We start with the Eurozone where Mario Draghi indeed brought out the ECB “bazooka”.

Source: nextquotidiano.it

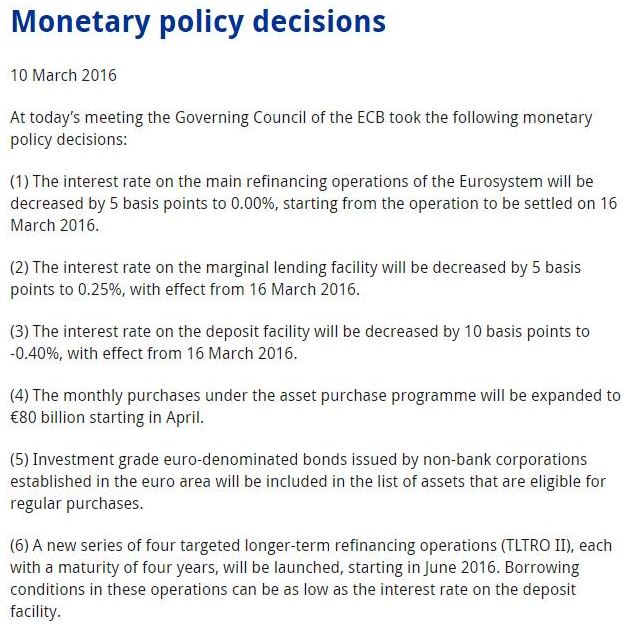

Here is what the central bank decided to do: rate cuts, expanded QE, buying corporate bonds, new TLTRO, etc.

Source: @fastFT

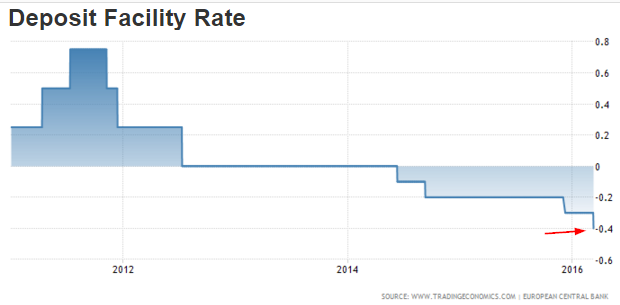

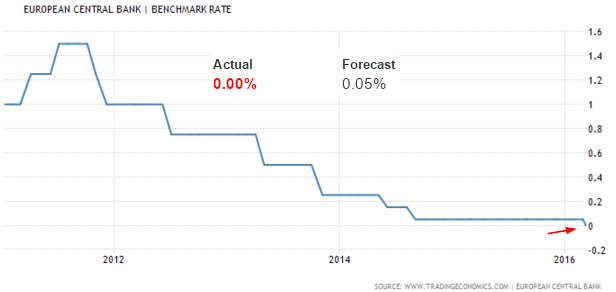

While this cut in the deposit facility was expected, the benchmark rate cut was new.

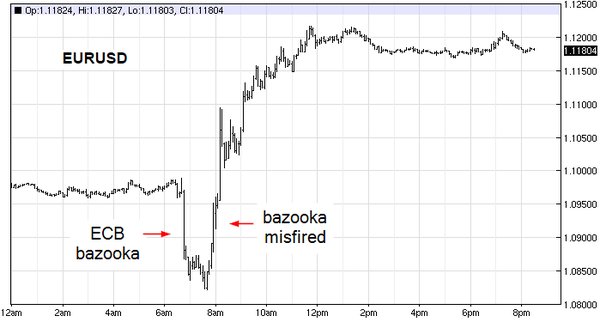

The markets cheered, with both bond and stock markets moving higher until Mr. Draghi’s bazooka misfired. Here are the two key comments.

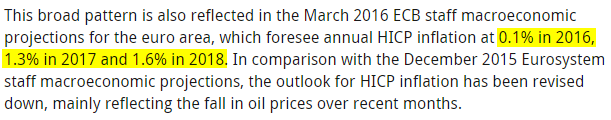

1. The ECB slashed inflation projections suggesting that the central bank is unable or unwilling to push inflation rates higher.

Source: ECB

2. Draghi’s comment on rates was the main “misfire” when he suggested that the central bank is done cutting rates. Many were hoping that the ECB would adopt a tiered rate structure, only penalizing banks who hold reserves above a certain level (which is what the BoJ is doing). This way the central bank could take rates deeper into negative territory with a limited impact on bank profitability (negative rates on reserves become increasingly costly in QE as reserves grow). But that wasn’t what the ECB decided.

Source: ECB

These comments quickly reversed the earlier enthusiasm sending stocks and bonds lower. Here is the action in the euro which had a 3.6% intraday swing. Somehow a stronger euro doesn’t seem to be the ECB’s desired effect – which is why many analysts called this a “misfire”.

Source: barchart

During the day, the 10yr Bund yield more the doubled from the lows. The corporate bond purchases announcement suggests that the ECB will have more options as opposed to being forced into zero- or negative-yielding government paper.

It’s interesting that unlike the Fed, which has a great deal of experience guiding the markets, the ECB seems less aware of markets’ potential reaction to its communications. Here are the June Euribor futures.

Leave A Comment