This week we are going to look at gold from a different perspective— the intrinsic value perspective. I will then introduce a unique unknown fund to invest in the precious metals and resource development sector. It is an incredible opportunity which invests your money right alongside the premier resource investor of this generation. I will then move on to what I will now label as my Post Bubble Contraction (PBC) watch section and examine the leading indicators to follow to keep abreast of the PBC process. We will finish up with updates on Plunger’s trades and other highlights.

Last weekend’s report included several long-term charts of gold by Rambus. These charts point towards an outcome unexpected and unwelcomed by gold investors as the charts infer lower prices ahead. Since the number one rule of investing is ”don’t lose money” a prudent course would be to move to the sidelines in this sector except for special situations. I agree with this strategy, however, later on, I will explain why I am starting to allocate a conservative amount of funds into some of the gold shares in addition to the few promising discovery and development plays that I own.

Recently at the gold tent, I noticed a profoundly discouraged post. It was indicative of how beat up many gold investors are. The quote ended with this sentence:

“And come on now, folks. How much of a hit do we have to take before realizing the light at the end of the tunnel is not just a train, it has already run over us.

Hope is not a strategy. It is the pit of death.”

Of course, we all know these type of posts come near the end of a bear market so I would like to look at gold with an eye on the future. I see gold the same way I see oil…bearish in the short to intermediate term, but in the long term, these two sectors are going to make us a lot of money… That is If you can keep your eye on the prize.

Rambus’ price objectives are both valid and shocking, however, it is my view that these price objectives are derived from a paper, not physical trading system. Those measured move objectives may be reached, but I don’t personally believe you will be able to buy the physical anywhere near those numbers. Back in 2008 when silver was sporting a $9 price tag I couldn’t get anyone to sell me any silver for anything less than $14 and it didn’t stay there for long. Also keep in mind the old market adage: The cure for low prices is low prices! So it may get there, but it would only be the catalyst for higher prices later on. This will be true in both gold and oil.

Straight Talk About Inflation

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” John Maynard Keynes

Let’s get right down to it…The dirty little secret…inflation funds the state. The Fed creates the money and the government gets first use of it so they don’t have to suffer the currency dilution effect, whereas the citizens do. So just like in Roman times, inflation transfers wealth from the producer of real goods to the first user of the new money. That’s what is going on in the world today. Keep in mind inflation is NOT rising prices, it is the increase of money and credit. Rising prices are the symptom of inflation.

Now you may not think price inflation is a serious threat since prices of daily goods seem to be under control or rising slowly. But this is a narrow view of the entire picture, call it a pie sliced view of the monetary structure. Just because consumer prices are not rising particularly fast does not mean that massive inflation is not occurring. Recall again, inflation is the increase of money and credit NOT rising prices. Rising prices is simply a symptom of the increase of the money & credit supply. So with central bank printing presses running red hot why don’t we have rampant rising prices? It is because in a post bubble contraction the increase of credit stays on the Fed’s & private banks balance sheets unable to get lent off… but its still there!

In Weimar Germany from 1920-23, the printing presses ran red hot producing currency and injecting it directly into the economy resulting in virtually immediate hyper-inflation. Keep in mind there was no developed bond market in the Weimar…no bond vigilantes. That’s not what is going on in today’s developed economies. Central banks are creating credit, not currency, so the money supply is being stored up, it is still there. With decreasing money velocity and a decreasing year over year lending rate, the credit stays on the banks balance sheets. Ultimately, however, it will have a delayed reaction in its effect on prices of goods and service.

Above: Watching over worthless currency in Deutschland

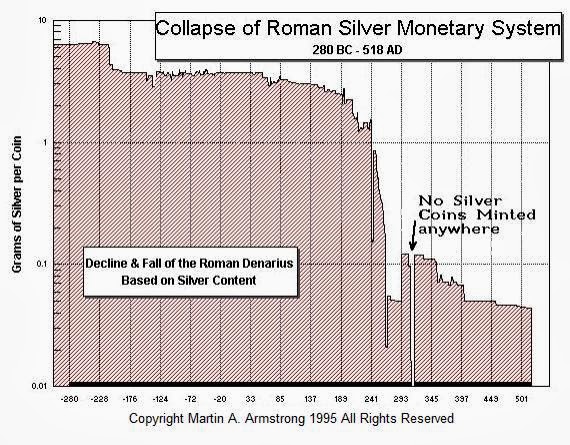

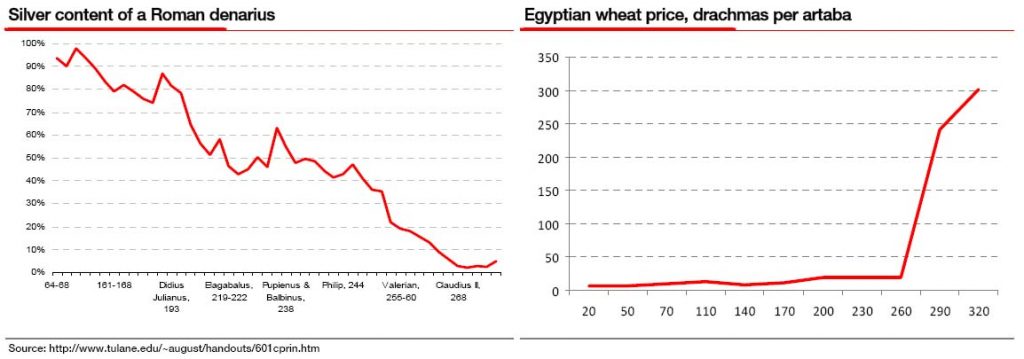

In Roman times, the government funded itself by sending slaves and treasure into Rome. Later on they increased their funding by higher taxes and the debasement of their currency. It started with the emperor calling in coins and clipping the edges and by the third century, the silver content had gone from 98% to 2%. Incidentally, our Fed has debased the value of the US Dollar at about twice the rate as the Romans did since the Fed was created in 1913.

Again Keynes, before he himself became a bondservant of the state:

“There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose.”

In Rome there was roughly a 20-30 year delay before the effects of coin debasement worked its way through into actual price rises. We also saw this delay effect occur in our modern economy as the US printed massive credit from 1945-1970 yet it was not reflected in the price structure until the mid-1970’s with the repricing of tangible goods such as grains, oil and gold. This same dynamic is incubating in the economies of the world today. The central banks are conducting massive QE but its effects will not manifest until the post bubble contraction runs its course. This process will have multiple knock on effects that we cannot possibly foresee, but eventually the world will likely reach what is known as the “bang point”. That is when the government can no longer continue its borrowing and insolvency becomes evident. At the bang point an inflection point arrives and the currency inflates along with an increase in money velocity. At that time the surviving credit in the system becomes reflected in the general price level. Recall that credit merely reflects claims on future production and prices will then account for the total outstanding credit in the system. Stated differently, prices will break out into a massive inflation.

Below we see when Rome hit its “Bang Point” as reflected in the price of wheat:

This general rise in prices will increase the desirability of tangible assets and depress the appeal of financial assets due to the store of value which tangibles embody. Again, the 1970’s experience occurred after the breakdown of the Bretton Woods monetary regime in 1971 which had followed the failure of the London Gold Pool price suppression scheme. Prices then began to immediately price in the great inflation that had already occurred. That’s what the 1970’s was all about. Just like in Roman times this process was subject to a delay which took over a generation before prices recognized the inflation.

1930’s Redux- First the Deflation?

The 1970’s was all about pricing in the great rise of money and credit of the prior 30 years. This is quite different from what occurred in the 1930’s which also experienced a rip roaring bull market in the gold shares. In the 30’s however, the gold stock bull market was the result of the post bubble contraction during the depression. Gold stocks rose as a result of falling input prices leading to lower production costs. As input costs declined the gold price rose because gold offered the ultimate form of liquidity in a credit constricted world. These similar conditions should be the foundation to the next bull market in the gold shares as well.

Leave A Comment