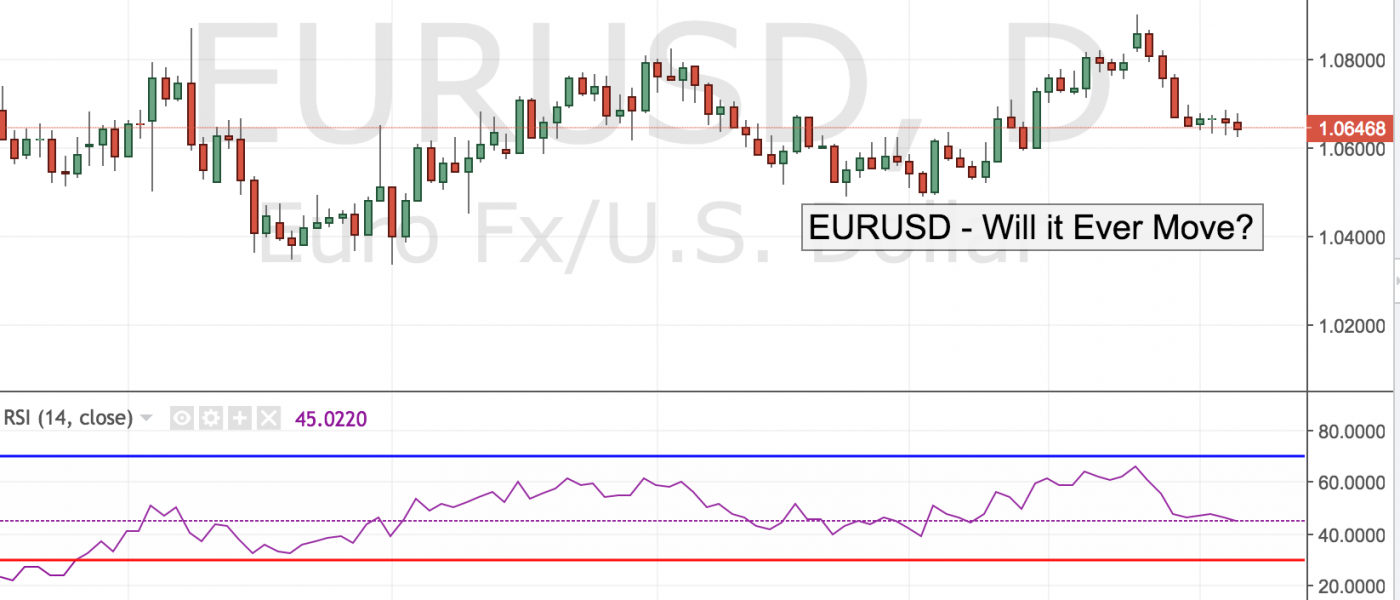

The pair has seen some of the tepid price action in months with average daily range barely reaching 50 pips. There is no doubt that currency traders are simply marking time as they await US labor market data tomorrow.

But euro has some structural problems of its own, not the least of which is the French election which appears to be split in a four-way tie and the persistently low inflation that is causing the ECB to rethink its QE taper move just yet.

The economic conditions in the EZ are actually improving as the low exchange rate and better labor demand fuel growth in the export-driven region, but the market is looking at interest rate differentials and if President Draghi continues to hint that taper will be delayed for another quarter or so, the EUR/USD could test the key 1.0500 support level once again.

Leave A Comment