Greetings,

With Markit releasing the February flash PMI reports, let’s look at the global manufacturing trends. It’s not a pretty picture.

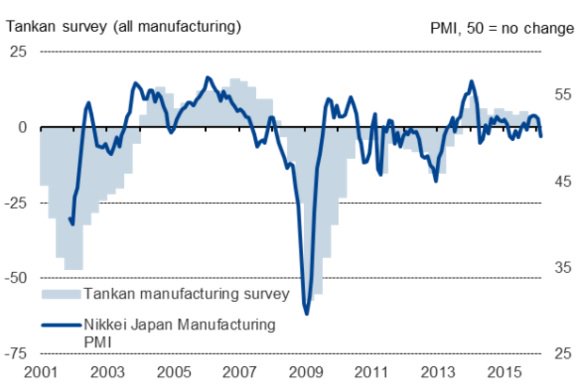

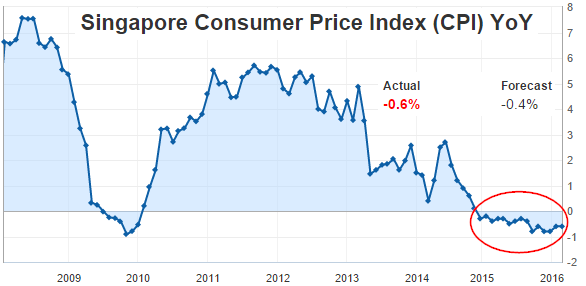

1. Japan’s flash PMI is at an 8-month low as manufacturing stalls.

Source: @MarkitEconomics

Source: @MarkitEconomics, h/t Jake

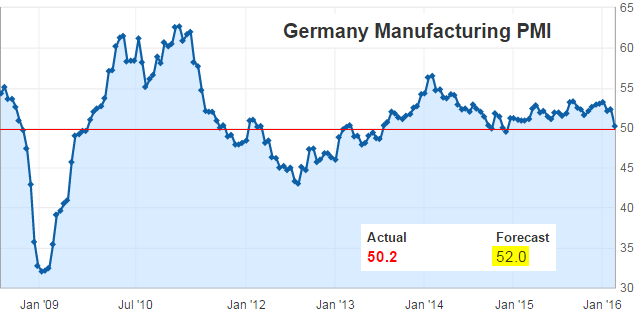

2. In the Eurozone the PMI report shows German manufacturing sector no longer growing.

Source: Investing.com

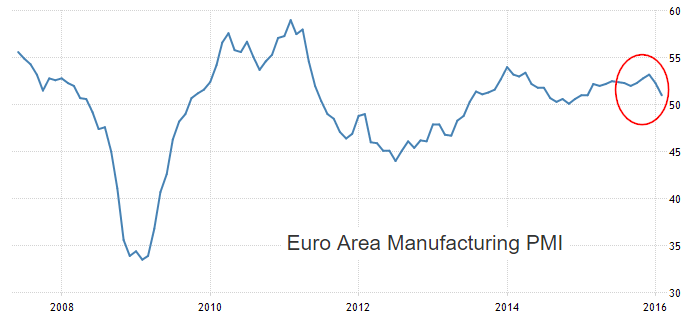

In aggregate the Eurozone PMI also declined more than expected.

Source: FT

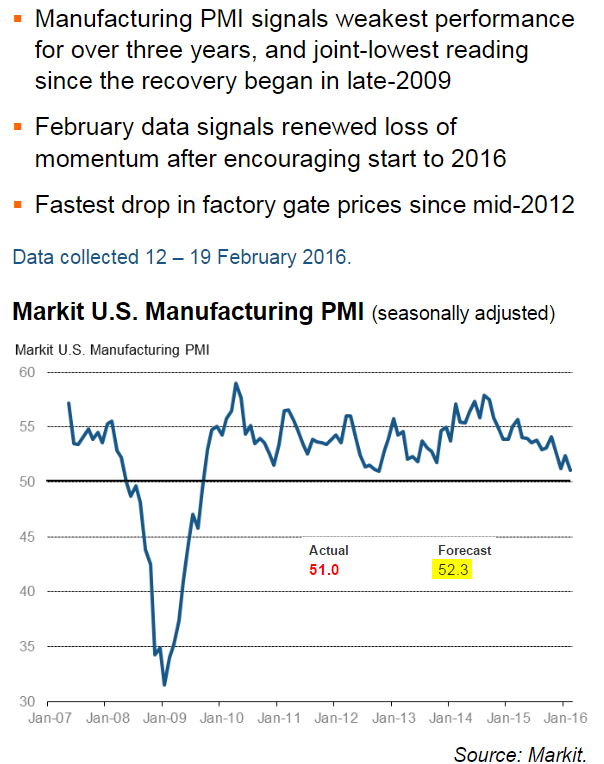

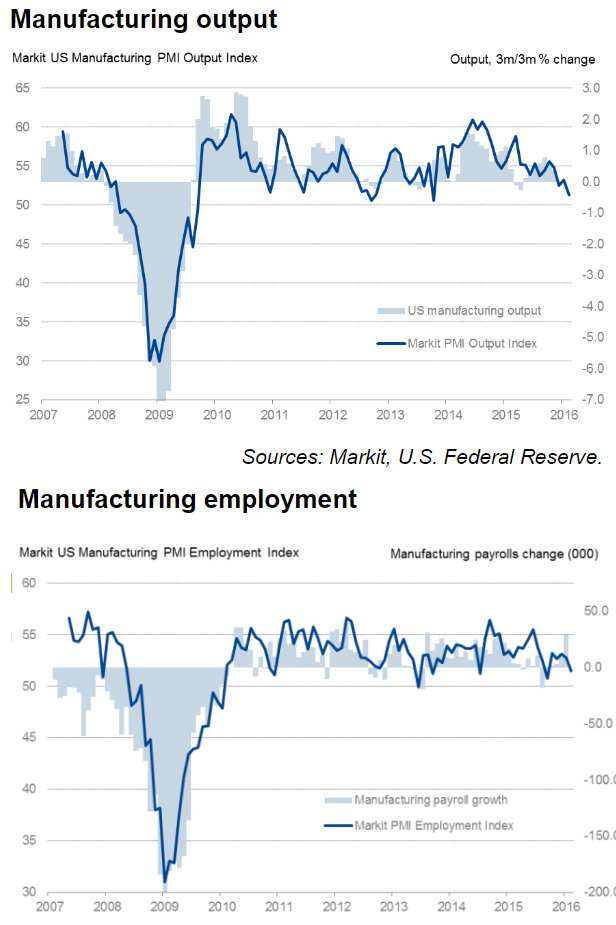

3. According to Markit, US manufacturing is still expanding (slightly) but Markit is quickly catching up to the ISM measures (discussed previously).

Here are the US manufacturing PMI sub-indices for output and employment.

Source: Markit

Turning to China, the latest economic signals remain poor.

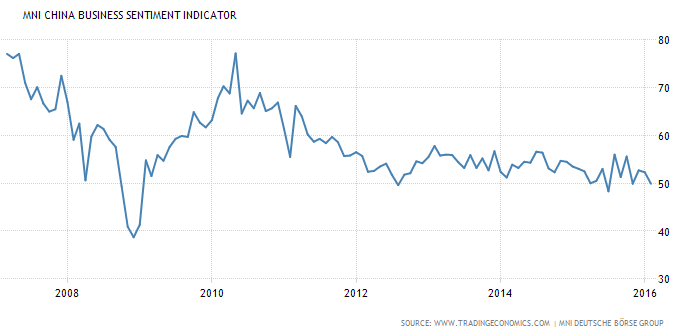

1. The MNI China Business Sentiment weakens again.

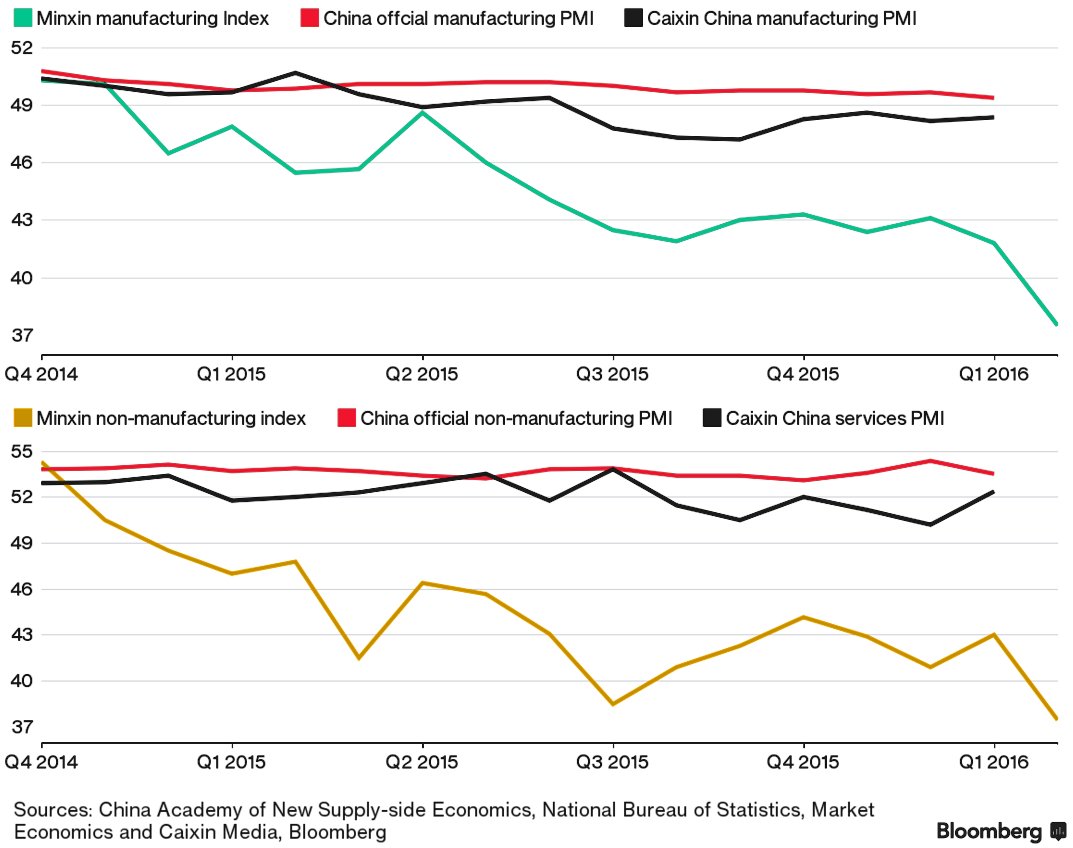

2. Moreover according to Bloomberg, a private survey index called Minxin shows there may still be significant near-term downside risks to China’s growth.

Source: ?Bloomberg.com

Source: ?@vexmark, @business

In other China-related developments, the RMB forwards rose on bets that the PBoC may push the yuan higher prior to the G-20 Shanghai meeting. It’s “window dressing” time.

Source: @Schuldensuehner, h/t Jake

Here is one reason why we’ve seen the Baltic Dry index collapse recently. The bulk shipping capacity doubled since 2007 with the expectations of China’s continuing demand for iron ore.

Source: @vexmark

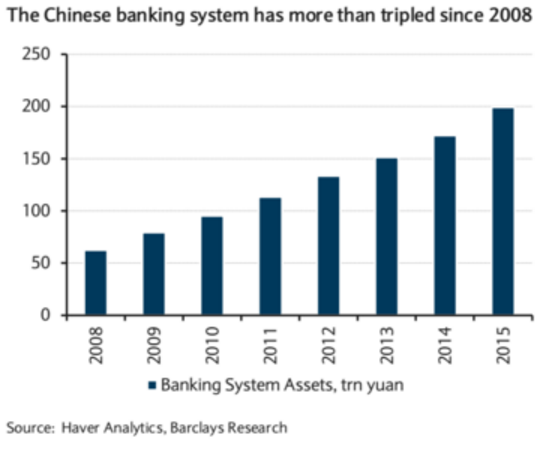

The Chinese banking system growth in recent years has been spectacular. What happens to the economy when banks’ balance sheets can no longer support such growth as bad loan volume rises further?

Source: @valuewalk, Barclays

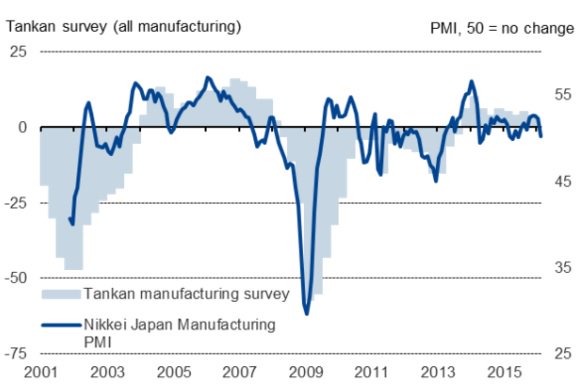

Related to the above, Singapore’s current deflation has been the longest in recent history, with the latest decline worse than expected.

Source: Investing.com

Leave A Comment