Greetings,

Once again we begin with the Eurozone where economic reports remain mixed.

1. The German unemployment rate hit another record low.

2. Ireland’s unemployment is now below the level of autumn 2008.

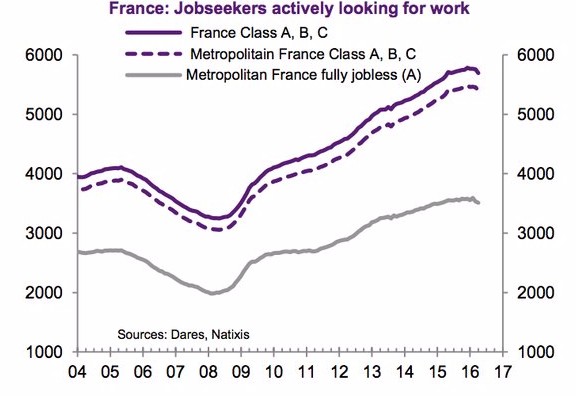

3. Jobless numbers in France seem to have peaked. By the way, over time, French unemployment could decline substantially if Hollande manages to push through the labor reforms.

Source: Natixis, @joshdigga

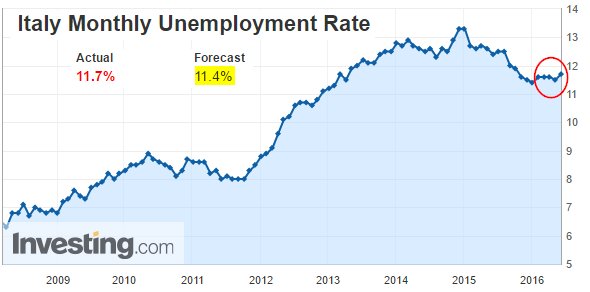

4. On the other hand, Italian unemployment rate ticks up unexpectedly.

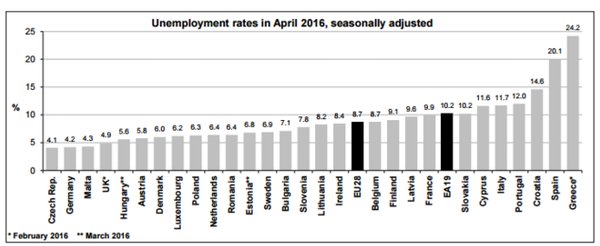

5. Across the Eurozone, the unemployment rate is now near five-year lows. Note that the numbers in the graph below don’t always correspond to those above (for example for Germany). National unemployment figures often differ from “harmonized” measures used for comparison purposes.

Source: ?@fastFT

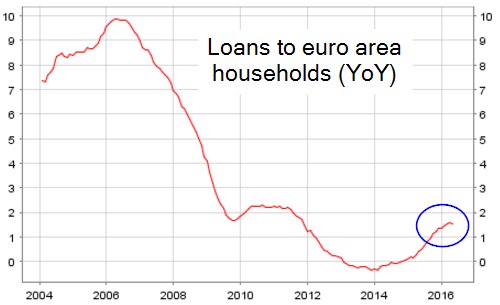

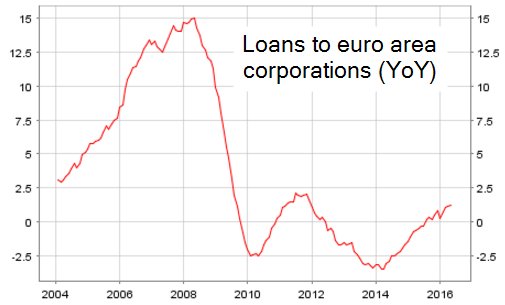

6. Euro area loan growth to households slowed while corporate lending growth is still gradually improving. A significant slowdown in private credit growth – which remains near historical lows – could derail the fragile recovery.

Source: ECB

Source: ECB

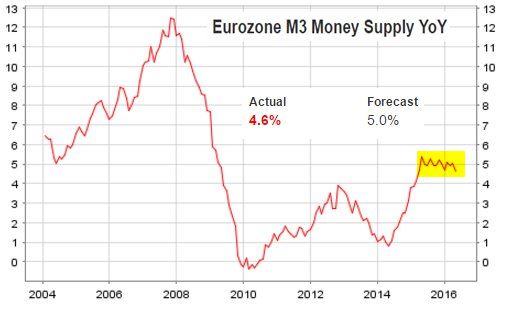

7. Growth in the euro-area broad money supply has already stalled (coming in below consensus).

Source: ECB

8. As discussed yesterday, the Eurozone is still officially in deflation but prices should begin growing again on a year-over-year basis as a result of higher oil prices.

Source: @fastFT

9. Italian 2yr yield moves deeper into negative territory. Amazing.

10. Greek shares are up almost 50% from the lows in February in response to the successful bailout process.

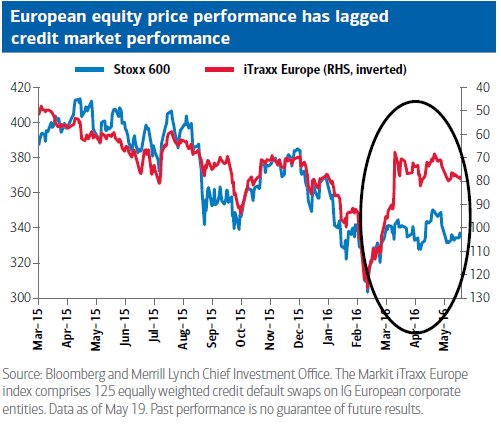

Separately, European credit has been outperforming equities. Are European shares cheap or are credit spreads too tight in response to the ECB’s planned corporate bond purchases?

Source: BofAML

Now on to the UK where retail deflation persists. The British Retail Consortium Shop Price Index (price changes in UK retail outlets) is shown below on a year-over-year basis.

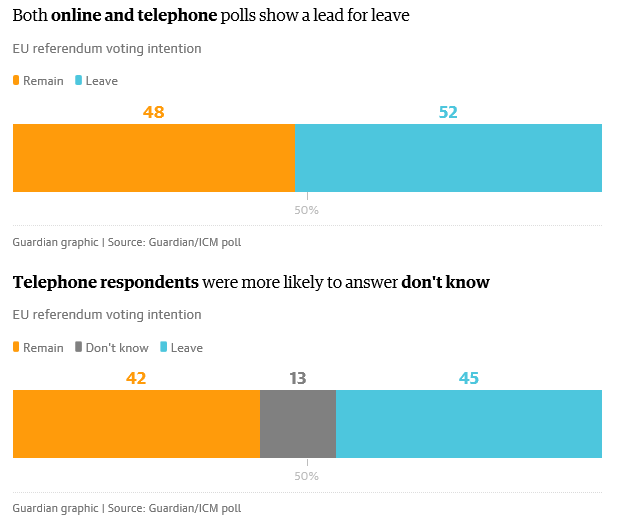

Brexit risk is back on the table as the latest Guardian poll seems to show a lead for “leave”.

Source: The Guardian

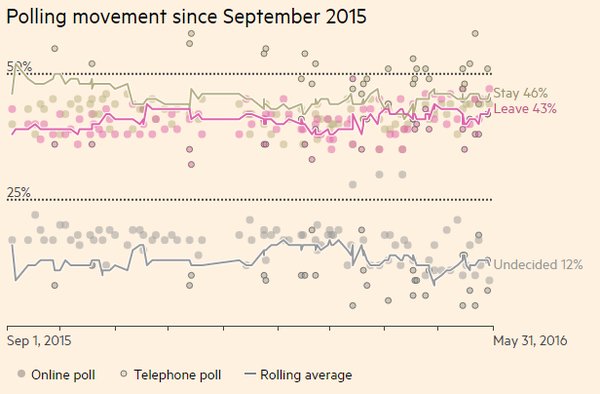

Here is the FT’s Brexit poll-average chart.

Source: @FT

The British pound took a beating in response to the new Brexit poll.

Source: @barchart

Nonetheless, the betting markets still heavily favor “stay”.

Leave A Comment