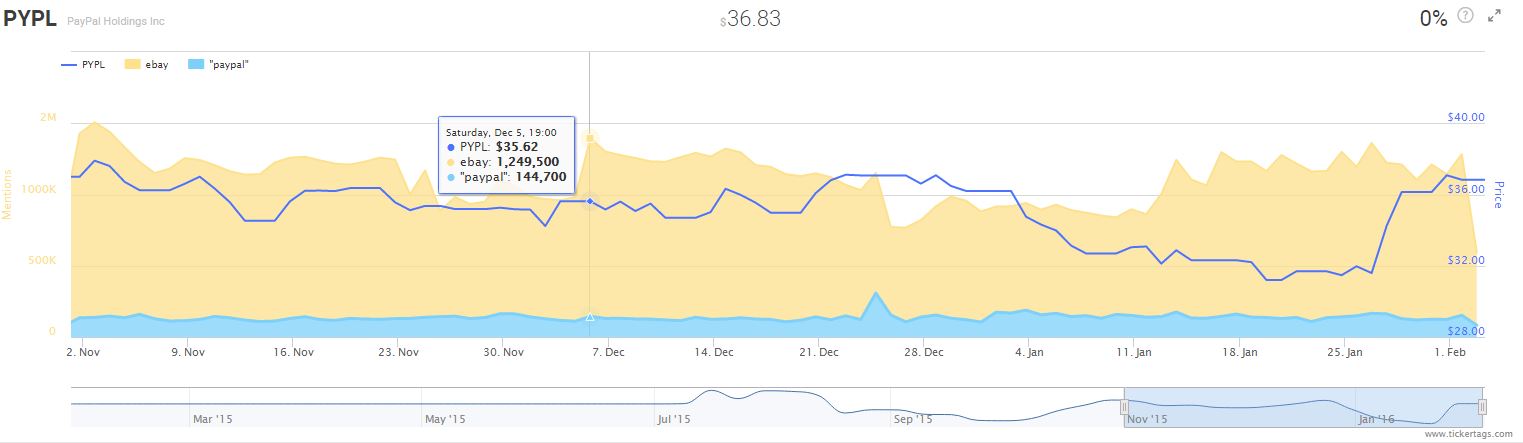

Interest for PayPal never fell since October 2015. Per TickerTags, the count of mentions for PayPal held steady, at a million. There is still a direct correlation between PayPal and eBay. Even after the separation, the frequency of mentions for eBay and PayPal were in sync:

Source: www.TickerTags.com

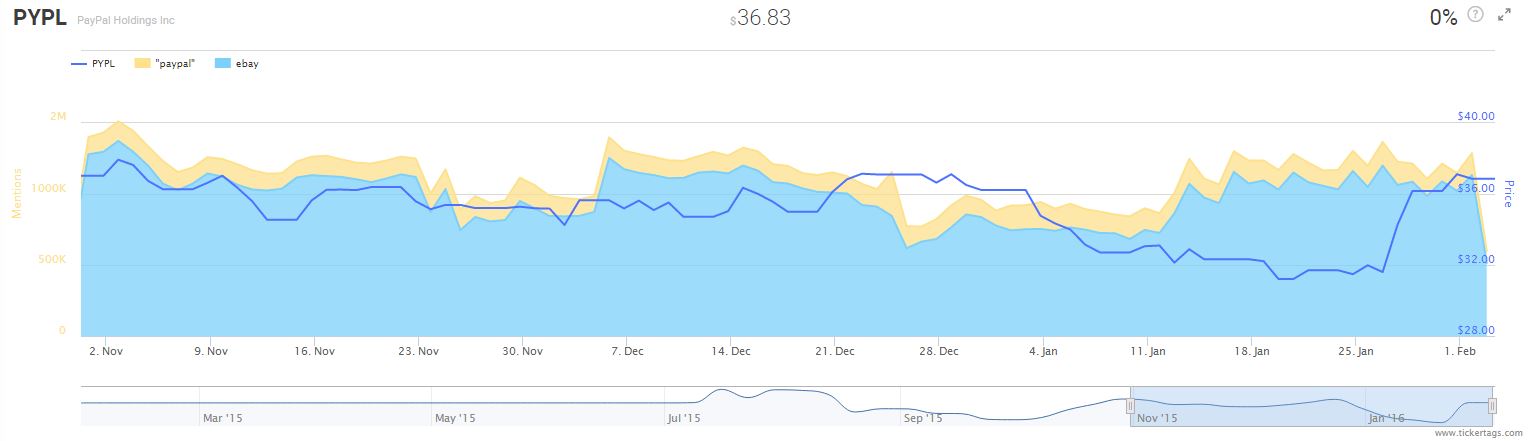

As mentions for eBay improved by mid-January, PayPal’s stock continued falling. User interest for the auction site surged ahead of PayPal’s stock rebounding:

Source: www.TickerTags.com

PayPal’s association with eBay clearly hurt the stock. Sales for eBay in the forth quarter was flat at $2.32 billion. Its earnings of $0.50 per share only met consensus estimates. At a stock price closer towards yearly lows, eBay has a P/E of around 16.5 times.

Although the stock is inexpensive, there is limited upside for eBay. Its StubHub and Classifieds units will take several quarters to grow. While this means limited stock appreciation for eBay’s shareholders, it is a positive development for PayPal. The more eBay builds its business, the more transactions PayPal will have to process.

In increase shareholder value, PayPal is buying back $2 billion worth of shares, or 5 percent of float. The company raised revenue and earnings guidance for the first quarter. Moderate transactional growth at eBay helps PayPal’s revenue. Ex-eBay, merchant service volume is healthy.

In its fourth quarter, merchant service volume grew 36 percent. The company also benefits from a shift of desktop users to mobile. 81 percent of the volume came from mobile (25 percent of total volume).

Leave A Comment