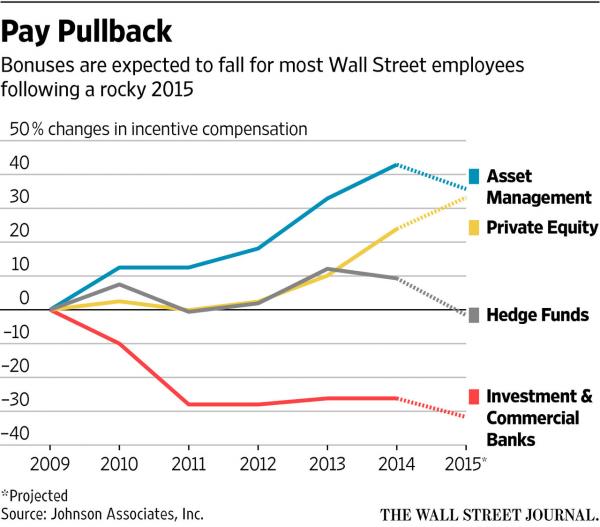

While 2015 has seen its share of market tribulations, from repeated “flash crashes” in various asset classes, to the “summer of the Greek referendum”, to the late summer EM/China devaluation market swoon, it has managed to rebound once again with the S&P practically back to all time highs, as central banks have once again thrown the kitchen sink at stocks. However, not all is well on Wall Street, where when one cuts all the noise, just one thing matters: the year-end bonus. It is here that as WSJ reports citing the latest survey from Johnson Associates, bonuses are expected to see a broad drop for the first time in four years.

The reason: “chaotic global markets harmed the returns of many money managers and delayed companies’ plans to go public, affecting pay for asset-management employees and investment bankers charged with underwriting initial public offerings. Bonuses for fixed-income traders are also expected to drop for a fifth year in a row as large banks continue to wrestle with new regulations that rein in risk-taking.”

That, and much less rigging of course, in everything from FX, to stocks, to bonds, to gold, to commodities, etc.

Not surprisingly, the last time year-end bonus payouts dropped across the industry was 2011, when the market – just like in 2015 – was poised for virtually no gains.

“It’s a disappointment,” said Alan Johnson, managing director at New York-based Johnson Associates. “It’s been such an uncertain year, a stressful year. Pay is down moderately, but it feels worse.”

The uncertain mood across the industry should continue into 2016, said Mr. Johnson, who predicted many firms would take steps to shrink their workforces again to help lift returns. “This year will be an inflection point,” he said. “Firms are going to have to look at their cost structures again.”

In some cases, the bonus cuts will be relentless: as reported over the weekend by Schweiz am Sonntag, Credit Suisse may need to cut bonuses by as much as 60 percent this year because of losses incurred by a writedown. Annual loss of 2.6 billion francs to 2.8 billion francs, the newspaper reported. The bank may thus need to slash bankers’ bonuses by as much as 60%, in accordance with rules set by the Swiss Financial Market Supervisory Authority, or Finma, according to the newspaper.

Leave A Comment