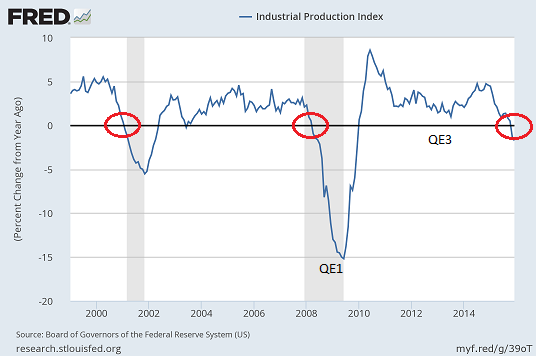

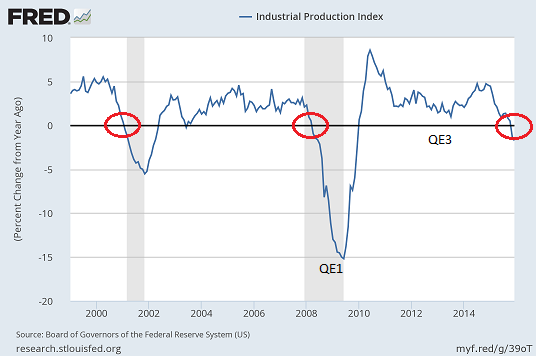

A manufacturing recession doesn’t matter… until it does. Consider industrial production. For the third straight month, industrial production, which includes mining, utilities, as well as manufacturing, contracted.

How anemic is American industry right now? The year-over-year percentage change provides a helpful snapshot of the weakness.

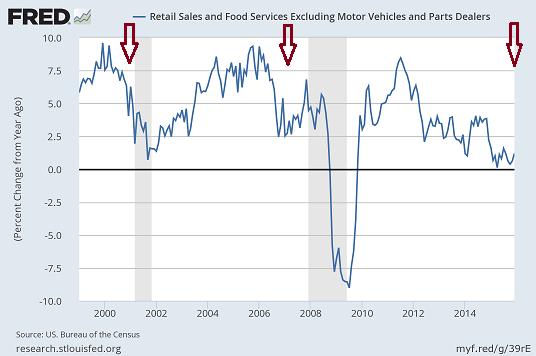

Not surprisingly, media mega-stars routinely dismiss manufacturers, miners and utility providers as relics of yesterday’s economy. They maintain that consumers are the only ones who count in a consumption-based society. The erosion of the high-paying careers in those segments notwithstanding, might the rosy projections for household consumption be misleading? After all, retail sales (ex auto) pulled back 0.1% in December, even as economists anticipated 0.2% growth.

We can look at consumer trends in a variety of ways. As I pointed out in my most recent commentary (1/12/16), year-over-year percent growth in personal consumption expenditures (PCE) has been declining steadily for roughly 18 months. Meanwhile, year-over-year percentage changes in retail sales (ex auto) emulate what is taking place in American industry.

So what happened to the “clear-cut” benefit of lower oil prices? Weren’t they supposed to be a giant tax cut for the American consumer, prompting them to spend? Not when wage growth is tepid. And not when many households have chosen to increase their savings.

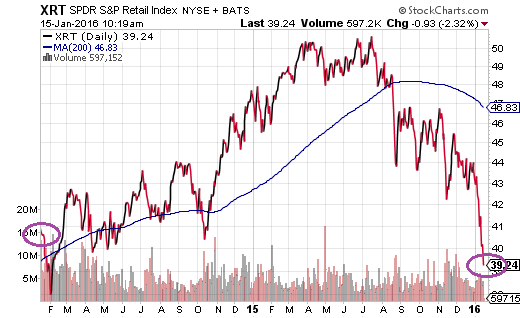

It should not go unnoticed that the S&P SPDR Retail Index has quickly descended into bear territory. The S&P SPDR Retail ETF (XRT) is currently down about 22.3%. Even more disheartening for those who had not become more defensive in their asset allocation over the past year? The price of XRT is lower than it was two years ago.

Ironically enough, the question is no longer whether U.S. stocks have entered a bear market in the same way that the retail segment has. Indeed, year-over-year percent growth in personal consumption expenditures (PCE), the average mid-sized company stock and the average small-company stock have all surpassed the 20% bear market threshold. In the same vein, the median stock in the Russell 3000 and the Value Line Index show the same.

Leave A Comment