In his book “The Tipping Point” Malcolm Gladwell defines a tipping point as “the moment of critical mass, the threshold, the boiling point”.

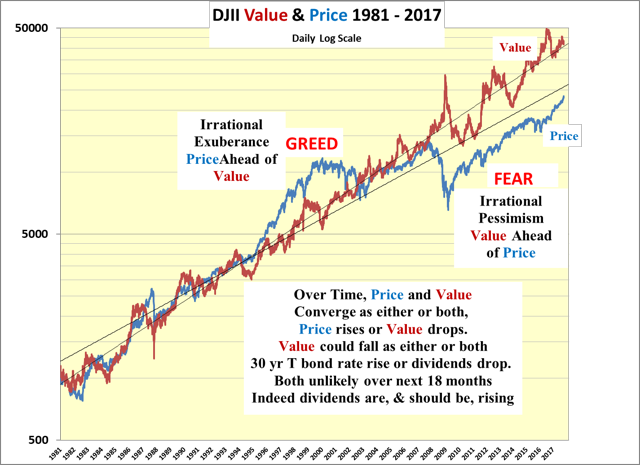

Given the recent upward acceleration of the price of the DJIA there appears to be a growing realization among market participants that equities are more favorable investments than bonds. Whether consciously or not, it seems that a tipping point has been reached whereby the dividend discount model is rapidly moving back into vogue.

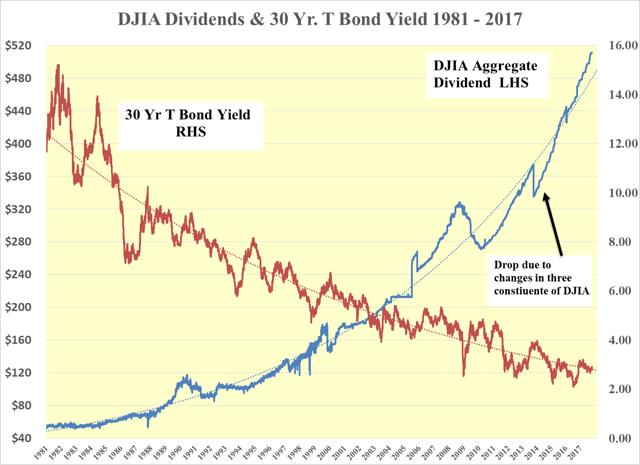

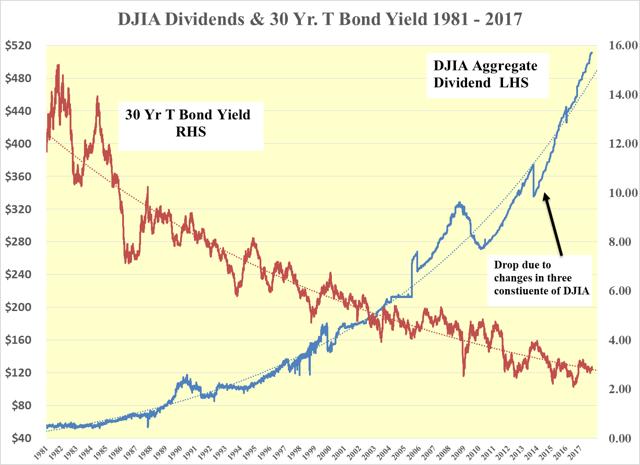

Since Lehman, the dividend discount value of the DJIA has remained well above its price as dividends have risen and the yield on the 30 year T bond has fallen and stayed down.

While many pundits have opined that we are in a state of “irrational exuberance”, the dividend discount model shows that in reality, we are still in the state of “irrational pessimism”. This has been the case since Lehman and fair value relative to bonds has yet to be reached

As shown in the graph above there is a long way to go before the DJIA price of 23,442 reaches equilibrium with its value of 40,317. While this could be achieved by long rates rising and it seems that is what the market has been expecting all along, it doesn’t look as though that will happen anytime soon. As a guesstimate, the 30 Year T Bond should remain in the 2.75% to 3.25% range which has been the case over the last year.

Long-Term Rates should Remain Low for Longer

In addition to the lack of inflation, we still have massive excess bank reserves of $2.25 trillion sitting at the Fed keeping money velocity low as well as the $7 trillion fall in the issuance of bank debt. Corporate debt has replaced part of this decline but there is still $4 trillion of debt that has been removed from the market, which is needed to feed the insurance, pension and trust markets.

While some of this shortage may be filled by a reduction in the demand from the Fed, as it reduces its balance sheet by not rolling over debt, the $4 trillion gap should take some considerable time to fill. This should mean that long rates should stay low for longer. This now seems to be slowly coming into focus in the markets, which could well account for the accelerating upward move in the DJIA.

Leave A Comment