“Overbought!”

“Oversold!”

There’s not a day that goes by without a pundit using one of these powerful words to support an existing bias. Most interesting, some pundits use the term “overbought” to further a bullish outlook while others use it to justify a bearish outlook. The same is true with the term “oversold.”

Unfortunately, there’s never a definition of overbought/oversold provided by these pundits and no analysis accompanying these predictions. They are merely forms of entertainment, but regrettably are not treated as such.

The truth: there’s almost an endless array of ways to define a market as oversold or overbought using an endless array of indicators and an endless array of time periods. If you analyze these variations going back in time, each will have a different outcome.

In the past few months, we have seen both extreme oversold and extreme overbought conditions, a function of the violent sell-off in the first few weeks of January (worst start to a year in history) followed by the equally violent advance that took place from mid-February through the end of last week.

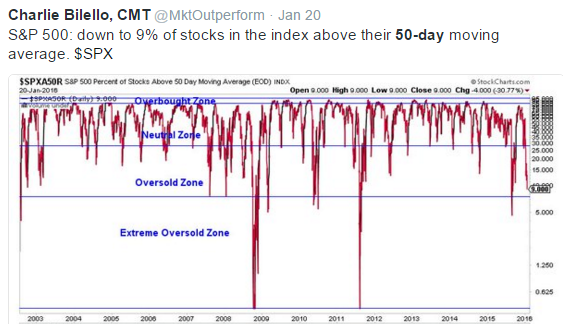

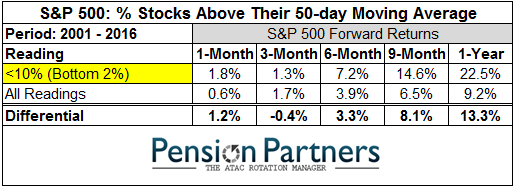

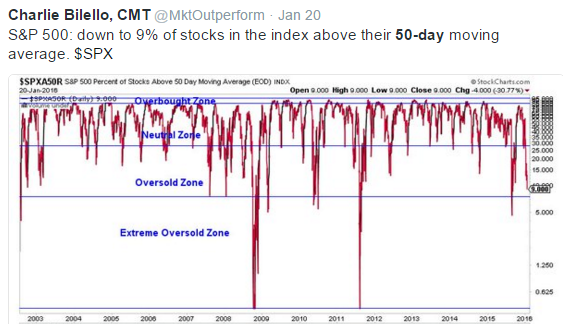

On January 20th, the day the S&P 500 hit an intraday low of 1812, I tweeted that the percentage of stocks above their 50-day moving average had moved down to 9% (an extreme seen less than 2% of the time going back in history). You tend to see bounces from such extremes. This is on average, of course, for there is no holy grail in markets. (Note: many a perma-Bear used my tweet to argue that “breadth was weak” and therefore the market was headed for further declines.)

By February 22, the market had rallied a bit and another indicator, the McClellan Oscillator, was flashing an “extreme overbought” reading (seen less than 2% of the time going back in history). I tweeted out the following chart and noted in a subsequent tweet that you “tend to see strength” (over 1-12 months) after such readings. The S&P closed that day at 1945. (Note: many a perma-Bear used this tweet to argue that the market was extended, “due” for a pullback, and soon headed for lower lows.)

Leave A Comment