There is a long list rationalizing Friday’s powerful thrust. The list runs the gamut from the return of central banker domination of markets to the end of corrective market action running a slew of short-sellers. From the renewed push on risk-averse investors chasing yield again to new glory times and a full recovery of what often the same guys called a bear market days ago. (Of course latter arguments defy the earnings recession issue as now prevails, and would persist for some time ‘even if’ currency devaluations were halted.)

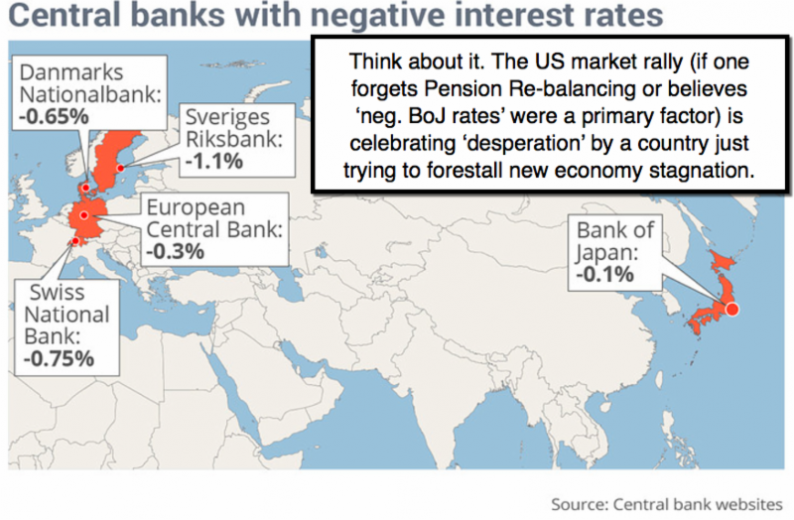

You know what’s missing from that list, (or the loss of attached behavior to Oil at least in Friday’s session)? What’s missing is the reason we were wary all week about an upward move that related to ‘Pension Re-balancing’. The answer is that interest rates continue to fade; and yes that reflects ‘disinflation’ as they prefer to call deflation; while all of this inflames the global currency war, which cannot end well. Should the proper reaction to this scramble (to an S&P zone we were hoping-for anyway on the rebound) be consternation, that central banks like the BoJ are just acting in economic desperation, with no special reason to believe that more doses that failed before will succeed now?

For instance; how well has Japan done with the race to zero; now below zero? If there’s a laboratory experience on easy rates and Quantitative easing; it’s the Tokyo experiment. What’s also not focused upon is how these moves, if by any chance they actually triggered the dramatic economic recovery and inflation; by definition would accelerate the destruction of wealth that’s gone on for years. In a sense consumers (or those not dependent on inflation-adjusted income) have actually seen a relative retention of purchasing power during deflationary times. Perhaps that’s why not everyone is happy central banks want to build debt to a level that only a runaway inflation and currency debasing could resolve.

Leave A Comment