Several Federal Reserve’s Board of Governors want to begin the process of reducing the size of the Fed’s balance sheet by the year’s end, according to minutes from last month’s meeting. This revelation creates considerable uncertainty as investors want to know:

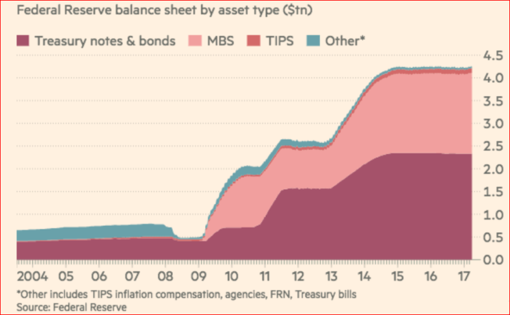

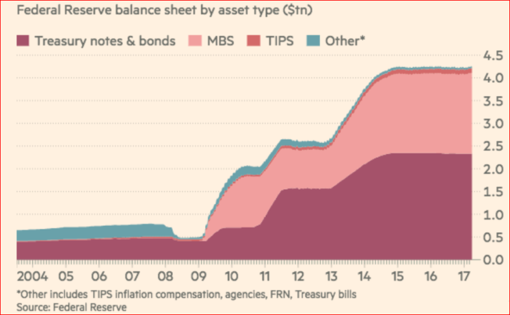

The Fed’s balance sheet has swollen from $869 billion in 2007 to $4.45 trillion as of today. Thus the effort to shrink the balance sheet will take a lot of careful doing and time. Currently, the Fed reinvests income into the same type of securities it holds and thus maintains the level and composition of Treasuries and MBSs so as not disturb those markets.

How will the markets react to the unwinding of the Fed’s balance sheet?

In 2011, for example, Bill Gross (then at PIMCO) shorted Treasuries in anticipation of the end of QE2 saying “ who will buy Treasuries now?” The trade backfired as the market interpreted Fed policy as a reduction in monetary stimulus and stocks went down and bonds prices went up.

In June 2013, the financial markets experienced some gyrating moments when the Fed announced that it would cease its third and last quantitative easing program. The so-called “taper tantrum” resulted in a 4.3 per cent drop in the stock market in a matter of three trading days and the yield on the 10-year Treasuries backed up by 55bps in less than two months. This time the bond market had a totally different reaction than in 2011. Many feared that the Fed, being the only game in town, would cash in their chips and force long-term interest rates to soar. It took the better part of a year for long-term rates to fall as deflationary concerns took the upper hand in the minds of traders starting when the oil price collapsed in 2014.

Leave A Comment