It’s actually quite difficult to answer the question posed in the title, which in itself is a clue. What we know for sure is what does not count as reserves for a non-reservable currency system. It’s that contradiction that sets off the often graphic misconceptions.

Quantitative easing has been described as printing money. That’s certainly what central banks wish for you to think because its primary purpose is to influence inflation expectations along those lines. In practice, QE only creates bank reserves as a direct byproduct of its undertaken transactions. So, in reality the most that can be said of quantitative easing is that it “prints” bank reserves.

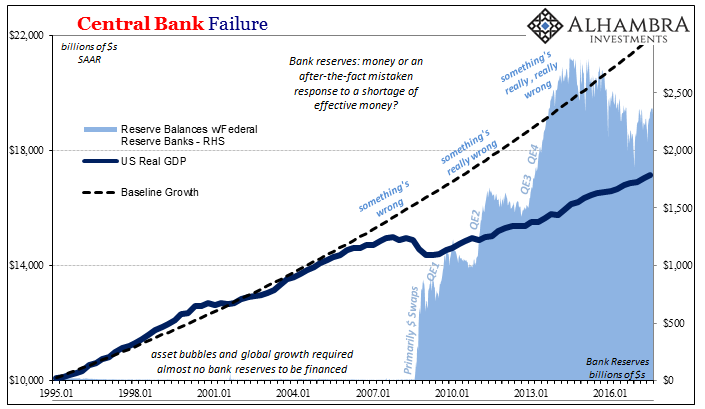

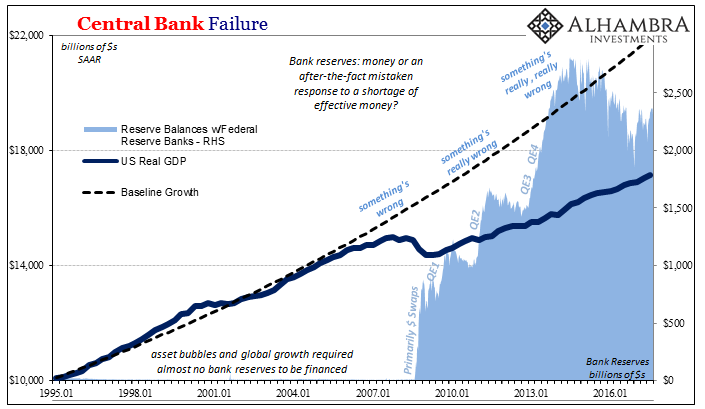

Whether or not those reserves are money is the entire story. For many if not most they are because what else does a central bank do if not that? But bank reserves in the American system are, actually, a recent occurrence. There were practically none up until the panic in September 2008; the week the GSE’s fell into conservatorship, the one right before Lehman, the entire balance of bank reserves totaled $9.02 billion with a “b”, not trillion with a “t.” For some, this explains a lot, meaning that without bank reserves the system was monetarily vulnerable.

And yet, there was then the problem of multiple QE’s. Despite the sudden appearance of trillions of them, the global dollar system underwent several subsequent liquidity/monetary setbacks. As Open Market Account Manager Brian Sack exclaimed during one of those setbacks in early August 2011:

MR. SACK. Can I add a comment? In terms of your question about reserves, as I noted in the briefing, we are seeing funding pressures emerge. We are seeing a lot more discussion about the potential need for liquidity facilities. I mentioned in my briefing that the FX swap lines could be used, but we’ve seen discussions of TAF-type facilities in market write-ups. So the liquidity pressures are pretty substantial. And I think it’s worth pointing out that this is all happening with $1.6 trillion of reserves in the system. [emphasis added]

With them or without them, the result was the same: gross systemic illiquidity. At the very least, it should give one pause when blindly assuming what role bank reserves might actually play in the modern monetary system.

How could the system evolve in this fashion? The answer is, ironically, at least at the start, federal funds.

In December 1957, the Federal Reserve launched a comprehensive study of the federal funds market. It wasn’t a new piece of the US dollar system by any means, but in the fifties it was resurrected after decades being dormant in the aftermath of the Great Depression. The monetary collapse in the early thirties obviated any need for such a robust, dynamic money market simply because nobody remaining trusted it any longer; it became common bank practice to hold a huge liquidity cushion far and above any statutory requirements as a matter of prudence.

As that practice wound down in the re-remerging economic and financial opportunities of the fifties, federal funds came roaring back so that by the end of the decade the US central bank was forced to reckon with what by then had already become standard operation. The results of the ’57 study, published in ’59, found:

Immediate availability of Federal funds, in contrast to the delayed availability of clearing-house funds, has given rise to other uses. A large part of all transactions in Treasury bills and other short-term Government securities is settled in Federal funds. Purchases and sales for the Open Market Account of the Federal Reserve System are also settled in Federal funds. The practice of settling a substantial part of Government securities transactions in Federal funds, which has become increasingly widespread, has drawn others than member banks into the market. Government securities dealers, as market intermediaries, have become important participants. Dealers in financing their positions often use repurchase agreements and buybacks to tap out-of-town money, and settlement is made in Federal funds, transmitted through the Federal Reserve leased-wire system. Other corporations, largely because of their securities transactions, find themselves in possession of or in need of Federal funds. They sometimes enter the market as buyers and sellers, usually indirectly by having their commercial bank act for them.

Leave A Comment