I have followed the oilfield services sector very closely, especially the goings on at Weatherford WFT. I have taken issue with Weatherford’s accounting treatment for goodwill and other items. Below is a synopsis of those issues.

Background

Weatherford provides equipment and services for oil and gas exploration and production. The price of Brent oil recently closed at $38, more than 65% below its Q2 2014 peak. Weatherford’s revenue and earnings have been in free fall alongside the price of oil.

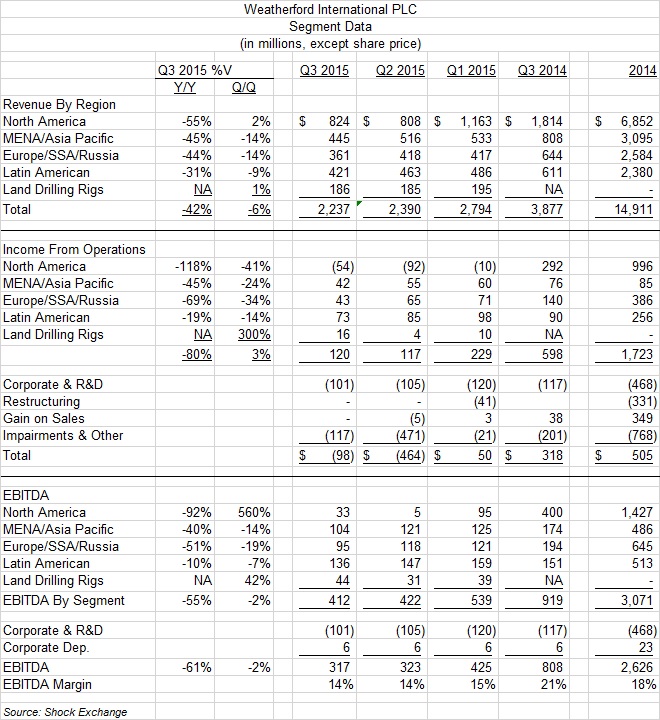

Weatherford’s respective Q3 2015 revenue and EBITDA (ex-items) were off Y/Y by 42% and 61%. North America, where the company derives the lion’s share of its revenue fared even worse; North American revenue and EBITDA were down 55% and 118%, respectively. Meanwhile, income from operations was negative for three consecutive quarters. These figures do not include allocations for corporate costs and R&D which were a combined $120 million, $105 million and $101 million in Q1, Q2, and Q3 2015, respectively.

$3.2 Billion Goodwill And Intangibles Could Be Impaired

Weatherford has grown its operations via acquisition. Many of those acquisitions were made when oil prices were much higher than they are today. At Q3 2015, the company had goodwill of $2.8 billion and intangible assets of $380 million. $1.9 billion of the company’s $3.0 billion goodwill at year-end 2014 was attributed to North American operations.

Through year-to-date Sept. 30, 2015 (“September YTD”), North American operations have generated revenue of $2.8 billion, EBITDA of $133 million, and a pretax loss of $156 million. These figures do not include allocations for corporate costs and R&D which were a combined $326 million for September YTD. If corporate allocations were based on percentage of revenue, North America’s percentage would be about 38% or $124 million; September YTD EBITDA and pretax loss would have been $9 million and $280 million, respectively. That said, the approximate $1.8-$1.9 billion in goodwill associated with it could be impaired.

Leave A Comment