Ctrip.com International Ltd. (CTRP) Consumer Discretionary – Internet & Catalog Retail | Reports March 16, After Market Closes

Key Takeaways

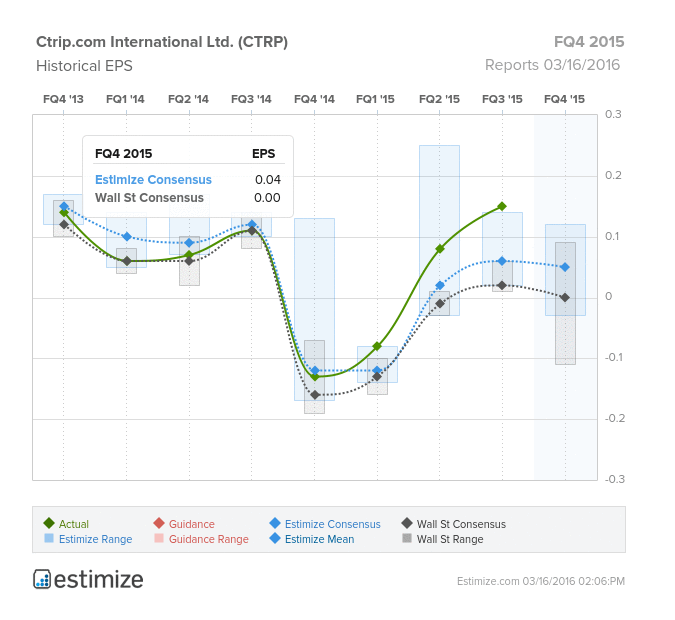

Chinese travel has been a hot industry in the past year, prompting travel booking companies to rush to get in on the action. Ctrip (CTRP) has reaped the rewards this trend, beating in each quarter of fiscal 2015. The Estimize community is looking for EPS of $0.04 and revenue of $439.91 million, 83% higher on the bottom line and $5 million greater in sales. However our Select Consensus, a weight average of the most accurate and recent analysts, is forecasting a slightly greater beat of 5 cents. Ctrip has seen favorable revisions activity of late, with earnings soaring 57% in November. Compared with Q4 2014, this predicts a YoY increase on the bottom line by 130% while sales are expected to grow 42%. Historically the hospitality company has consistently beat expectations, trumping Estimize in 56% and Wall Street in 80% of recorded quarters.

The booming travel industry in China has seen leisure and outbound tourism, the two biggest drivers for the travel market, has seen experiencing exponential growth in the past few years. In the fourth quarter international ticket volume grew 18.3% while China’s air passengers grew by 9.6% on a year-over-year basis. Ctrip has been the primary beneficiary of the rising travel trend, holding a dominant market position in the region. Recent partnerships with eLong and Qunar are expected to propel Ctrip’s market share in Chinese hotel and airline bookings to about 70%-80%. Moreover, Priceline’s recent $500 million investment in Ctrip will help bolster its expansion in outbound travel. Ctrip’s consolidation of the Chinese travel industry and growth in the global market gives it the scale and distribution power to generate more meaningful margins. Shareholders have been pleased with the company’s progress as shares have skyrocketed over 65% in the past 12 months

Leave A Comment