Let’s begin with several charts on China from our friends at RBS as well as other sources.

1. The nation’s reliance on over-investment for growth stands out when compared to other nations.

Source: ?@RBS_Economics

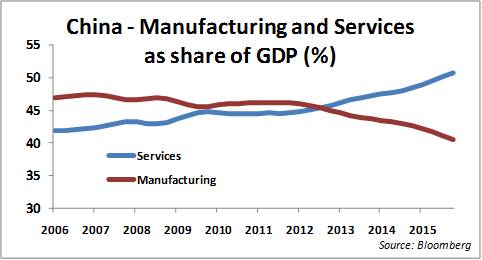

2. According to RBS, the economic “rebalancing” has been primarily driven by the financial services sector. Reliance on the financial sector for growth is risky (as we’ve seen in other economies).

Source: ?@RBS_Economics

3. China’s corporate debt growth has been spectacular and the debt addiction seems to continue. While credit growth has slowed, it remains above 11% per year.

Source: ?@RBS_Economics

Source: ?@RBS_Economics

4. RBS China GDP tracker shows real GDP growth materially below the official figures.

Source: ?@RBS_Economics

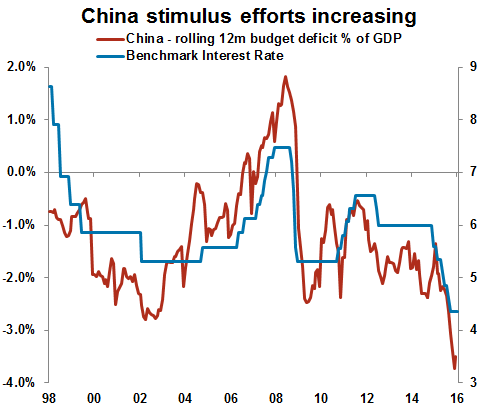

5. If the above trends scare you, don’t worry. Stimulus is here to save the day – at least in the near-term. A couple of years down the road could be a different story.

The monetary easing has ways to go and fiscal stimulus is ramping up (shown as a spike in government deficit). In order to maintain growth, China will have to materially increase central government debt.

Source: ?@Callum_Thomas

6. The last chart shows that China’s falling natural resources demand and production overcapacity is spilling into the global commodity markets. The nation is dumping its excess product abroad.

Source: ?@Schuldensuehner, @BloombergBrief

China’s refined fuel exports are not helping the global oversupply. And so far it is the oversupply that seems to pressure oil prices. At least in the US there is no evidence of weakening demand.

Source: DB, h/t Josh

On Monday the supply issues continued to pressure crude, as everyone realized that Russia’s and Venezuela’s attempts to talk OPEC (mostly the Saudis) into some sort of production cuts is futile – at least for now. NYMEX crude oil sold off some 6.5% during the day and fell below $31/bbl after hours. Interestingly oil also decoupled somewhat (although not entirely) from equities.

Leave A Comment