Ok, so obviously the question on everyone’s mind is this: “how is it that the bottom hasn’t fallen out for markets yet?”

The dollar had a miserable Q1 and far from presaging “reflation,” 10Y yields are flirting with disaster, where “disaster” means a deflationary rally below 2.25 exacerbated by short-covering and a return to market of Japanese buyers lured by a favorable FX backdrop and lower hedging costs. See how something doesn’t look right about this picture?….

Quick! Tweet something about markets to distract everyone. Here’s one about the disconnect between bonds and stocks from BofAML: pic.twitter.com/dNohecJvZT

— Tracy Alloway (@tracyalloway) April 6, 2017

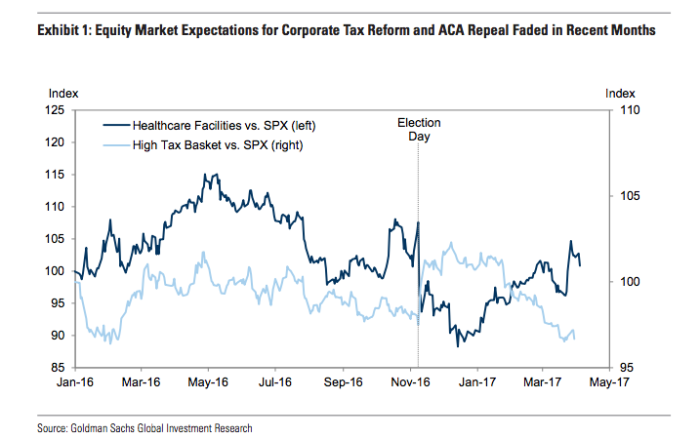

Turning to equities, we’ve seen almost all the “Trump trades” reverse on policy disappointment after policy disappointment. Someone won’t believe us about that, so allow us to show you the proof.

“Oops #1“…

“Oops #s 2, 3, and 4”:

(Click on image to enlarge

(Goldman)

So what gives? Why does the broad equity market just refuse to roll over and die? Well, one popular explanation is the faith in “soft” data. So, amusingly, “faith” in “hope”. It’s like a double euphemism for “bullsh*t.”

Anyway, below find Goldman’s take on “Why the Equity Market Rally Outlived Faith in Policy Change.”

Via Goldman

Leave A Comment