This discussion will get to trump’s tax cuts and how they fit in with the present day financial situation. But first it is necessary to report on Janet Yellen. Yellen, on her way out as Fed Chairman, affirmed the New Normal in response to Neel Kashkari’s fear of rising 10 year rates. She had this to say:

I think there are good reasons to think that the relationship between the slope of the yield curve and the business cycle may have changed.

Both agree that the yield curve is flattening, that long term rates are not going up anytime soon. Yet Yellen offered this additional insight, that it no longer mattered much what the slope of the yield curve looks like because it doesn’t affect the business cycle anyway!

If you believe that the supply and demand of 10 year bonds has more to do with other factors, such as safety and use as collateral in the interest rate swaps markets and other financial markets, you could come to Yellen’s conclusions.

And Kashkari is so desperate to see the 10 year yield go up, that he has voted against the three short term Fed increases. He thinks it is those increases that will put a damper on inflation.

So, who is right? I believe they are both right.

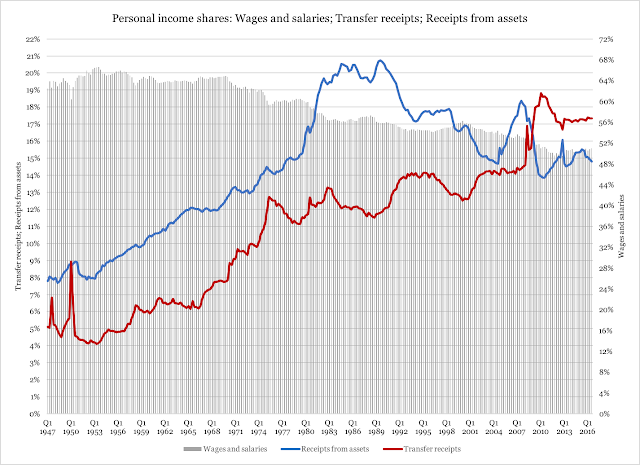

It appears that Janet Yellen is right, if we are to look at the tax base as it relates to income from workers. It has steadily declined, with some leveling off with Reaganomics, then the Dot Com Bubble and then the Reflation under Obama since 2009. But wage decline as a portion of the tax base appears to be relentless as the following chart shows. It is worth watching as time goes on:

Source: Economic Analysis Bureau Dept. of Commerce

Transfer receipts in red are entitlements, which have actually stuffed the coffers of government. In 2008 mass layoffs increased unemployment insurance, causing a spike in taxes. Baby Boomers retiring have paid more out in taxes through social security than earnings.

Leave A Comment