Tuesday, October 25

Wednesday, October 26

Thursday, October 27

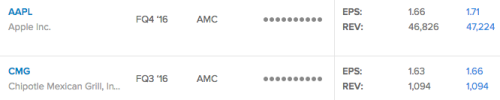

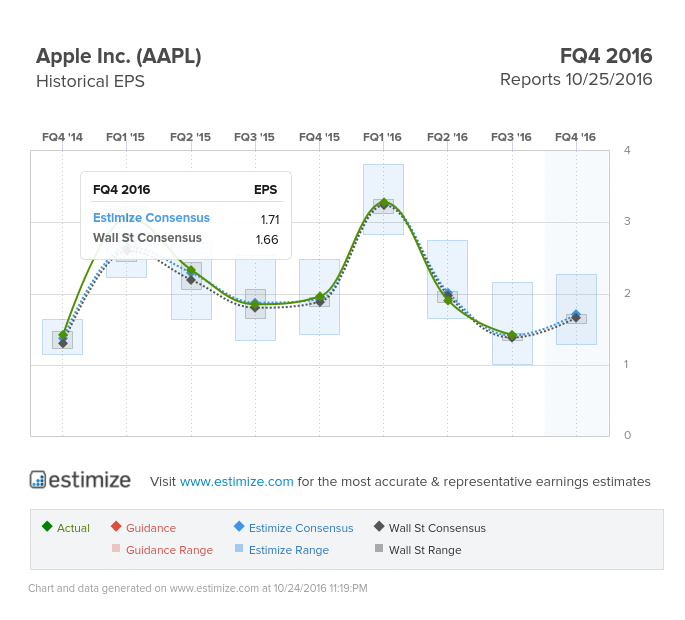

Apple (AAPL)

Information Technology – Computers & Peripherals | Reports October 25, after the close.

The Estimize consensus is looking for earnings per share of $1.71, 5 cents higher than Wall Street and down 13% from the same period last year. That estimate has increased 1% since Apple’s most recent report. Revenue is anticipated to decrease 8% YoY to $47.2 billion. The stock typically moves up 5% in the 30-day post earnings period.

What to Watch:The iPhone continues to be Apple’s biggest catalyst, accounting for two thirds of its revenue in any given quarter. The phone has largely struggled in the past year due to the limited appeal of the iPhone 6s and increasing competition. However, the recent release and success of the iPhone 7 have put many of those concerns to rest. Sales of the phone have got off to an incredible started and now account for 43% of all iPhone sales recorded in the quarter. The phone was only available for the final two weeks of Q3, making this an even more remarkable feat.

Other products haven’t done as well, as the company tries to diversify away from the iPhone. Macs have been struggling, with sales declining 11% in the third quarter. Apple is prepared to unveil new macbooks later this week. iPad sales have also been in a downward spiral, with Apple only selling 9.9 million last quarter, compared to 10.3 million in the second quarter. Upgrade demand for these tablets have been abysmal, so it makes sense that the iPad 2 is still the most widely owned iPad to date. And according to a new IDC report, Apple Watch sales are hurting also, with sales plummeting 70% during the quarter.

Chipotle (CMG)

Consumer Discretionary – Hotels, Restaurants & Leisure | Reports October 25, after the close.

The Estimize consensus is looking for earnings of $1.66 per share on $1.094 billion in revenue, 3 cents higher than Wall Street on the bottom line and in-line on the top. Compared to a year earlier, earnings are expected to decline 62% with revenue decreasing 10%. EPS estimates have been pushed down by 13% since the last quarterly report, and revenue estimates have come down 4%. The stock has fallen 14% YTD.

Leave A Comment