The Great Recession of 2008 provided markets with an interesting irony: As the US economy was collapsing under the weight of crumbling home prices, investors curiously flocked to the US dollar under the guise of “The Safety Trade.”

But the truth is that investors weren’t running into the dollar for safety, what they were actually doing was unwinding a carry trade. In a carry trade an investor borrows a depreciating currency that offers a relatively low interest rate and uses those funds to purchase an appreciating currency that offers the potential for higher returns on its sovereign debt and stock market. The trade’s objective is to capture the difference between rates, while also benefitting from the currency that is rising in value against the borrowed (shorted) funds.

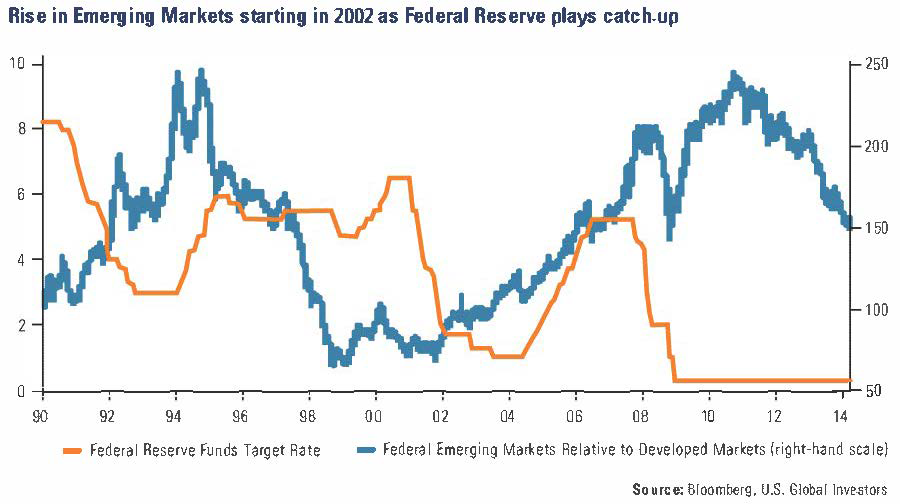

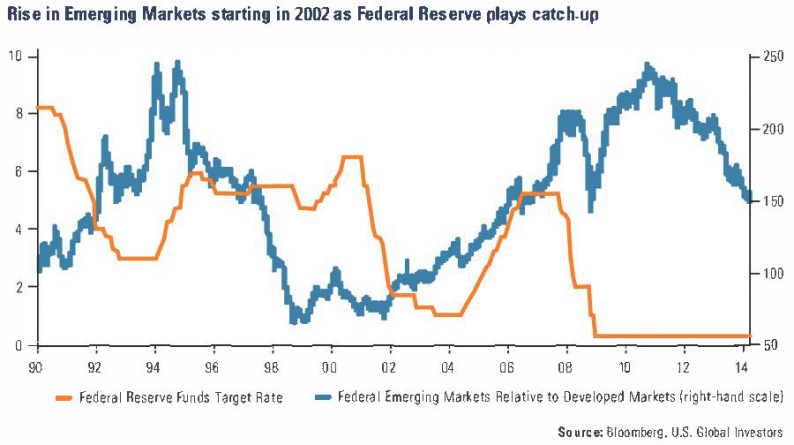

In the years leading up to the 2008 crisis, a popular trade was to short the US dollar and invest in higher yielding emerging markets (EM’s) such as Brazil, Russia, India, and China referred to as the “BRIC’S”. The Federal Reserve’s manipulation of interest rates following the attacks of September 11, 2001, sent the market on a desperate search for yield. Investors found the return they were seeking in the EM’s and remained there for years as the Fed was merely playing catch-up with rates. The Fed Funds rate went from 1 percent in 2004, to 5.25 percent in 2006, while the value of the dollar reduced during that timeframe.

As you can see from 2002 to 2008, EM stocks rose and the dollar fell as investors took advantage of the relative yield differential between the US and EM’s.

But by the second half of 2008 the market’s focus shifted away from yield differentials and FX advantages to a massive concern over tumbling US growth spilling over to the EM’s due to collapsing real estate prices and insolvent banks. The short dollar/long EM carry trade reversed as investors panicked to cash out of booming BRIC markets and bought back dollar loans to close out the trade. This sent the dollar soaring and EM stocks crashing, which provided the peculiar narrative that investors were moving into the dollar for safety even as the US economy and financial system was in freefall.

Leave A Comment