What about the stronger-than-expected Q3 GDP report? The first read of Q3 GDP surprised to the upside, printing at 2.9%. This was better than the Street consensus estimate of 2.6% and the Atlanta Fed GDPNow estimate of 2.1%. It was also a big improvement from the Q2 reading of 1.4%. However, there were some potential anomalies/phenomena signs to consider.

Exports of goods, most notably soybeans, was up 14.1%. This was helped by a generally weaker U.S. dollar for the first three-quarters of 2016, versus 2015. A stronger dollar could/should take the wind out of the export sails. It is believed that the strong export data added about one full percentage point (1.2%) to the GDP number and almost all of the export gain was due to the way soybean exports are accounted for in the GDP report.

Orders for Non-Durable Goods contracted by 1.4%. This follows a gain of 5.7%, in Q2 2016. Since the beginning of 2015, Non-Durable Goods orders have printed in a range of 1.2% to 3.2%, until Q2 2016. Average Q2 and Q3 data and Non-Durable Goods orders were back in their recent range

Inventory building, heading into the holiday season boosted GDP, but is unlikely to repeat in Q4 2016 and Q1 2017, when inventory runoff is more likely. All in all, inventory building, though stronger, was not as robust as typical Q3s of the past.

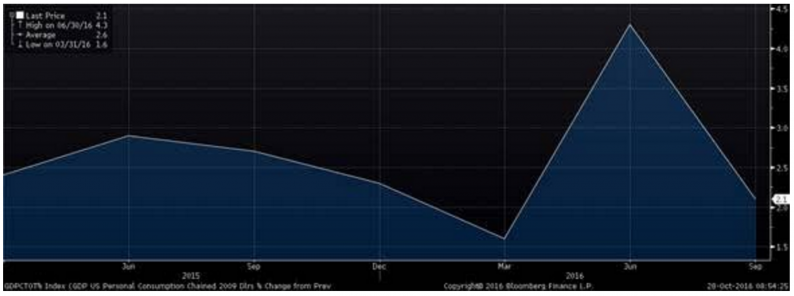

Personal Consumption gains slowed from 4.3% to 2.1%. This is more indicative of Personal Consumption since 2015. I believe some of the 4.3% rise in Personal Consumption in the second-quarter of the year showed up in Durable Goods data in Q3.

U.S. Personal Consumption since 2015 (Bloomberg):

I believe Q3 2016 was a “catch-up” quarter rather than the start of a new trend. As a catch-up quarter, it is just “alright,” as recent history demonstrates.

U.S. GDP since 2010 (Bloomberg)

I do believe that the Q3 rebound does indicate that the U.S. economy remains on its 2.0% growth track. Just as those who saw doom and gloom in the first half of 2016 were proved wrong (I was not among them), I believe that those who are euphoric about today’s GDP print will also be proved incorrect. During the current earning season, many (if not most) CEOs of multinational corporations warned of slowing global growth. If correct, slowing global growth could slam the brakes on U.S. exports, particularly if the U.S. dollar remains strong.

Leave A Comment