When the Bank of Canada announced its first-rate hike in nearly a decade this past July, it stated that there was no longer the need for “emergency measures” taken in 2015 to counter the adverse effects of the collapse in oil prices. A subsequent increase in the bank rate has announced this September in response to the strong first half year’ performance. In addition, surveys of business intentions regarding investment and hiring encouraged the Bank to continue restoring interest rates to pre-2008 crisis levels. Analysts started to pencil in 3 rate hikes during 2018, anticipating strong growth in support of their forecasts.

Short-term interest rates headed skyward and in a related mover, the Canadian dollar strengthens. All systems were ‘go’ for investors in the equity markets.

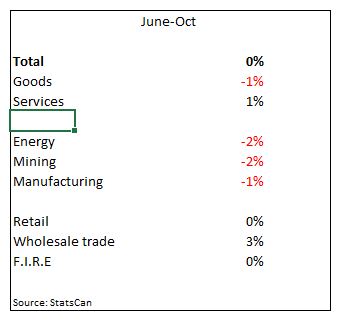

We now have the benefit of hindsight with the release of the GDP data for the June- October period and the numbers tell a quite different story. Over this period the economy simply did not grow, the level of total annual output in October matched that of June. Inside the aggregate data reveals some glaring weaknesses in important industries.

Canada GDP June-Oct 2017 (annual rates)

Overall the goods-producing sector has steadily declined, led by fall in output in energy, mining and manufacturing. The service sector, which represents the largest single component of GDP, expanded a mere 1% since June. Retail trade, in volume terms, remains flat. Wholesale trade has expanded the fastest, but this expansion is most likely unwelcomed in the sense that it represents goods produced that remain unsold and will have to be written down before year’s end. The category of finance, insurance and real estate (FIRE) has been, in the first half of the year, a strong performer, especially given the rapid rise in housing prices across the country. But the slowdown in the housing industry is now more apparent from these results.

Where can we anticipate better performance in the coming year? Nothing has changed in the energy sector regarding prices or new markets for Canadian oil and gas producers, so energy will not be a growth sector of any significance. Business investment is held in check while so much uncertainty clouds NAFTA’s future. New regulations in the mortgage market will likely slow down the housing activity as some borrowers will be no longer qualify.Given the record levels of household debt, retailers will be under pressure to meet sales targets. Wages continue to be suppressed, holding down final output prices. The introduction of a higher minimum wage in Ontario will squeeze profits in selected service industries. Under these circumstances, it understandable if the Bank of Canada holds off rate hikes in 2018. The economy, simply, lacks traction.

Leave A Comment