Greetings,

We begin with Brazil where the political situation remains fluid. The rally in the nation’s currency and equity markets has ended for now.

The stock market was down nearly 4% on the day.

Source: barchart

The Brazilian real took a 3% hit.

Source: barchart

All of a sudden investors realized that Dilma Rousseff is not just going to step down in response to the massive protests – in spite of the ongoing scandal/investigation. Moreover, the opposition has not offered up an acceptable alternative candidate.

Source: @fasrFT

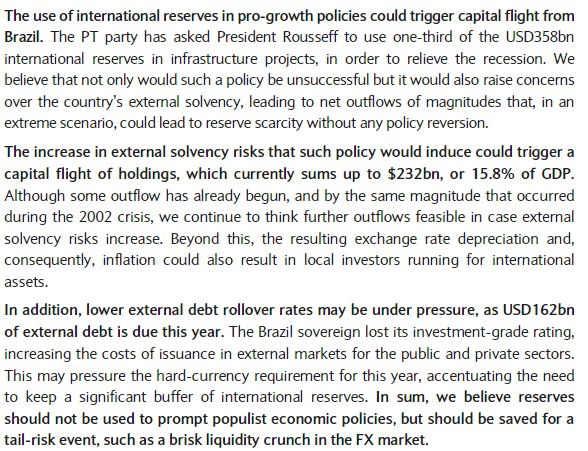

Additionally, the recent proposal to use Brazil’s FX reserves for fiscal stimulus poses serious risks. Raiding the central bank to pursue populist agenda is not going to end well.

Source: Barclays

Here are a few observations on other emerging markets.

1. The mess in South Africa continues as the Finance Minister got into a spat with the police over some of the activities in his previous role with the government. Further debt downgrades remain likely and the traders used this risk-off day to sell the rand.

Source: barchart

2. The Ukrainian currency took a 5.6% hit as the government is under pressure to sell assets. It’s hard to see the situation stabilizing anytime soon.

Source: barchart

3. Poland’s deflation remains entrenched, with the CPI coming in below consensus. Anecdotally, there seems to be some downward pressure on wages as well.

4. South Korea’s jobless rate jumped to 4.9% and the nation’s youth unemployment is at a record high of 12.5%. China’s slowdown is taking its toll.

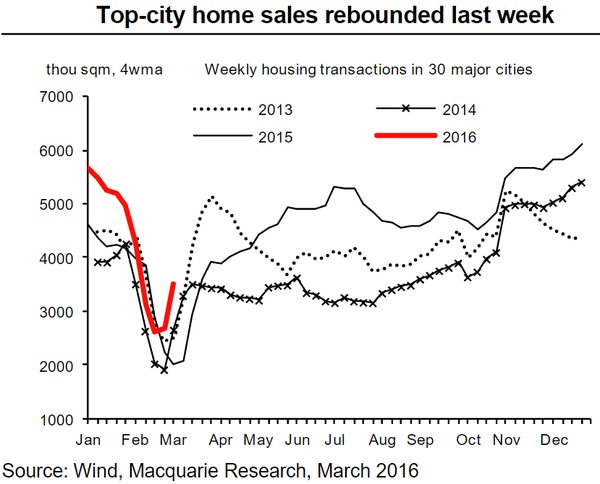

5. Speaking of China, the nation’s home sales are undergoing a seasonal rebound. Other housing data suggest that property markets are firming up.

Source: Macquarie

6. Emerging markets bond fund flows seem to have picked up momentum, with three weeks of consecutive inflows for the first time in a year.

Source: Deutsche Bank

In Japan, the central bank has left policy unchanged but further rate reductions have not been ruled out. As discussed previously, with inflation remaining stubbornly low the BoJ may be forced to ease again this year. For now the yield curve is the flattest it has been since the early 90s.

Leave A Comment