Greetings,

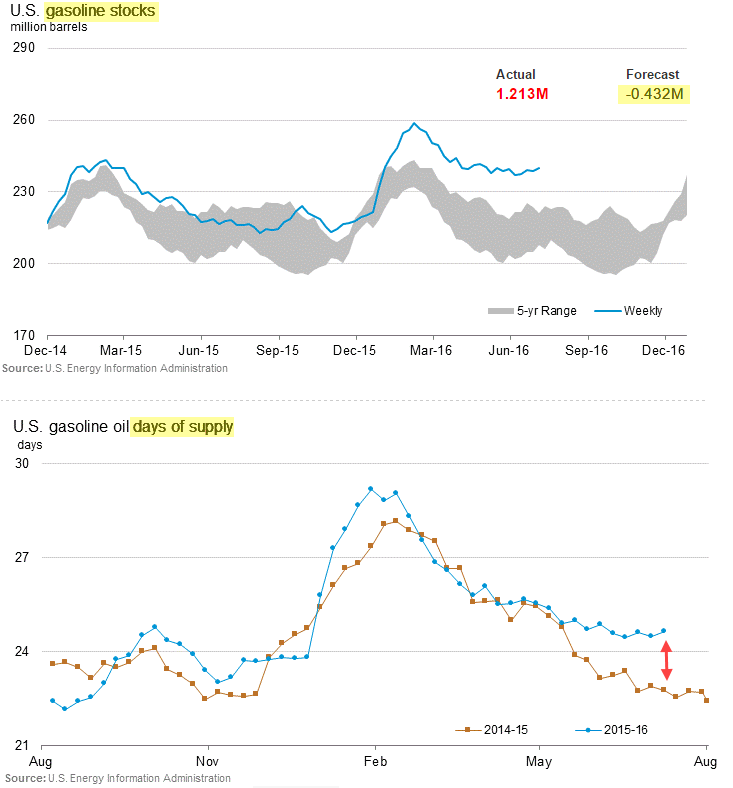

1. We begin with the energy markets, where U.S. gasoline inventories significantly exceeded forecasts.

2. NYMEX crude shed 4% in response to the above report, falling below $45/bbl again.

Source: Investing.com

Some analysts are suggesting that crude and products inventories will continue to weigh on the market in the months to come.

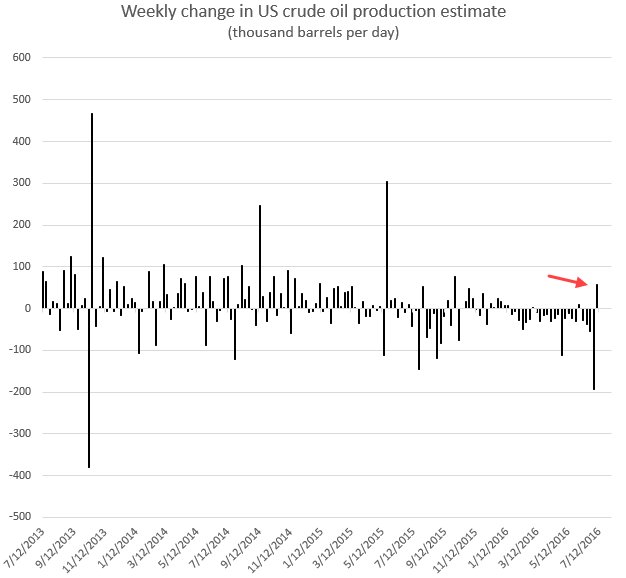

3. We can’t conclude much from one data point (below) but according to certain forecasts, we should soon see stabilization in US crude oil production.

Source: EIA

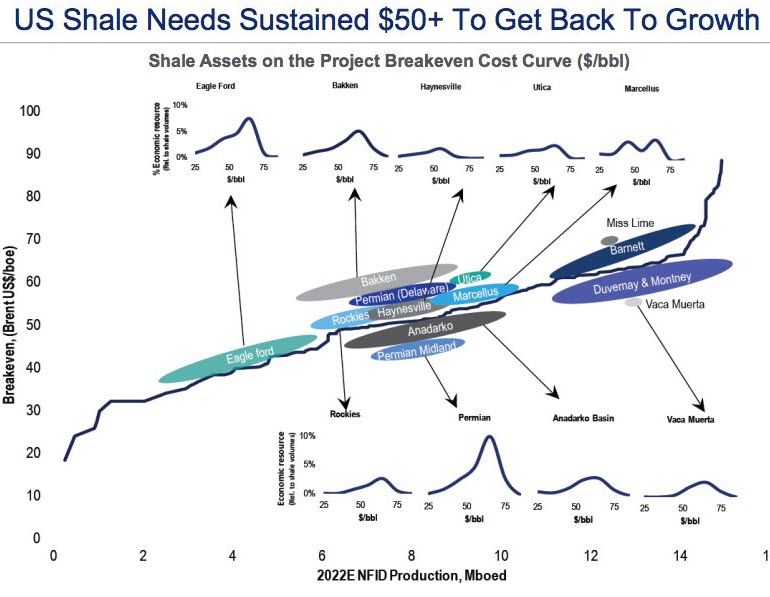

4. According to Citi, US shale producers need $50/bbl+ over time to return to growth. It’s important to note however that a number of firms have pre-sold crude oil in the futures market above $50 – which will keep them profitable as long as they can continue hedging (in effect complementing their earnings with carry).

Source: Citi, ?@joshdigga

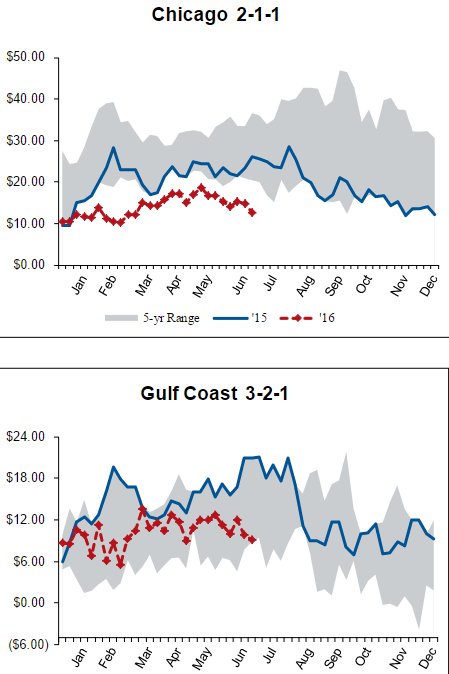

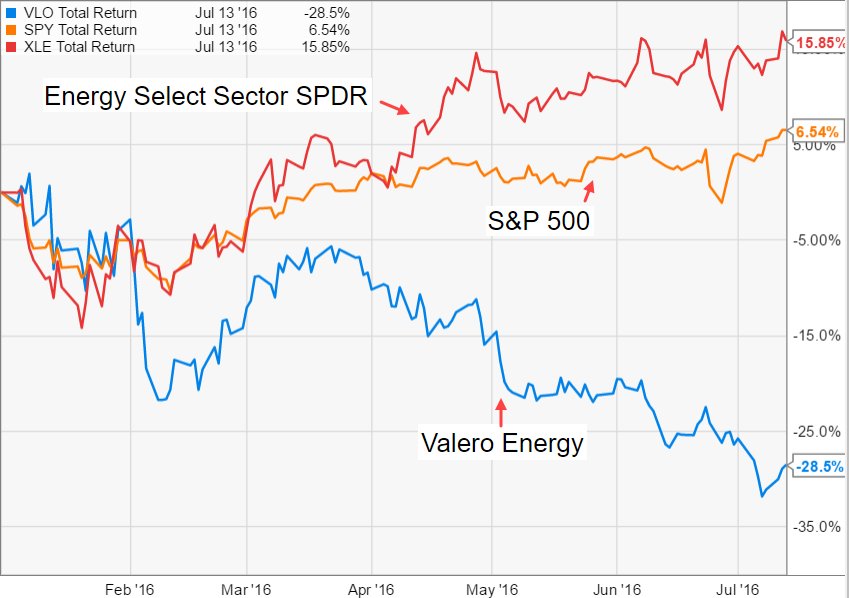

5. With oversupply of gasoline (first chart above), US crack spreads (refining margins) are declining, putting refineries under pressure.

Source: Scotiabank

Source: Ycharts.com

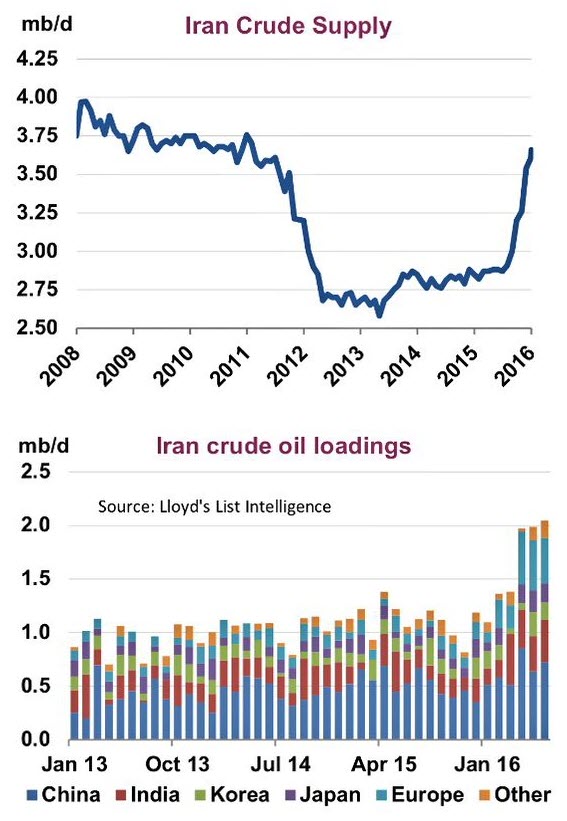

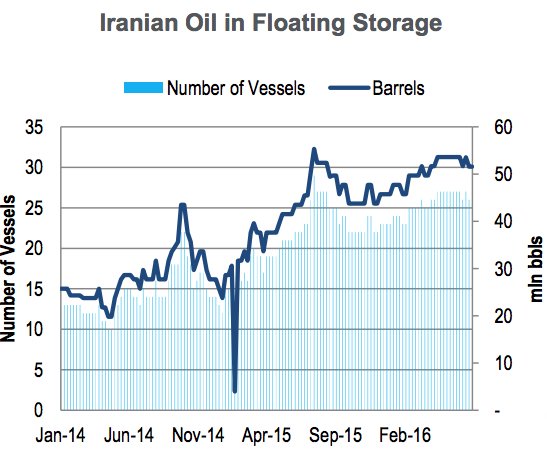

6. Iran’s oil production rises to a 5-year high while the nation’s supply of crude in floating storage remains elevated.

Source: ?@JavierBlas2, @IEA

Source: Citi, ?@joshdigga

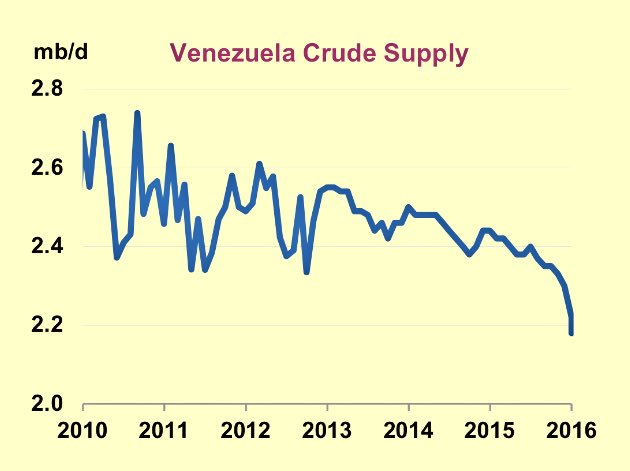

7. Venezuela crude oil production falls to the lowest level since 2003, choking off the nation’s only major source of hard currency.

Source: ?@JavierBlas2, @IEA?

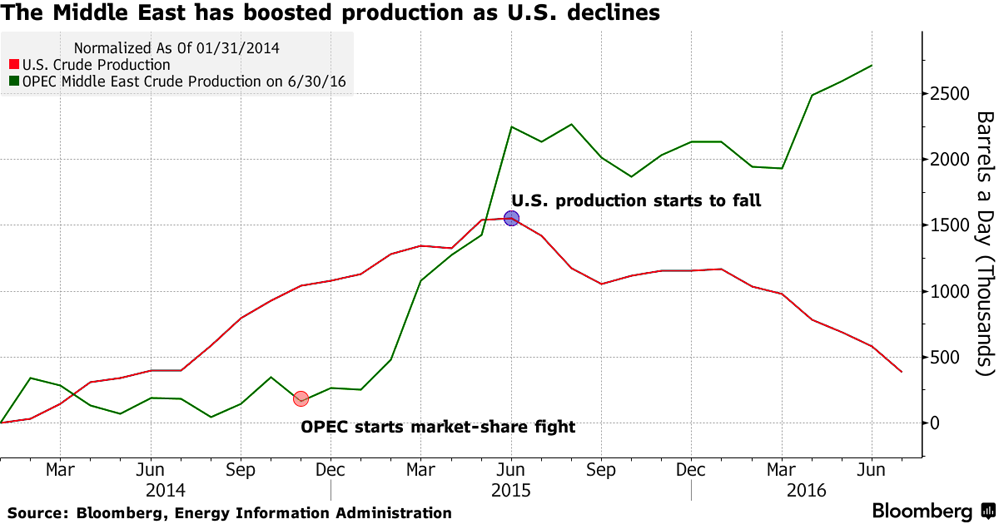

8. As discussed yesterday, increases in the Middle East crude production have largely offset the North American declines.This shift in market share was (supposedly) the goal of this “price war”.

Source: ?@vexmark, @technology

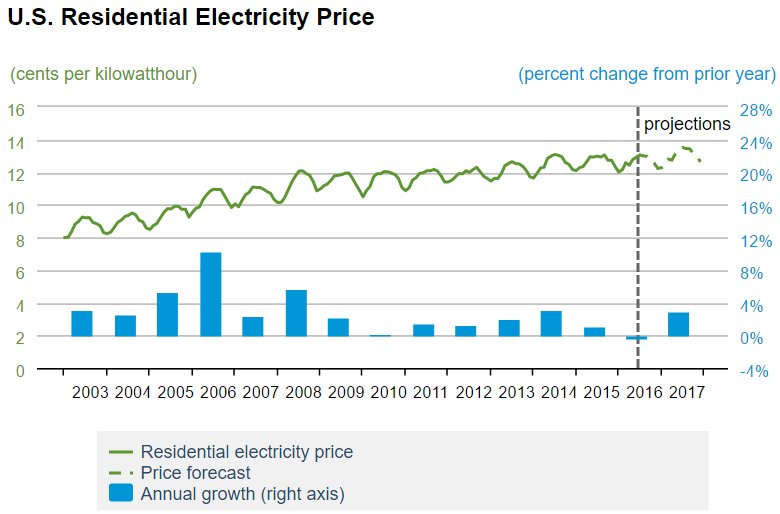

In US power market, residential and wholesale electricity prices continue to diverge. It’s time someone disrupted this “market”.

Source: @EIAgov, @bfly

Source: @EIAgov

Leave A Comment