In this past weekend’s newsletter, I discussed the end of the mutual fund redemption period. (Charts updated through yesterday’s close.)

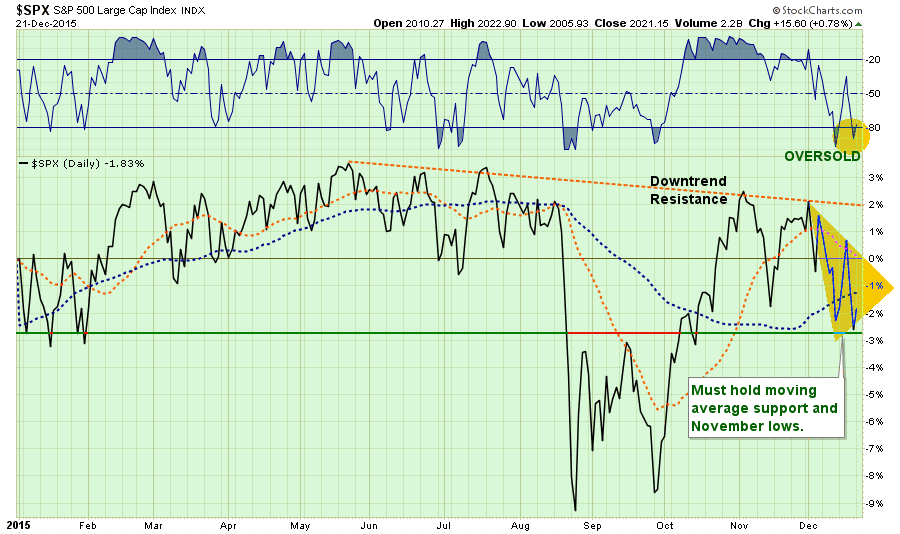

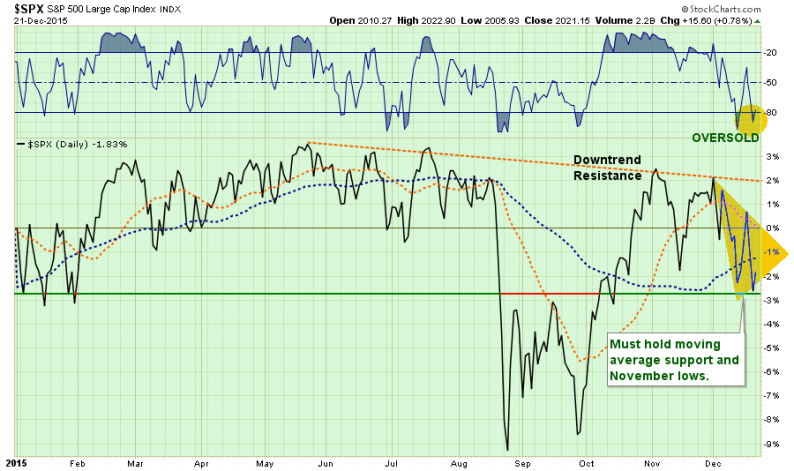

“Friday’s sell-off, combined with options expirations, pushed the markets back to short-term oversold conditions and at previous support.”

(Note: After a second attempt at the downtrend resistance the market has built an accelerated downtrend. If the market is unable to reverse this decline in short-order, the odds of a more substantial correction increase.)

“For the year, the markets continue to post negative returns, which is a low probability event historically for 5th years of decades.

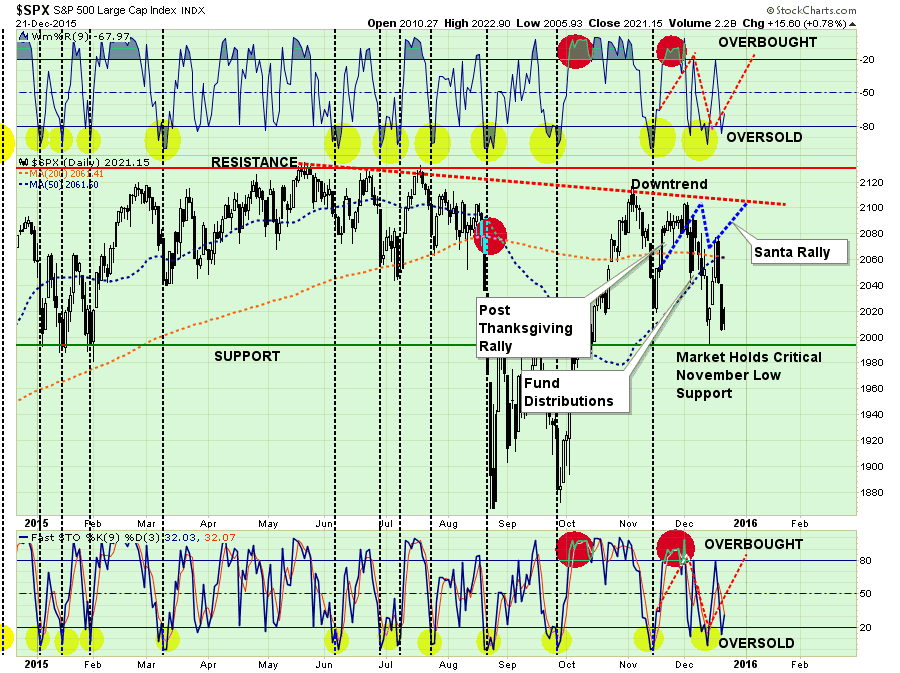

However, as I laid out at the beginning of November, with markets now oversold, option rolls and redemptions complete, this should clear the way for a rally into the end of the year. Such a rally will likely not be huge, but enough to re-balance portfolios heading into 2016.”

“I have reiterated over the last several weeks, that such a rally, driven primarily by window-dressing by mutual funds for year-end reporting, is in line with previous expectations.”

It’s Now Or Never For Santa

With the market now back to oversold conditions and redemptions complete, it is now or never for the traditional“Santa Rally.”

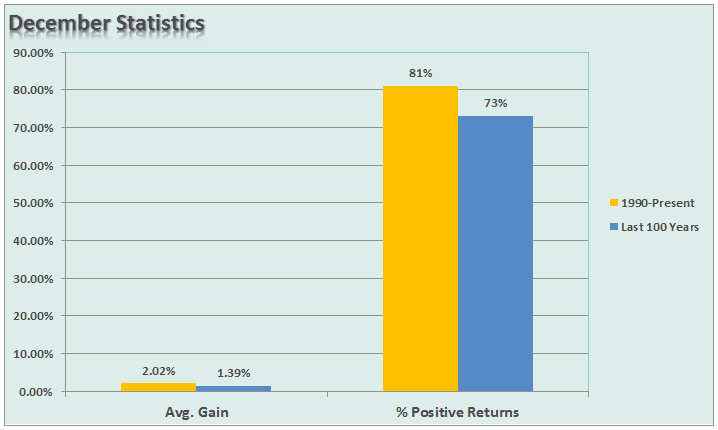

If we go back to 1990, the month of December has had average returns of 2.02% with positive returns 81% of the time. Over the past 100 years, those numbers fall slightly to a 1.39% average return with positive returns 73% of the time. Statistically speaking, the odds are high that the market will muster a rally over the next couple of weeks.

However, given the volatility of the recent decline, any rally that does ensue will likely fail at the current downtrend resistance. As I discussed in detail recently, the underlying dynamics of the market are substantially weak and, on a longer-term basis, are more akin to market peaks than the beginning of new bull market advances.

Leave A Comment