By Mani

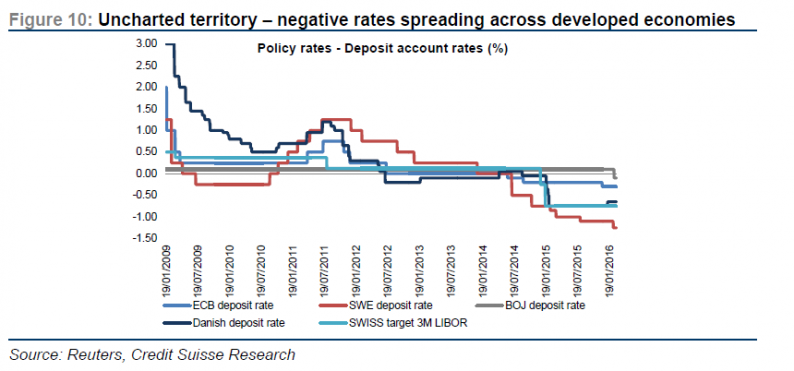

Though periods with nominal rates below zero are rare and the current environment with negative rates across the developed world is unprecedented, analysts at Credit Suisse remain selective and favor banking names that can sustain a prolonged period of low interest rates. Jan Wolter and team point out in their March 4 research note that ECB action driving spreads tighter could be a positive for banks in the short term.

European banks are net losers from negative rates

In their latest research note on European banks, Wolter and colleagues take a close look at how negative rates impact banks. The analysts argue that banks were net beneficiaries as lower rates helped repair balance sheets in 2009.

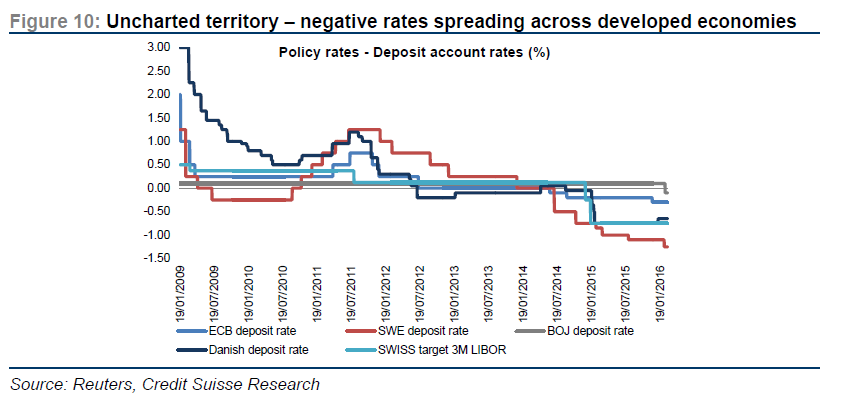

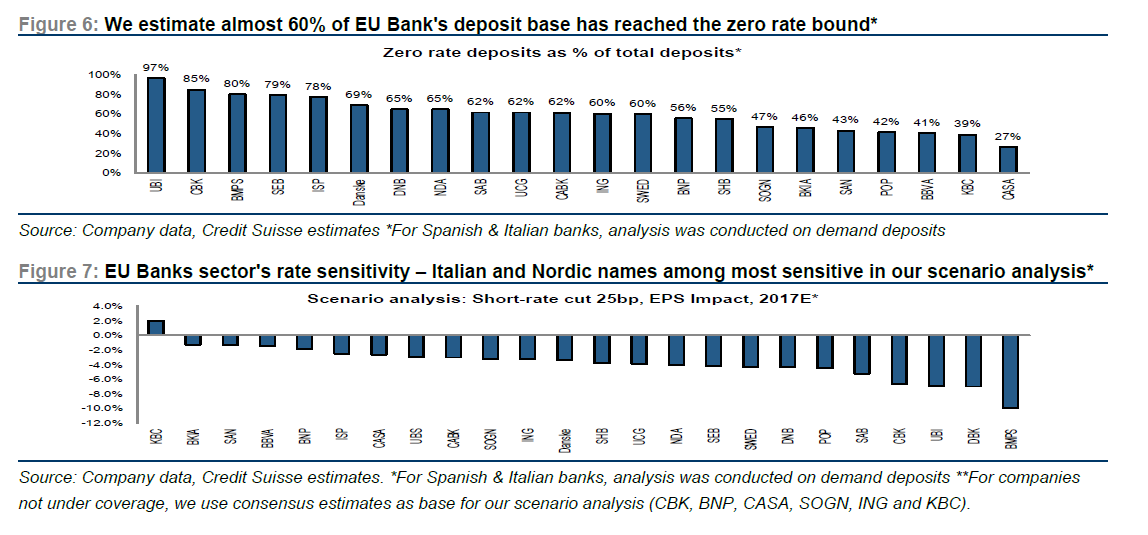

However, they think that at this juncture, it looks as if banks are net losers from lower rates as they believe sell-side estimates already capture the positives and that improvements in credit demand are small. They estimate that about 60% of EU Banks’ deposits already reached the zero rate bound. The Credit Suisse analysts’ research suggests that every 25bp rate cut equates to 3-4% sector EPS downgrade, with Italian domestic and Nordic banks already being largely impacted.

Wolter and team argue that banks can mitigate negative rates in four ways: (a) trim deposit rates, (b) reprice assets, (c) grow fees and (d) grow lending. They anticipate that the best scope for liability repricing in Spain. The analysts point out that Swedish and Danish banks have successfully repriced mortgages and that Swedish banks have so far not passed on anything of the 15bp repo cut in February:

Bank shares could react negatively if ECB announces deposit rate cut

Digging deep into valuations of European banks, Wolter and team point out that on a reported basis, the sector is trading on c.0.8x TNAV in 2016E, for a ROTE of 9.1%, 2016E and at about a 29% discount to the broader market. The analysts believe the main reasons for the sector being traded at discount to TBV are the ultra-low rates environment and regulatory uncertainty.

Leave A Comment