Greetings,

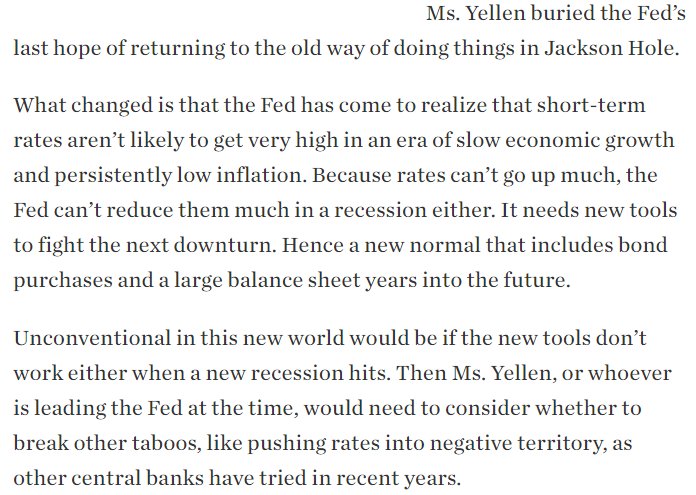

We begin with the United States where Janet Yellen indicated that a return to the more traditional techniques to manage monetary policy is unlikely going forward. That’s because with rates remaining depressed for the foreseeable future, there is only so much “traditional” easing that can be done before hitting zero. At the same time, few on the FOMC are willing to entertain the possibility of negative rates.

Source: @WSJ

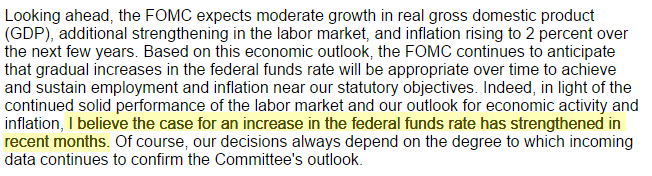

Chair Yellen also echoed the Fed’s Fischer’s earlier comments that a rate hike is coming.

Chair Yellen’s speech, Jackson Hole, Wyoming, August 26, 2016; Source: FRB

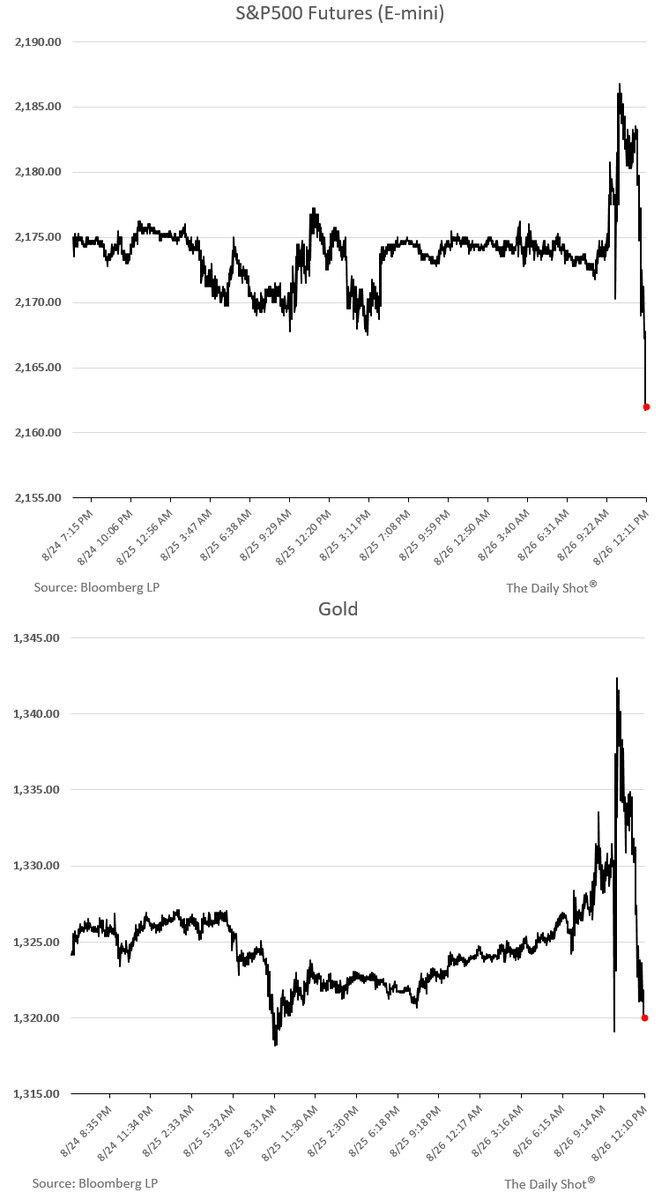

Markets initially had some difficulty finding direction, with a relatively muted overall reaction to the speech. Much has already been priced in.

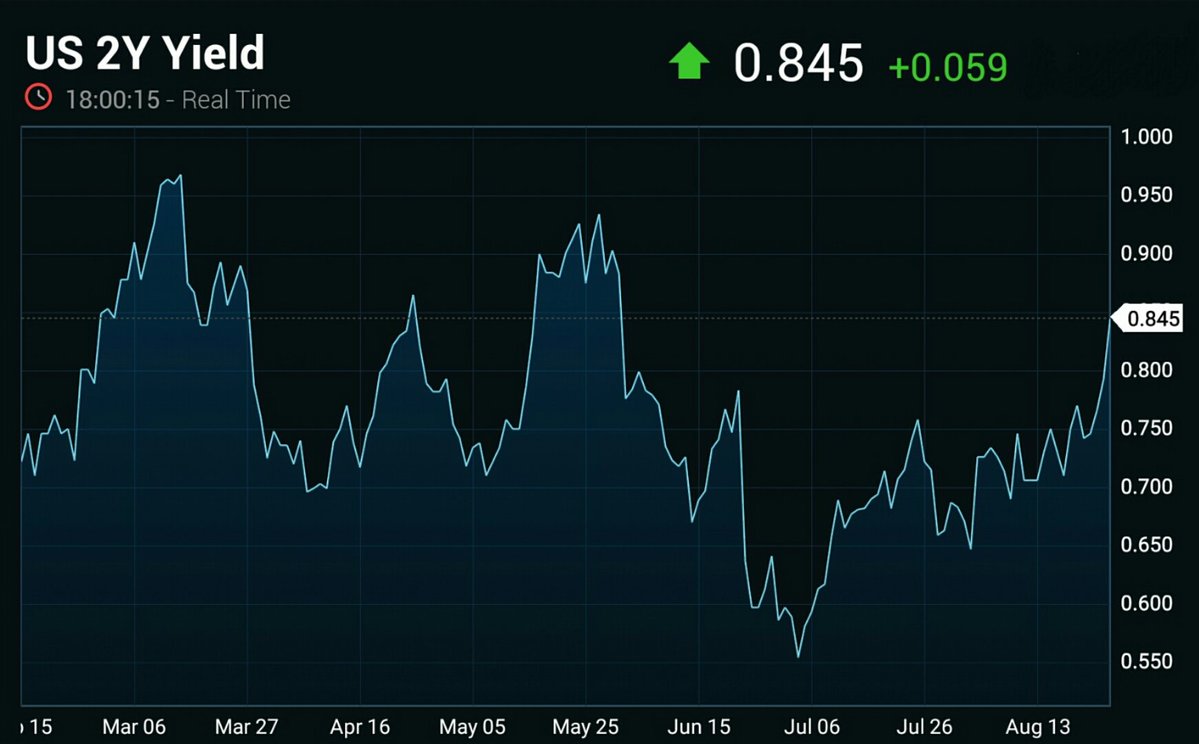

1. The 2yr Treasury yield continued to rise.

Source: Investing.com

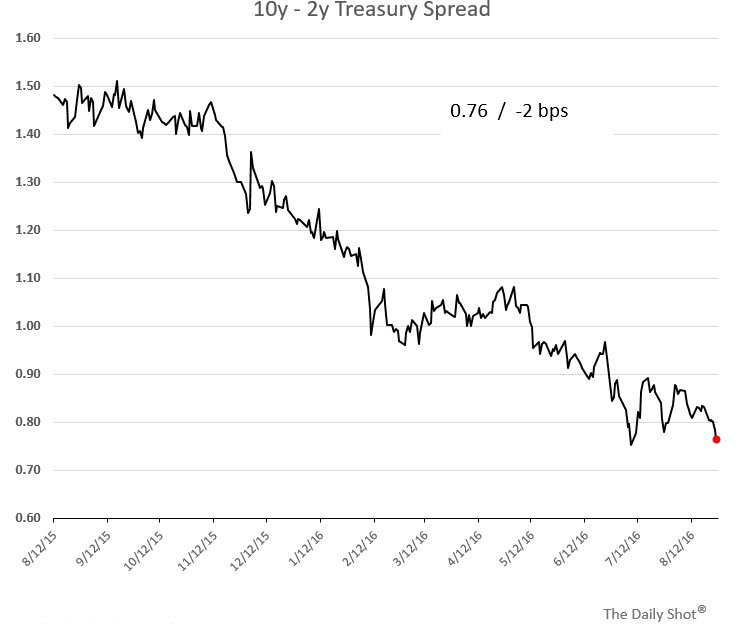

2. The Treasury curve flattened further, with the 10y-2y spread hitting 76bp.

Source: St. Louis Fed (FRED)

3. It was strange to see gold and equities so correlated.

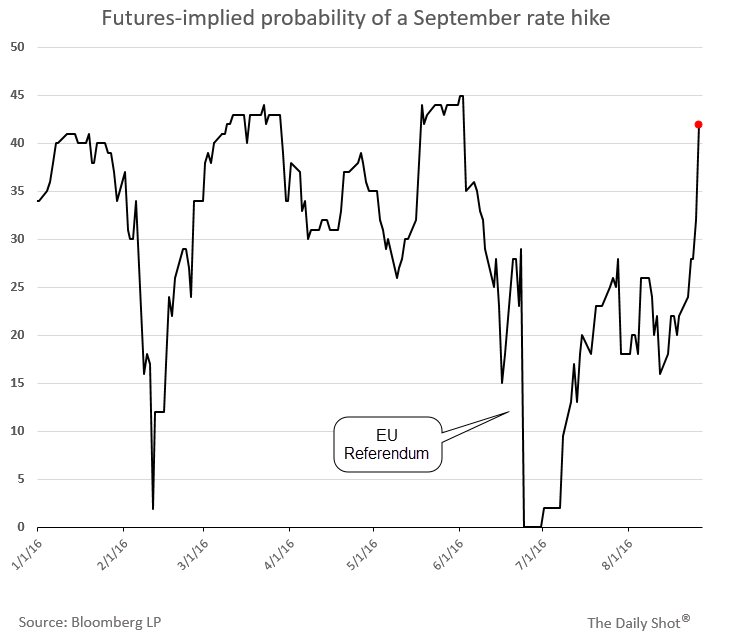

4. The September implied rate hike probability jumped to 42%, although many analysts remain skeptical.

Bloomberg Function: “WIRP”

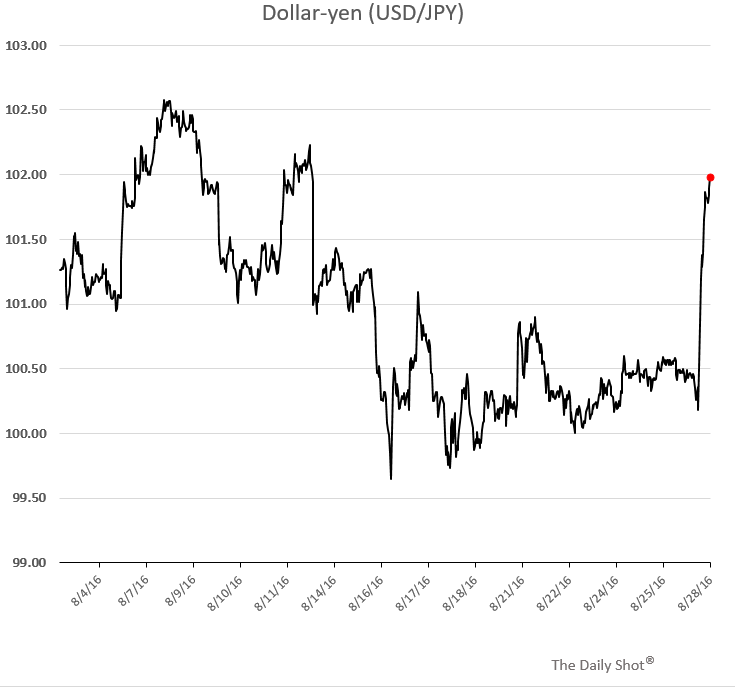

5. Dollar bulls are waking up again. The dollar’s rise against the yen was especially sharp (second chart below).

Source: YCharts.com

Source: myfxbook.com

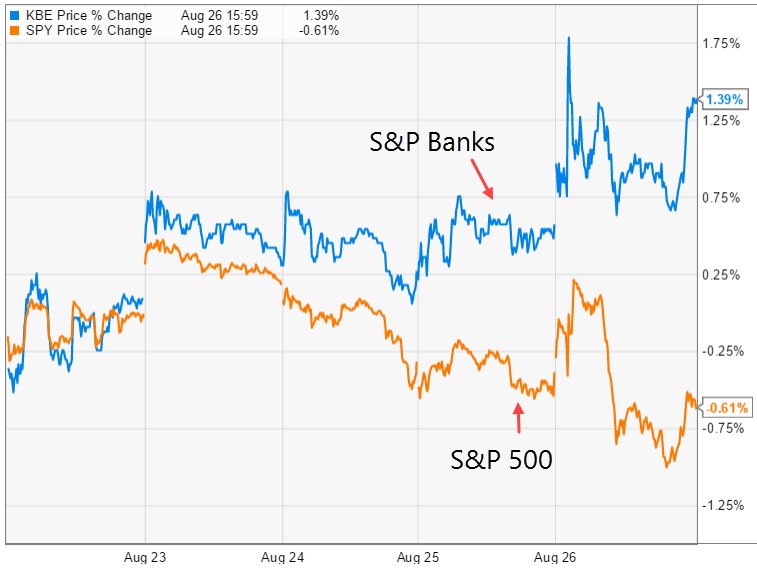

6. Banks are looking forward to this rate hike because they can charge more for loans but still pay zero on deposits (higher interest margin). US banking shares jumped.

Source: YCharts.com

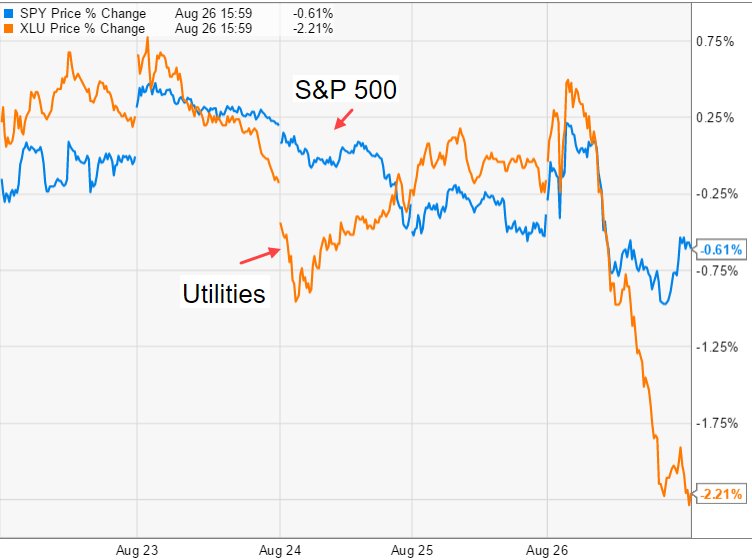

7. Shares of US utilities were hammered on higher rate expectations.

Source: YCharts.com

8. The Russell 1000 index 30-day historical volatility remains remarkably low. The implied volatility (VIX shown in the second chart below), while off the recent lows, ended up roughly where it started on the day.

Source: Bloomberg Terminal, Function “HVG”

Source: YCharts.com

Leave A Comment