Once again, let’s take a look at the latest news in the energy markets.

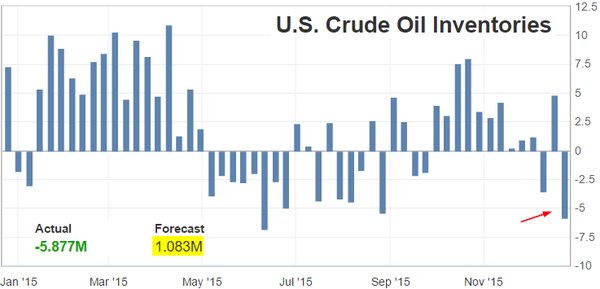

Now the EIA report also shows a large draw on US crude inventories (yesterday we saw the API results). This draw-down was significant and is taking place at the time of the year when inventories normally expand.

Source: Investing.com

As a result of this inventory draw, we got that crude oil bounce I’ve been discussing. WTI futures rose by 9% over the past couple of days. The oil short has been a crowded trade.

Source: Barchart.

Moreover, the unexpected drop in US inventories sent Brent-WTI spread (the nearby contract) deeper into negative territory. WTI is now trading well above Brent – something we haven’t seen in quite some time. US shale firms now face additional competition from abroad.

Source: @SoberLook, barchart

Before celebrating the crude oil rally, it’s important to point out that the fundamentals remain terrible for now. For example, according to the EIA, US crude oil production is persistently above last year’s level. After the initial drop from the peak, production leveled off – even at these low prices. There is no question production will decline further next year, but the timing remains a big question mark.

Source: @SoberLook, EIA

The rally in crude oil turned on the risk sentiment as oil-sensitive products (such as HY) rallied. Here is the MLP index vs. S&P500.

Source: Ycharts.com

The Baltic Dry Shipping Index has been hitting new lows.

Source: stockcharts.com

But not all shipping is the same. With the crude oil curve remaining steep this year (contango), shipping crude oil has been quite profitable and crude tanker rates spiked.

Source: @acemaxx, @fastFT

Turning to US fixed income markets, we see speculative accounts being quite short treasuries. The net short balances of course are rather different across the curve, but the sentiment is very negative for most maturities. We’ve seen this before as funds bet against treasuries and got burned. Is it going to be different this time? Perhaps. For now it looks like a crowded short.

Leave A Comment