The last week was quite an interesting one for the oil markets, particularly due to the city of New York filing a lawsuit against the industry for “contributing to global warming.” The state of California is also waging a war against the industry for largely the same charge. It is curious to see how this works out and until it is resolved, the industry will certainly have a dark cloud over its head that could easily result in high risks. In addition, the US government’s failure to reach an agreement that would continue funding could result in a US government shutdown, which is likely to result in market turbulence. Thus, we have a lot to report on.

ExxonMobil (XOM)

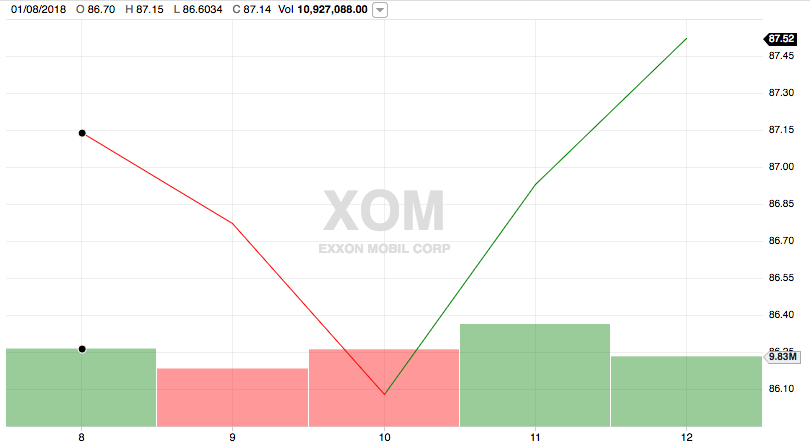

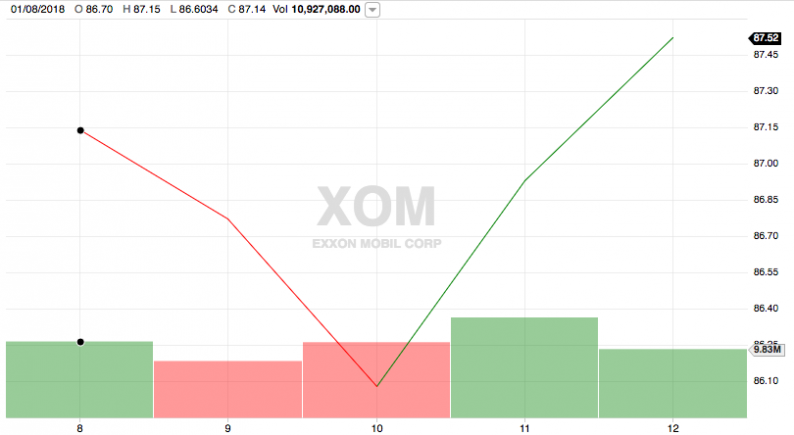

ExxonMobil delivered a gain last week, although it did decline fairly sharply in the first half of the week. On Monday, January 8, 2018, shares of ExxonMobil opened at $86.70 and declined to a low of $85.98 on Wednesday before rebounding and closing out the week at $87.52. This gives the company a return of 0.95% on the week.

Source: Fidelity Investments

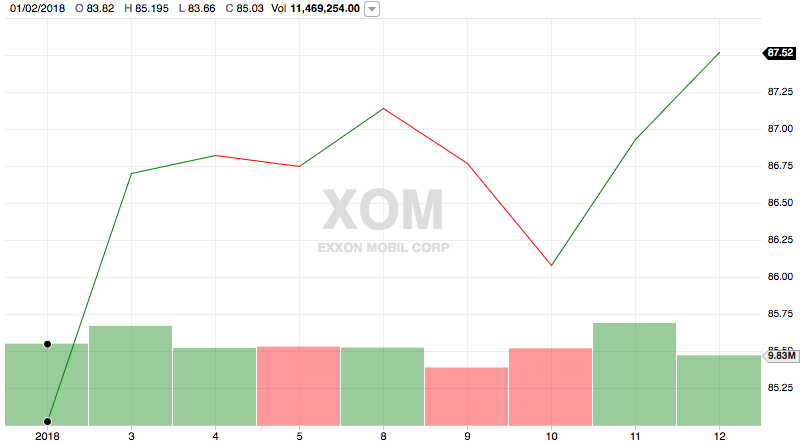

The stock’s two-week performance was quite volatile, although it was also sharply positive and will certainly please long-term investors. On Tuesday, January 2 (the markets were closed on Monday), ExxonMobil opened at $83.82 per share. This gives the stock a two-week gain of 4.41%, fairly respectable for such a large company.

Source: Fidelity Investments

By far the biggest news of the week was the notification that New York City filed suit against ExxonMobil and four other large oil companies, many of which are discussed in these weekly reports, for their role in contributing to global warming. Regardless of your views of the merit of this suit, the possible consequences are very real and could result in significant financial penalties for the companies targeted if the city prevails in this lawsuit. The outcomes of civil suits are notoriously unpredictable and thus this will remain a very real risk to the company’s financial standing until it is ultimately resolved. As another part of this suit, the city’s pension funds have been ordered to withdraw from all fossil fuel investments, representing $5 billion of investment funds.

ExxonMobil also made a sixth oil discovery off of the coast of Guyana, increasing the total amount of recoverable resources in the location to more than 3.2 billion boe. This will certainly prove positive for ExxonMobil’s reserve development and could ultimately contribute to production growth, which is something that the company sorely needs.

Chevron (CVX)

Chevron also delivered a gain to investors last week with much more stability than ExxonMobil saw. The stock opened at $127.86 per share on January 8, 2018 and closed out the week at $133.60 per share. This represents a gain of 4.49% on the week, significantly better than ExxonMobil.

Leave A Comment