We begin with the United States where in spite of extremely low market-based inflation expectations and tighter credit conditions, the Fed could be back in play in 2016. A March hike is of course out of the question, but we may get a surprise later in the year.

As discussed before, many economists are discounting current inflation expectations as being inconsistent with the current oil forward curve and simply unsustainable. On the other hand US traditional inflation measures are stirring.

Here we have the core PCE (the Fed’s favorite indicator) and the core CPI – both showing some acceleration in prices.

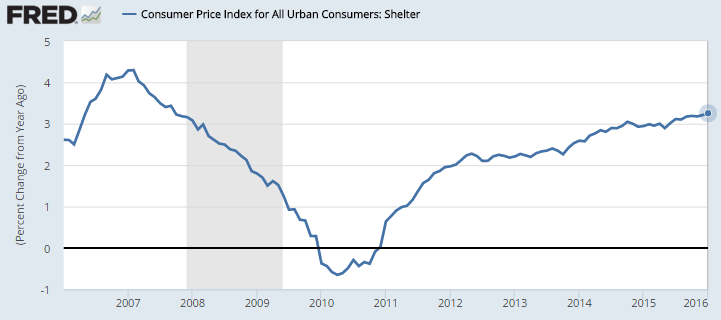

As a number of economists had predicted, healthcare inflation is waking up. Also the cost of shelter in the US is now rising at over 3% per year, with the rate continuing to increase. Sadly, this is materially higher than the national wage growth rate, putting pressure on Americans with low-paying jobs. This is the result of a housing shortage in the US and it’s unlikely that there is much the Fed can do about it. Nevertheless, it’s a data point.

Moreover, other measures suggest that, unlike in the Eurozone, there is no evidence of deflationary pressures in the US.

1. The so-called “sticky” CPI (the less volatile components of the CPI) is near 2.5% – the highest since 2009.

2. The “trimmed mean PCE” inflation rate is also on the rise.

Source: @SoberLook

Further reports released last week could add to the ammunition of the more hawkish FOMC members. For example US consumer spending was stronger than expected last month. Alas, some of this increase was driven by higher spending on healthcare, but it’s an important data point nevertheless.

The futures markets are starting to react to all these reports, with the Fed Funds futures falling on Friday (lower futures prices imply higher rates).

Source: barchart

Another US dollar rally will likely be the result of further rate hikes, posing significant risks to the economy. However, given the Fed’s focus on some of the indicators above, rate hikes in 2016 are now back on the table (more on the topic here).

Leave A Comment