Oil and stocks are behaving as forecasted. However, metals and miners aren’t. Therefore I had to reassess the charts looking for alternate scenarios. Yes, one of the scenarios is medium term bearish. However, the odds are not favoring it. Nevertheless, it’s something to monitor, and if exercised it will present an incredible buying opportunity.

Metals were up today, and that is particularly odd behavior one day before a FED announcement. I can only assume markets are beginning to think Trump has a real chance of winning in light of Hillary’s FBI problem.

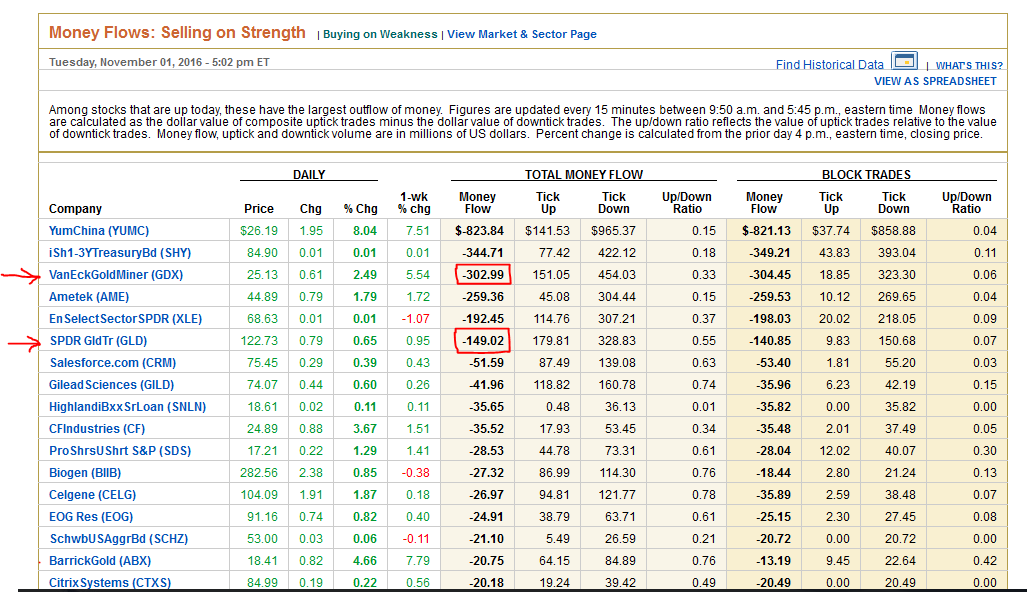

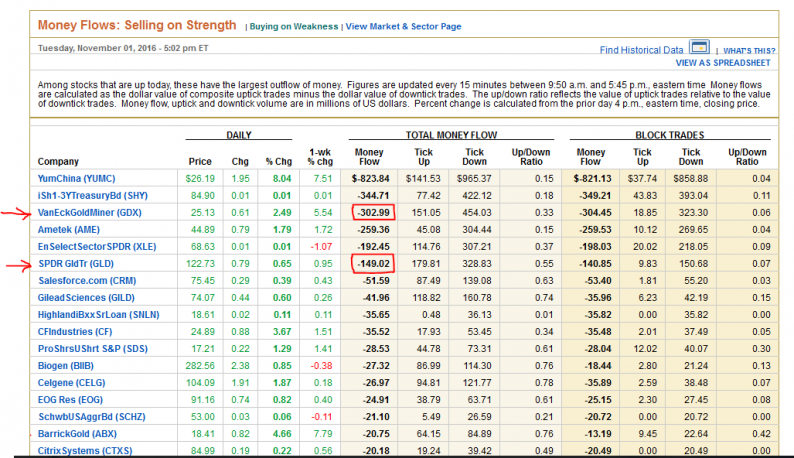

Once again there was selling on strength in miners. These numbers support the bearish view as it appears smart money is selling these rallies. Time will tell.

-SELLING ON STRENGTH- Numbers came in again today for GDX. Data provided by the WSJ.

-US DOLLAR- The dollar needs to find support around the 97.50 level to keep a bullish perspective.

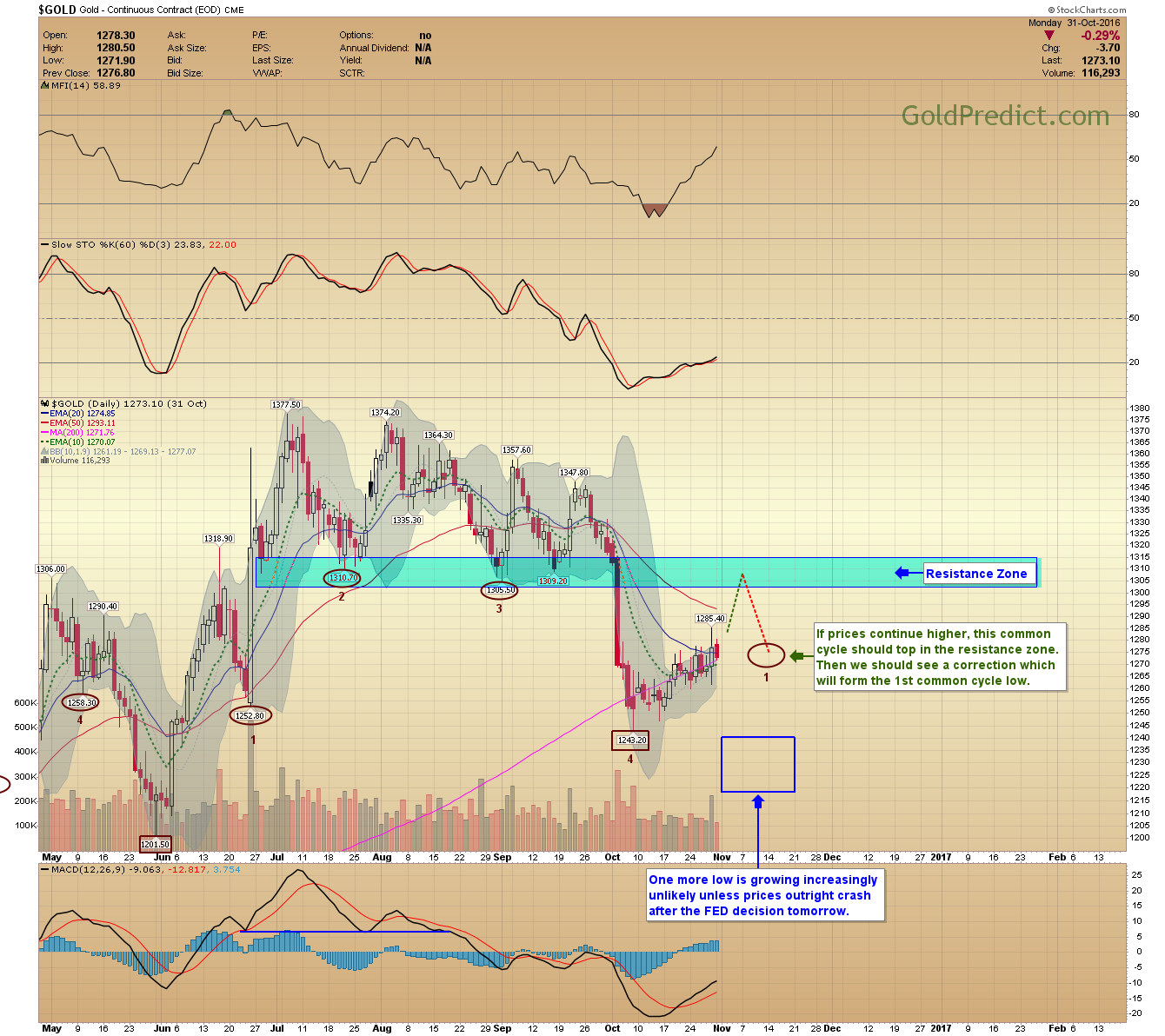

-GOLD STEP 1- If prices continue higher, this common cycle should top in the resistance zone. Then we should see a 2-3 week correction which will form the 1st common cycle low.

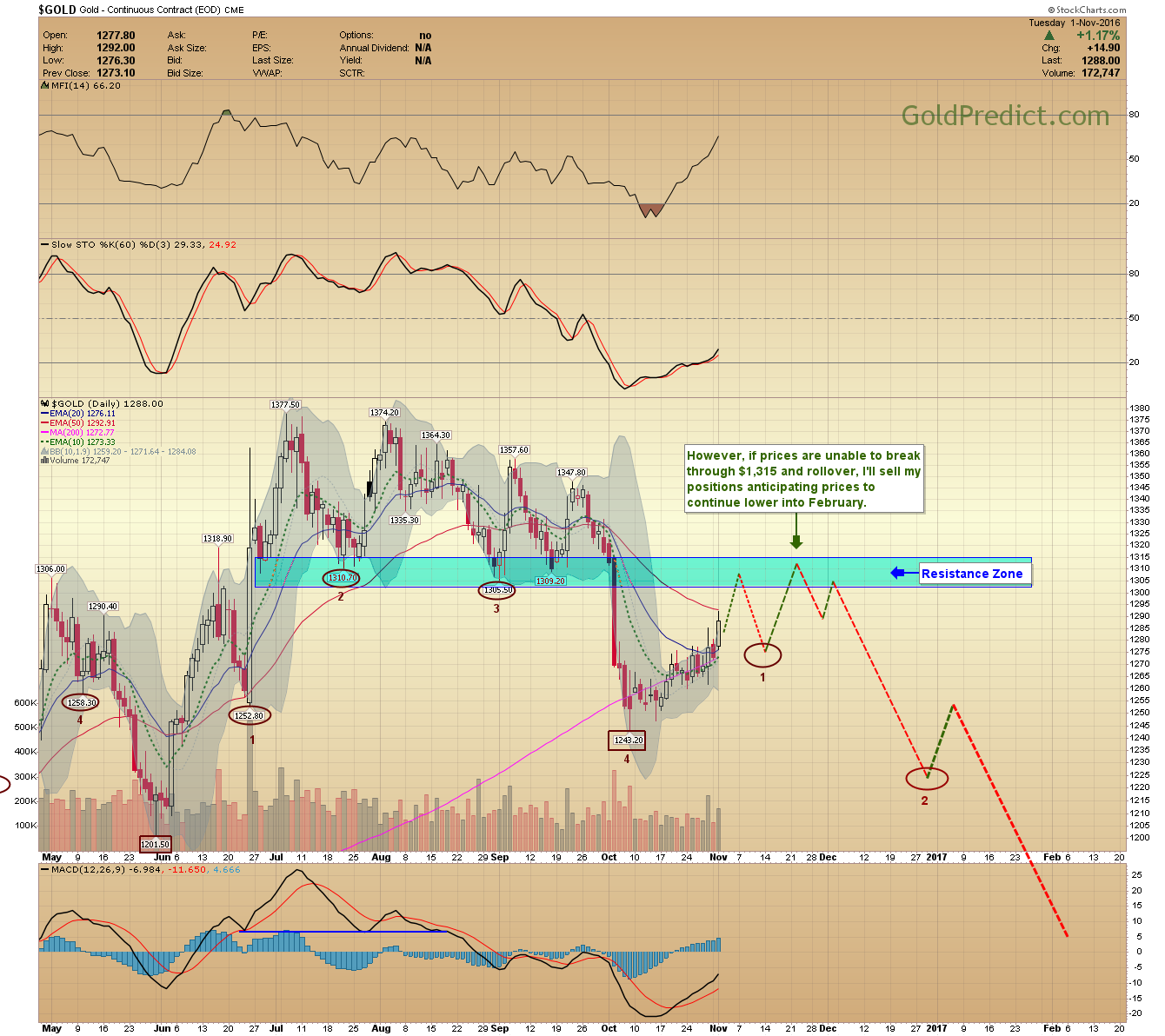

-GOLD STEP 2- I will take partial positions here anticipating the next cycle higher will break through the resistance zone ($1,315).

-GOLD STEP 3 FAILURE- However, if prices are unable to break through $1,315 and rollover, I’ll sell my positions anticipating prices to continue lower into February.

-SILVER- Silver jumped higher today and technically won’t provide a confirmed low at $17.11 until $19.00 is taken out.

-GDX- Price is entering the resistance zone. It needs to break through decisively to avoid the bearish potential in the chart.

-HUI- The bearish possibility in miners (if gold can’t break above $1,315) translates into a possible head and shoulder top formation. For this scenario to play out, the HUI needs to remain below 240, top and then roll over breaking below the neckline at 195. In this scenario, prices would likely drop until February and reach between 120-135.

Leave A Comment