Before I go into the substance of it, remember that just being bullish doesn’t make for a trade. You have to have a risk/reward setup that meets your objectives. I believe that commodities will not run back to 2014 levels quickly. Instead I expect an upward sloping trading range that will give numerous points to take intermediate profits. Along that line, I wrote Nov 2016 Soybean 12 calls against my long 10 call position. If the market dips, I’ll add back.

Commodities Are Cheap

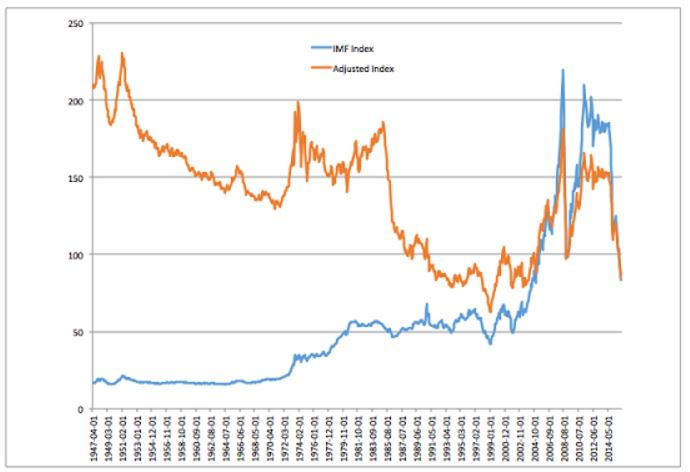

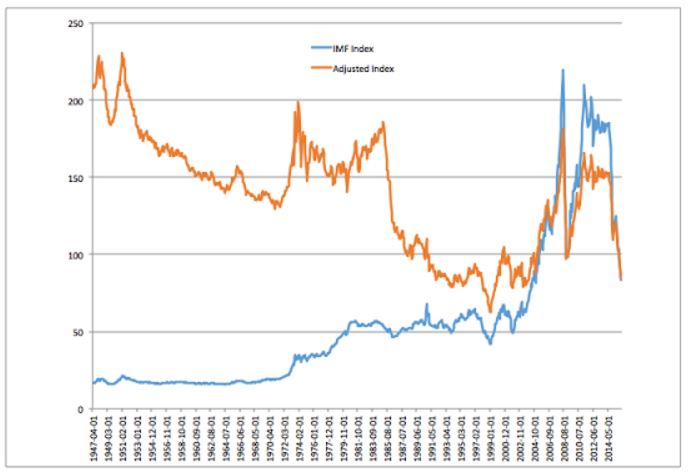

Here is a graph that I used in the first post of this blog. It graphs a commodity index over time in both nominal terms and adjusted by the US consumer price index and the value of the US dollar. If you were reading the blog at that time you may remember that I use the IMF commodity index as a base and splice it back to 1947 with the US PPI for crude materials.

The commodity index on a deflated basis is actually getting close to the lows of the late ’90s. Now it is well known that over time commodity prices tend to fall relative to other prices. (I know the “sustainability” guys don’t want to believe this, but just look at the graph!) Nonetheless, the situation in the late 90s was truly extreme. We had a major crisis in emerging markets, the major commodity demand growth area. We also had a huge flow of funds from what was then called the old economy into the dotcom stuff. I thought that commodities were undervalued then, and we are very close to that now.

Oil Prices

Energy is the most important commodity group on the board. Not only is it the largest by dollar value, but it serves as an input to everything else. If you want to get physics class philosophical, you can say that energy is even more basic than food. And energy prices are dominated by oil. Readers of this blog know that I think that oil prices will slowly rise over the next few years (And I am painfully aware that I am still somewhat behind on a long Dec 2018 crude trade). This will boost the cost of production for everything else. BTW it is not true that declining natural gas prices will compensate for this. Worldwide, oil is much bigger than gas. In fact the increased use of gas is mostly displacing coal, so overall energy prices are not falling.

The Lags Are Long But Not That Long

Leave A Comment